September 2023: ENSO Oils & Lubricants has forged a partnership with Gazpromneft-Lubricants, a subsidiary of Gazprom Neft PJSC, aimed at expanding the distribution of lubricant assets in South Asia. ENSO will engage in the importation and distribution of Gazpromneft-Lubricants' diverse range of oils and lubricants to cater to the requirements of various industries in India.

January 2024: Shell plc's subsidiary, Shell Lubricants, has finalized the acquisition of MIDEL and MIVOLT from M&I Materials Ltd., a United Kingdom-based company headquartered in Manchester. This acquisition aims to incorporate the MIDEL and MIVOLT product lines into Shell's worldwide lubricants portfolio, encompassing manufacturing, distribution, and marketing efforts.

ENSO Oils & Lubricants signed a contract with Gazprom Neft in September 2023 to facilitate lubricant distribution in Indian Sectors. Gazprom Neft’s subsidiary, Gazpromneft-Lubricants, will have their oils imported and distributed by ENSO throughout South Asia.

Shell plc subsidiary, Shell Lubricants, will acquire MIDEL and MIVOLT from M&I Materials Ltd. in January 2024. This purchase will include the trademarked product lines under Shell’s portfolio and was primarily done to enhance their marketing, distributing and manufacturing of lubricants.

Etna Products Inc. acquired JTM Products as part of a broader growth strategy that was formulated in April 2023. Along with metalworking fluid, the purchase enhanced the company’s technological capabilities by establishing a more efficient distribution network while also increasing manufacturing capabilities with a research and development center.

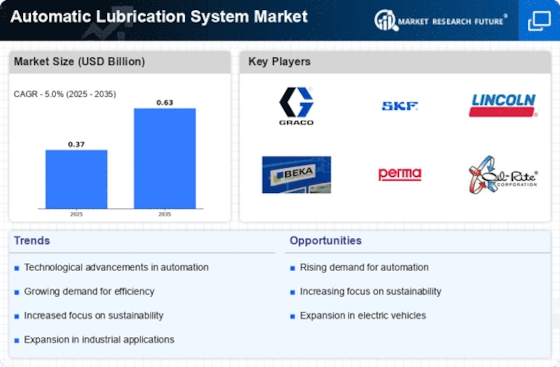

In April 2023, Graco erected the first automatic lubrication technology with their new GCI™ Series Cartridge Injector. Besides being a pioneer in the industry, the new injectors can increase the output of their predecessors while cutting downtime and unforeseen spending on personnel.

In April 2023, Timken Company issued a press release regarding the acquisition of American Roller Bearings Company and Nadella Group. The acquisition sets forward the company’s portfolio of engineered bearing solutions, improving its serviceability to enterprises overall. Besides expanding the company’s linear motion portfolio, the acquisition created synergies to foster growth and market opportunities for automatic lubrication systems.

In January 2024, Shell Lubricants made a purchase from M&I Materials Ltd. Manchester, which included the MIDEL and MIVOLT brands. The goal of the acquisition is to offset the MIDEL and MIVOLT brands into Shell’s global lubricant portfolio, thus improving its yield circulation thrusts.

In October 2023, NTN Europe launched the DRIVE BOOSTER single-point automatic lubricator, the FIRST of its kind. Set up of this novel contraption is straightforward, requiring no changes to pre-existing structures, and it facilitates lubricants that are precise and bespoke, thus eliminating the requirement for customization. By allowing remote installation, it improves worker safety by eliminating direct engagement with the machinery, and through its automatic lubrication features, it claims up to 25% cost savings.