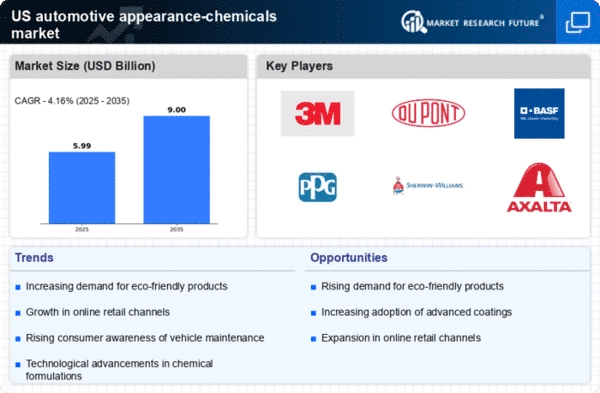

The automotive appearance-chemicals market is characterized by a competitive landscape that is increasingly shaped by innovation, sustainability, and strategic partnerships. Key players such as 3M (US), DuPont (US), and PPG Industries (US) are actively pursuing strategies that emphasize product development and market expansion. 3M (US) has focused on enhancing its portfolio of protective coatings and detailing products, while DuPont (US) has been investing in sustainable solutions that align with environmental regulations. PPG Industries (US) is leveraging its extensive distribution network to penetrate emerging markets, thereby enhancing its competitive positioning. Collectively, these strategies indicate a market that is not only competitive but also responsive to evolving consumer preferences and regulatory demands.In terms of business tactics, companies are increasingly localizing manufacturing to reduce lead times and optimize supply chains. This approach appears to be particularly effective in a moderately fragmented market where agility can provide a competitive edge. The influence of key players is substantial, as their operational decisions often set benchmarks for industry standards and practices, thereby shaping the overall market structure.

In October 3M (US) announced the launch of a new line of eco-friendly automotive detailing products aimed at reducing environmental impact. This strategic move underscores the company's commitment to sustainability and positions it favorably among environmentally conscious consumers. The introduction of these products is likely to enhance 3M's market share while responding to the growing demand for greener alternatives in automotive care.

In September DuPont (US) expanded its partnership with a leading automotive manufacturer to develop advanced coatings that improve vehicle durability and aesthetics. This collaboration not only strengthens DuPont's position in the market but also highlights the importance of strategic alliances in driving innovation. By aligning with automotive manufacturers, DuPont is poised to influence product specifications and standards, thereby enhancing its competitive advantage.

In August PPG Industries (US) completed the acquisition of a regional coatings company, which is expected to bolster its product offerings and expand its geographic reach. This acquisition reflects a broader trend of consolidation within the market, as companies seek to enhance their capabilities and market presence. The strategic importance of this move lies in PPG's ability to leverage the acquired company's technologies and customer base, thereby accelerating growth and innovation.

As of November the automotive appearance-chemicals market is witnessing trends that emphasize digitalization, sustainability, and the integration of artificial intelligence. These trends are reshaping competitive dynamics, as companies increasingly focus on developing innovative solutions that meet consumer demands for efficiency and environmental responsibility. Strategic alliances are becoming more prevalent, facilitating knowledge sharing and resource optimization. Looking ahead, competitive differentiation is likely to evolve from traditional price-based competition to a focus on innovation, technology, and supply chain reliability, suggesting a transformative shift in how companies position themselves in the market.