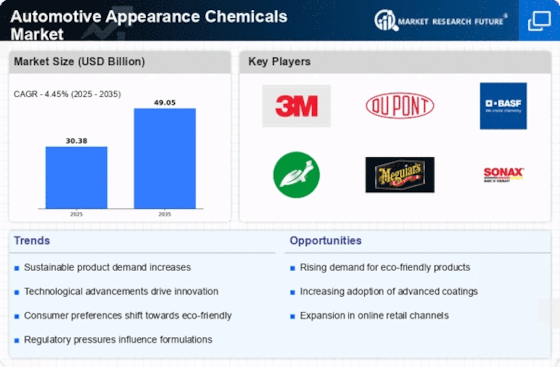

E-commerce Expansion

The expansion of e-commerce platforms is transforming the Automotive Appearance Chemicals Market by providing consumers with greater access to a wide range of products. Online shopping has become increasingly popular, allowing consumers to conveniently purchase automotive appearance chemicals from the comfort of their homes. This trend is particularly beneficial for niche products that may not be readily available in traditional retail outlets. E-commerce platforms also enable manufacturers to reach a broader audience, thereby increasing their market penetration. As more consumers turn to online channels for their automotive needs, the demand for effective marketing strategies and user-friendly online experiences becomes paramount. This shift towards e-commerce is likely to drive growth in the automotive appearance chemicals market, as companies that adapt to this trend can capitalize on the changing shopping behaviors of consumers.

Rising Vehicle Ownership

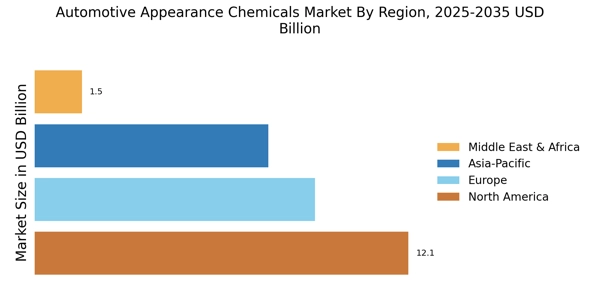

The increasing rate of vehicle ownership is a pivotal driver for the Automotive Appearance Chemicals Market. As more individuals acquire vehicles, the demand for maintenance and aesthetic enhancement products rises correspondingly. In recent years, the number of registered vehicles has surged, leading to a heightened need for cleaning, polishing, and protective products. This trend is particularly pronounced in emerging markets, where vehicle ownership is expected to grow significantly. Consequently, manufacturers of automotive appearance chemicals are likely to experience a boost in sales as consumers seek to maintain the visual appeal and longevity of their vehicles. The automotive appearance chemicals market is projected to expand as vehicle owners prioritize the upkeep of their investments, thereby creating a robust demand for innovative and effective chemical solutions.

Environmental Regulations

Increasing environmental regulations are shaping the Automotive Appearance Chemicals Market by pushing manufacturers towards more sustainable practices. Governments worldwide are implementing stricter guidelines regarding the use of harmful chemicals in automotive products. This regulatory landscape compels companies to innovate and develop eco-friendly alternatives that comply with these standards. As a result, there is a growing market for biodegradable and non-toxic appearance chemicals, which are gaining traction among environmentally conscious consumers. The shift towards sustainability not only aligns with regulatory requirements but also enhances brand reputation and consumer loyalty. Consequently, businesses that adapt to these regulations are likely to thrive in the automotive appearance chemicals market, as they cater to a demographic that prioritizes environmental responsibility.

Technological Advancements

Technological advancements in the formulation of automotive appearance chemicals are driving innovation within the Automotive Appearance Chemicals Market. The development of advanced cleaning agents, waxes, and coatings has led to products that offer superior performance and ease of use. For instance, the introduction of nano-coatings has revolutionized the way vehicles are protected against environmental damage. These innovations not only enhance the effectiveness of appearance chemicals but also cater to the growing consumer preference for high-quality products. As manufacturers invest in research and development, the market is likely to witness a proliferation of cutting-edge solutions that meet the evolving needs of consumers. This trend suggests a competitive landscape where companies that leverage technology effectively may gain a significant advantage in the automotive appearance chemicals market.

Consumer Awareness and Preferences

Consumer awareness regarding vehicle maintenance and aesthetics is a significant driver of the Automotive Appearance Chemicals Market. As individuals become more informed about the benefits of using specialized cleaning and protective products, the demand for these chemicals is likely to increase. Educational campaigns and marketing efforts by manufacturers have contributed to a heightened understanding of the importance of maintaining a vehicle's appearance. This trend is reflected in the growing sales of premium automotive appearance products, as consumers are willing to invest in high-quality solutions that promise better results. Furthermore, the rise of social media has amplified consumer preferences, with many individuals seeking products that enhance their vehicle's visual appeal. This shift in consumer behavior suggests a promising outlook for the automotive appearance chemicals market, as brands that effectively communicate their value propositions may capture a larger share of the market.