Market Growth Projections

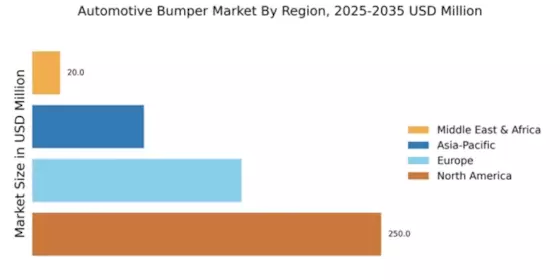

The Global Automotive Bumper Market Industry is projected to experience substantial growth over the coming years. With an anticipated market value of 11.3 USD Billion in 2024, the industry is set to expand significantly, reaching an estimated 19.8 USD Billion by 2035. This growth trajectory is supported by a compound annual growth rate of 5.21% from 2025 to 2035, indicating a robust demand for automotive bumpers driven by various factors such as technological advancements, regulatory compliance, and consumer preferences. The market's evolution reflects the broader trends within the automotive sector, highlighting the importance of innovation and adaptability.

Consumer Preferences for Customization

Consumer preferences are increasingly leaning towards vehicle customization, which is impacting the Global Automotive Bumper Market Industry. As buyers seek personalized features and aesthetics, manufacturers are responding by offering a wider range of bumper designs and materials. This trend is particularly evident in the growing popularity of aftermarket bumpers, which cater to individual tastes and preferences. The industry's adaptability to these consumer demands is likely to contribute to its growth, with a projected market value of 11.3 USD Billion in 2024. This shift towards customization may also encourage innovation in bumper design, further enhancing market dynamics.

Increasing Vehicle Production and Sales

The Global Automotive Bumper Market Industry is closely linked to the overall growth in vehicle production and sales. As global automotive production continues to rise, driven by emerging markets and increasing consumer demand, the need for bumpers is expected to grow correspondingly. In 2024, the market is valued at 11.3 USD Billion, reflecting the industry's responsiveness to production trends. Furthermore, with a projected compound annual growth rate of 5.21% from 2025 to 2035, the industry is poised for sustained growth, indicating that manufacturers must adapt to the increasing volume of vehicles on the road.

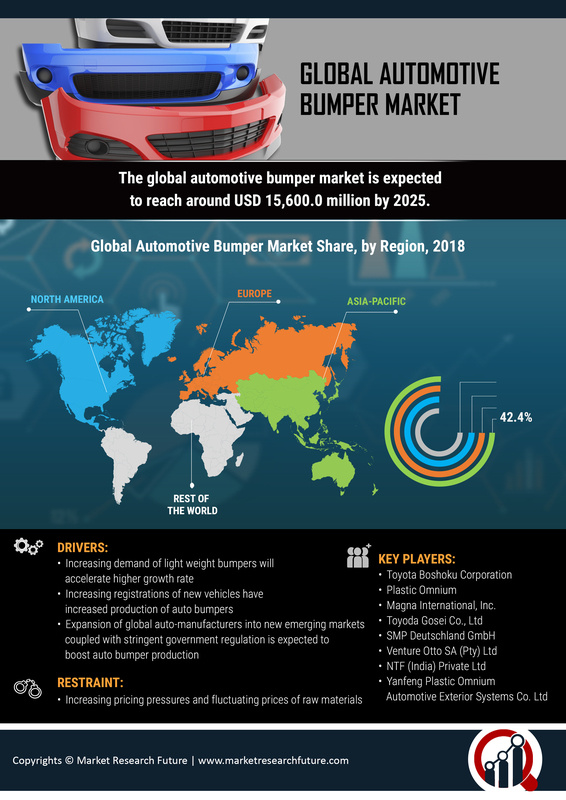

Rising Demand for Lightweight Materials

The Global Automotive Bumper Market Industry is experiencing a notable shift towards lightweight materials, driven by the automotive sector's emphasis on fuel efficiency and performance. Manufacturers are increasingly utilizing materials such as thermoplastics and composites, which not only reduce vehicle weight but also enhance safety features. This trend aligns with global regulatory standards aimed at reducing emissions, thereby contributing to a projected market value of 11.3 USD Billion in 2024. As automakers strive to meet stringent environmental regulations, the adoption of lightweight bumpers is likely to accelerate, indicating a robust growth trajectory for the industry.

Technological Advancements in Safety Features

Technological innovations in automotive safety are significantly influencing the Global Automotive Bumper Market Industry. The integration of advanced safety features, such as pedestrian detection systems and adaptive cruise control, necessitates the development of more sophisticated bumper designs. These innovations not only enhance vehicle safety but also comply with evolving regulatory requirements. As a result, the market is expected to grow, with a projected value of 19.8 USD Billion by 2035. The incorporation of smart technologies into bumpers may also lead to increased consumer demand, suggesting a dynamic shift in design and functionality within the industry.

Regulatory Compliance and Environmental Standards

Regulatory compliance plays a crucial role in shaping the Global Automotive Bumper Market Industry. Governments worldwide are implementing stringent environmental standards aimed at reducing vehicle emissions and enhancing safety. These regulations compel manufacturers to innovate and adopt eco-friendly materials and designs for bumpers. As a result, the market is expected to witness significant growth, with projections indicating a value of 19.8 USD Billion by 2035. Compliance with these regulations not only drives demand for advanced bumper technologies but also encourages manufacturers to invest in sustainable practices, thereby influencing the overall market landscape.