Research Methodology on Aerospace Fasteners Market

Introduction

The research methodology of the current report titled ‘Aerospace Fasteners Market - Analysis, Drivers, Restraints, Opportunities, Threats, Trends, Applications, and Growth Forecast to 2030’ provides the market definition, structure and overview of the global aerospace fasteners market. The report studies the forces such as drivers, restraints, and opportunities affecting the global aerospace fasteners market.

In the initial phase, Company Profiles and their competitive landscape are identified and studied thoroughly. The report provides an in-depth analysis of influencing factors that are impacting or driving the market. The report provides a comprehensive overview of the competitive landscape and a core assessment of the dynamics within the aerospace fasteners market.

Research Methodology

The research methodology adopted for this report is a combination of both primary and secondary sources. The primary research methodology used is interviewing and collecting information from key industry stakeholders, namely market players, vendors, manufacturers, local distributors, and industry experts. Secondary research methods were also used for industry data collection which includes company websites, investor presentations, earnings releases, globalfastenersmarket.net, industry journals, news articles, database of key industry players, documentary sources and other related sources.

Market Size Estimation

The market size of the global aerospace fasteners market was estimated using both top-down and bottom-up approaches. The top-down approach consists of analyzing the key players in the market and their respective revenues from the aerospace fasteners. The bottom-up approach consists of applying various quantitative techniques and formulas to arrive at the market size of the global aerospace fasteners market.

Market Segmentation

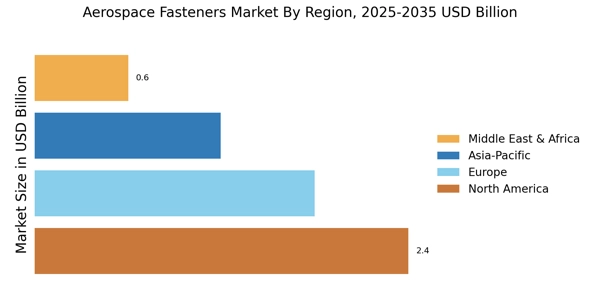

The global aerospace fasteners market has been divided into different segments, namely type (helicopter, aeroplane and rocket), application (aerospace and defence), material (titanium, stainless steel, aluminium and copper), and region (North America, Europe, Asia-Pacific and Rest of the World).

Data Triangulation

The data collected through the primary and secondary research is further analyzed by using various data triangulation methods that include data mining, and analysis of the potential impact of the expected growth of the market. The data has been triangulated based on both the supply side and demand side, and further validated in various key data points through primary interviews with the key market players. This helps in the validation of the market size in terms of value and volume.

Data Collection

The first phase of data collection starts with the understanding of the expectations of the primary stakeholders; their expectations are then studied in-depth and validated, followed by the procedural collection of specific data points. Secondary research data collection methodology is then used, which includes both public and private sector sources. Further, the data collected is then organized and arranged into a format that is easy to interpret.

Forecasting

The forecasting model used for market forecasting has been derived from the various historical data points obtained from the market trends, industry analysis, plausibility analysis and competitor analysis. The market trends have been studied from the years 2023 to 2030. The market size estimation is done based on the various databases available on the market and the various conducted surveys.

Assumptions

- The market for aerospace fasteners is expected to develop in the forecast horizon.

- Increase in the demand for aerospace fasteners owing to the growth in aerospace production is expected to benefit the aerospace fasteners market in the forecast period 2023 to 2030.

Conclusion

The research methodology adopted for this report gives an in-depth understanding of the market dynamics and an accurate market size estimation. The forecasting model adopted is a combination of historical market trends and industry analysis which helps in predicting the market size during the forecast period. The assumptions and limitations discussed in the research methodology help to reduce or eliminate the effect of possible errors during the analysis and forecasting.