Market Growth Visualization

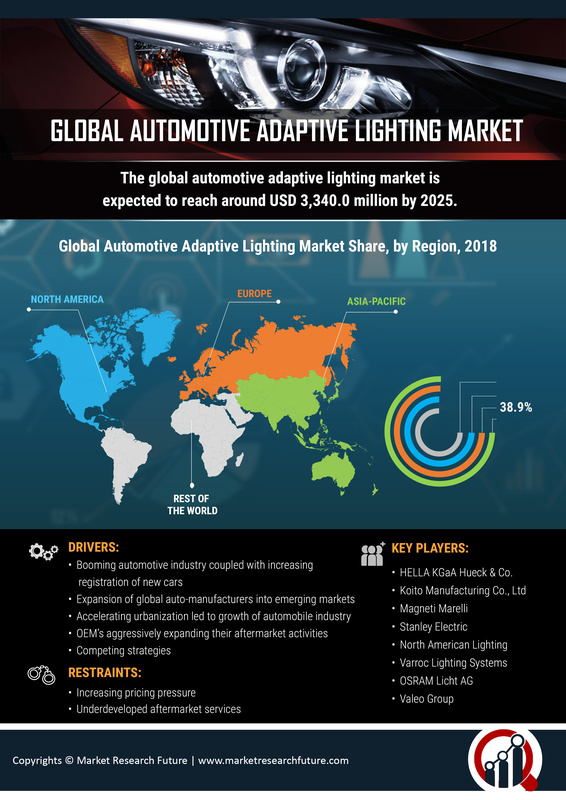

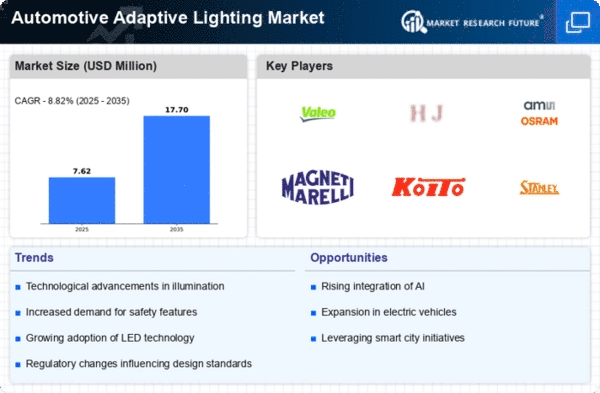

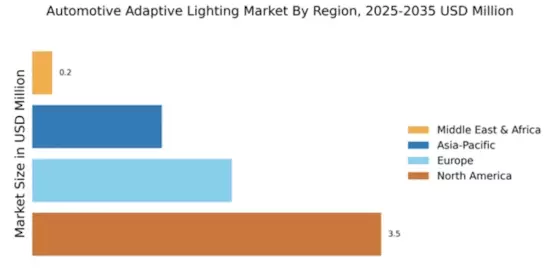

The Global Automotive Adaptive Lighting Market Industry is poised for substantial growth, as illustrated by the projected figures. The market is expected to reach 2.08 USD Billion in 2024 and is anticipated to expand to 5.25 USD Billion by 2035. This growth trajectory indicates a compound annual growth rate of 8.8% from 2025 to 2035. The increasing adoption of advanced lighting technologies, coupled with regulatory support and rising consumer awareness, suggests a robust future for the industry. These metrics highlight the potential for innovation and investment in adaptive lighting solutions across the global automotive sector.

Regulatory Support for Safety Standards

Regulatory frameworks promoting enhanced safety standards are significantly influencing the Global Automotive Adaptive Lighting Market Industry. Governments worldwide are implementing stricter regulations regarding vehicle lighting systems, which necessitate the adoption of adaptive lighting technologies. For instance, the European Union has introduced regulations that mandate the use of advanced lighting systems in new vehicles. This regulatory push is expected to drive market growth, as manufacturers strive to comply with these standards. The anticipated growth trajectory suggests that the market could expand to 5.25 USD Billion by 2035, indicating a robust demand for compliant adaptive lighting solutions.

Rising Consumer Awareness of Safety Features

Consumer awareness regarding the importance of safety features in vehicles is a key driver for the Global Automotive Adaptive Lighting Market Industry. As consumers become more informed about the benefits of adaptive lighting, such as improved night visibility and reduced accident rates, demand for these systems is likely to increase. Surveys indicate that a significant percentage of consumers prioritize safety features when purchasing vehicles, which encourages manufacturers to incorporate advanced lighting technologies. This trend is expected to contribute to a compound annual growth rate of 8.8% from 2025 to 2035, reflecting the growing emphasis on safety in automotive design.

Integration of Smart Technologies in Vehicles

The integration of smart technologies in vehicles is reshaping the Global Automotive Adaptive Lighting Market Industry. Features such as vehicle-to-vehicle communication and advanced driver-assistance systems (ADAS) are increasingly being paired with adaptive lighting solutions. This integration allows for real-time adjustments to lighting based on environmental conditions and traffic scenarios, enhancing overall driving safety. As automakers continue to innovate and incorporate these technologies, the demand for adaptive lighting systems is expected to rise. The market's growth is indicative of a broader trend towards smarter, more connected vehicles that prioritize user safety and convenience.

Technological Advancements in Lighting Systems

The Global Automotive Adaptive Lighting Market Industry is experiencing a surge due to rapid technological advancements in lighting systems. Innovations such as LED and laser technologies enhance visibility and energy efficiency, which are increasingly favored by consumers. These technologies allow for dynamic lighting adjustments based on driving conditions, improving safety and comfort. As a result, the market is projected to reach 2.08 USD Billion in 2024, reflecting a growing demand for sophisticated lighting solutions. Manufacturers are investing heavily in research and development to integrate these advanced systems into new vehicle models, further driving market growth.