Consumer Demand for Customization

The US Automotive Adaptive Lighting Market is witnessing a notable shift in consumer preferences towards customization and personalization. Modern consumers are increasingly seeking vehicles that reflect their individual styles and preferences, including lighting features. Adaptive lighting systems offer a range of customizable options, such as adjustable beam patterns and color temperatures, allowing drivers to tailor their lighting experience. This trend is supported by Market Research Future indicating that nearly 60% of consumers express interest in customizable lighting features in their vehicles. As manufacturers respond to this demand by integrating advanced adaptive lighting technologies, the market is likely to expand, driven by the desire for personalized automotive experiences in the US Automotive Adaptive Lighting Market.

Integration of Smart Technologies

The integration of smart technologies into vehicles is reshaping the US Automotive Adaptive Lighting Market. As vehicles become increasingly connected, adaptive lighting systems are evolving to incorporate features such as automatic beam adjustment and integration with navigation systems. These smart technologies enhance the driving experience by providing optimal lighting conditions based on real-time data, such as road conditions and traffic patterns. Market analysis indicates that the demand for smart lighting solutions is expected to rise, with projections suggesting a growth rate of over 12% in the next five years. This trend reflects a broader movement towards intelligent automotive systems, positioning adaptive lighting as a key component in the future of vehicle design within the US Automotive Adaptive Lighting Market.

Increased Focus on Energy Efficiency

The US Automotive Adaptive Lighting Market is significantly influenced by the growing emphasis on energy efficiency and sustainability. With rising fuel prices and environmental concerns, consumers and manufacturers alike are prioritizing energy-efficient solutions. Adaptive lighting systems, particularly those utilizing LED technology, consume less power compared to traditional halogen lights, thereby reducing the overall energy footprint of vehicles. Recent studies suggest that the adoption of energy-efficient lighting systems could lead to a reduction in energy consumption by up to 30% in the automotive sector. This focus on sustainability not only aligns with consumer values but also encourages manufacturers to innovate and invest in adaptive lighting technologies, further propelling growth in the US Automotive Adaptive Lighting Market.

Regulatory Influence on Safety Standards

Regulatory frameworks play a crucial role in shaping the US Automotive Adaptive Lighting Market. The National Highway Traffic Safety Administration (NHTSA) has established stringent safety standards that require vehicles to be equipped with advanced lighting systems. These regulations aim to reduce accidents caused by poor visibility and enhance overall road safety. As a result, automotive manufacturers are increasingly investing in adaptive lighting technologies to comply with these regulations. The implementation of new safety standards is expected to drive the adoption of adaptive lighting systems, as vehicles equipped with these technologies are more likely to meet regulatory requirements. This trend indicates a growing alignment between regulatory mandates and market dynamics within the US Automotive Adaptive Lighting Market.

Technological Advancements in Lighting Systems

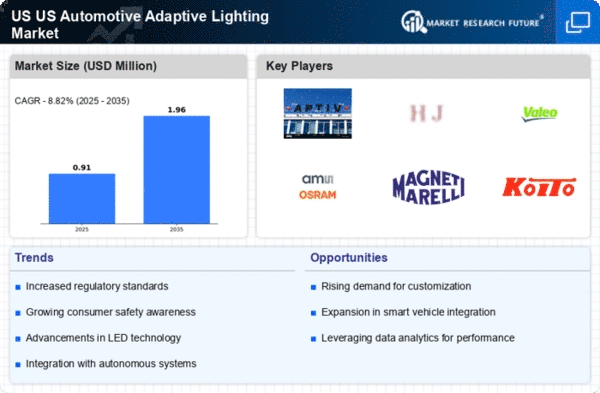

The US Automotive Adaptive Lighting Market is experiencing a surge in technological advancements that enhance vehicle safety and performance. Innovations such as LED and laser lighting technologies are becoming increasingly prevalent, providing superior illumination and energy efficiency. According to recent data, the market for adaptive lighting systems is projected to grow at a compound annual growth rate of approximately 10% through 2028. These advancements not only improve visibility during adverse weather conditions but also contribute to energy savings, aligning with the growing emphasis on sustainability in the automotive sector. As manufacturers integrate these technologies into new vehicle models, the demand for adaptive lighting systems is likely to rise, further driving growth in the US Automotive Adaptive Lighting Market.