Growing Adoption of Connected Vehicles

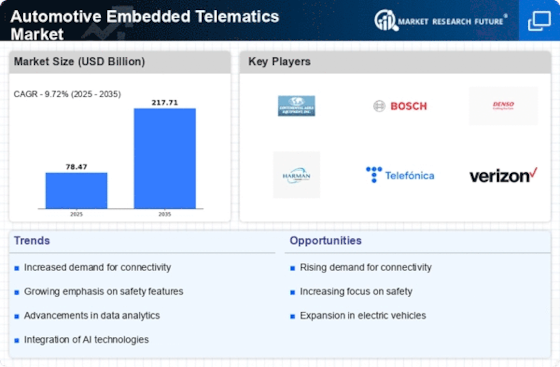

The Automotive Embedded Telematics Market is significantly influenced by the growing adoption of connected vehicles. As consumers increasingly seek vehicles equipped with internet connectivity, automakers are compelled to integrate telematics systems that facilitate real-time data exchange. This trend is reflected in the rising number of connected vehicles on the road, which is expected to reach over 300 million units by 2025. The integration of telematics not only enhances user experience through features such as navigation and infotainment but also enables manufacturers to gather valuable data for improving vehicle performance. This shift towards connectivity is likely to propel the Automotive Embedded Telematics Market forward, as it aligns with consumer preferences for smarter, more efficient vehicles.

Increased Focus on Fleet Management Solutions

The Automotive Embedded Telematics Market is witnessing a heightened focus on fleet management solutions, driven by the need for efficiency and cost reduction in logistics. Companies are increasingly adopting telematics systems to monitor vehicle performance, optimize routes, and manage fuel consumption. This trend is particularly evident in the commercial vehicle sector, where telematics can lead to significant savings and improved operational efficiency. According to industry estimates, the fleet management segment is expected to grow at a rate of approximately 15% annually. As businesses recognize the value of data-driven decision-making, the demand for telematics solutions in fleet management is likely to bolster the Automotive Embedded Telematics Market.

Technological Advancements in Telematics Systems

The Automotive Embedded Telematics Market is propelled by rapid technological advancements in telematics systems. Innovations such as artificial intelligence, machine learning, and big data analytics are enhancing the capabilities of telematics solutions. These technologies enable real-time data processing and predictive analytics, which can significantly improve vehicle performance and user experience. As automakers strive to differentiate their offerings, the integration of cutting-edge telematics features is becoming increasingly common. This trend is expected to drive the Automotive Embedded Telematics Market forward, as manufacturers invest in research and development to create more sophisticated and user-friendly telematics systems.

Rising Demand for Advanced Driver Assistance Systems

The Automotive Embedded Telematics Market is experiencing a notable surge in demand for advanced driver assistance systems (ADAS). This trend is largely driven by the increasing emphasis on vehicle safety and the need to reduce road accidents. According to recent data, the ADAS segment is projected to grow at a compound annual growth rate of over 20% in the coming years. As consumers become more aware of the benefits of these systems, automakers are integrating telematics solutions to enhance vehicle safety features. This integration not only improves the driving experience but also aligns with regulatory requirements aimed at reducing traffic fatalities. Consequently, the Automotive Embedded Telematics Market is likely to witness substantial growth as manufacturers invest in innovative technologies that support ADAS functionalities.

Regulatory Push for Vehicle Emissions and Safety Standards

The Automotive Embedded Telematics Market is also shaped by regulatory pressures aimed at improving vehicle emissions and safety standards. Governments worldwide are implementing stringent regulations that require automakers to adopt advanced technologies to monitor and reduce emissions. For instance, the European Union has set ambitious targets for reducing carbon emissions from vehicles, which necessitates the integration of telematics systems for compliance. This regulatory environment is driving investments in telematics solutions that not only ensure compliance but also enhance vehicle performance. As a result, the Automotive Embedded Telematics Market is likely to expand as manufacturers seek to meet these evolving standards while also appealing to environmentally conscious consumers.