Focus on Energy Efficiency

The growing focus on energy efficiency in the automotive sector is a significant driver for the Automotive Electrical Distribution System Market. As consumers become more environmentally conscious, manufacturers are compelled to develop vehicles that consume less energy. This trend is reflected in the increasing adoption of energy-efficient electrical distribution systems, which can optimize power usage and reduce waste. By 2025, it is estimated that energy-efficient technologies could account for a substantial portion of the automotive market, thereby driving demand for advanced electrical distribution systems that align with these energy-saving initiatives in the Automotive Electrical Distribution System Market.

Integration of Smart Technologies

The integration of smart technologies into vehicles is reshaping the Automotive Electrical Distribution System Market. Features such as connectivity, infotainment systems, and autonomous driving capabilities require advanced electrical distribution systems to support their operation. The market for connected vehicles is projected to grow significantly, with estimates suggesting that by 2025, over 70% of new vehicles will be equipped with some form of connectivity. This trend necessitates the development of sophisticated electrical distribution systems that can manage the increased power demands and data flow, thereby propelling the Automotive Electrical Distribution System Market forward.

Regulatory Compliance and Standards

Regulatory compliance and evolving standards are critical drivers for the Automotive Electrical Distribution System Market. Governments worldwide are implementing stricter regulations regarding vehicle emissions and safety, which necessitate the adoption of advanced electrical systems. Compliance with these regulations often requires significant upgrades to existing electrical distribution systems, thereby creating opportunities for market growth. As manufacturers strive to meet these standards, the demand for innovative and efficient electrical distribution solutions is likely to increase, further stimulating the Automotive Electrical Distribution System Market.

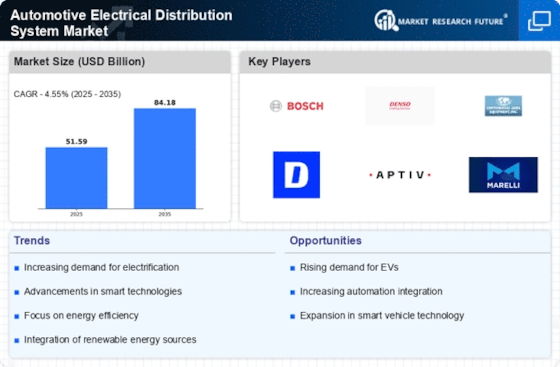

Rising Demand for Electric Vehicles

The increasing consumer preference for electric vehicles (EVs) is a primary driver for the Automotive Electrical Distribution System Market. As governments and manufacturers push for greener alternatives, the demand for EVs is projected to rise significantly. In 2025, the market for electric vehicles is expected to reach approximately 30 million units, necessitating advanced electrical distribution systems to manage power efficiently. This shift towards electrification requires robust electrical distribution systems that can handle higher voltage levels and complex power management, thereby driving innovation and investment in the Automotive Electrical Distribution System Market.

Advancements in Automotive Safety Features

The growing emphasis on safety features in vehicles is influencing the Automotive Electrical Distribution System Market. Advanced Driver Assistance Systems (ADAS) and other safety technologies require sophisticated electrical distribution systems to function effectively. The market for ADAS is anticipated to grow at a compound annual growth rate (CAGR) of around 10% through 2025, which will likely increase the demand for reliable electrical distribution systems. These systems must ensure that power is distributed efficiently to various safety components, thereby enhancing vehicle safety and performance, and driving growth in the Automotive Electrical Distribution System Market.