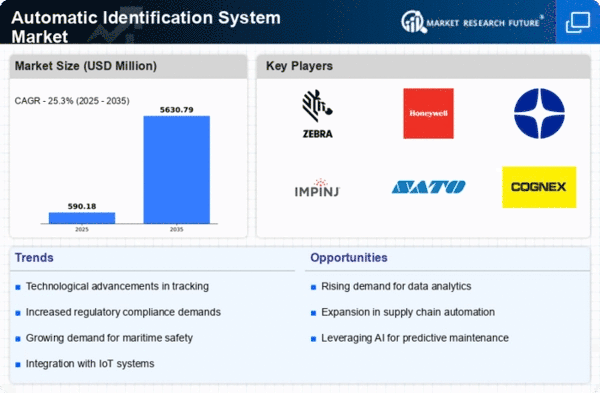

Market Growth Projections

The Global automatic identification system Market Industry is projected to experience robust growth over the coming years. With a market valuation of 0.3 USD Billion in 2024, the industry is expected to expand significantly, reaching 2.86 USD Billion by 2035. This growth trajectory indicates a compound annual growth rate of 22.75% from 2025 to 2035, reflecting the increasing adoption of automatic identification technologies across various sectors. The demand for efficient logistics, regulatory compliance, and technological advancements are key factors driving this expansion, positioning the industry for a promising future.

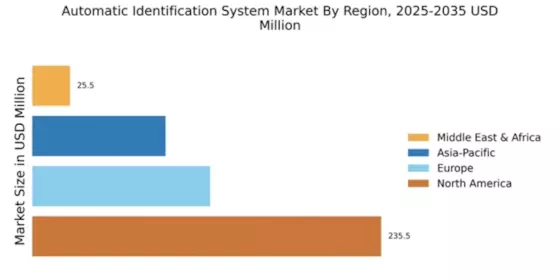

Emerging Markets and Global Expansion

Emerging markets present substantial opportunities for the Global Automatic Identification System Market Industry. As developing economies continue to industrialize, there is a growing demand for efficient identification solutions across various sectors. Countries in Asia-Pacific and Latin America are witnessing rapid growth in logistics and manufacturing, driving the need for automatic identification systems. These regions are increasingly adopting technologies such as RFID and barcode scanning to enhance operational efficiency and accuracy. The expansion into these emerging markets is expected to fuel market growth, as businesses seek to leverage automatic identification systems to improve productivity and competitiveness.

Growth of E-commerce and Retail Sectors

The growth of e-commerce and retail sectors significantly impacts the Global Automatic Identification System Market Industry. With the increasing volume of online transactions and the need for efficient order fulfillment, businesses are turning to automatic identification systems to streamline operations. Technologies such as barcode scanning and RFID enable retailers to manage inventory effectively, reduce shrinkage, and enhance customer experience. The ongoing expansion of e-commerce platforms necessitates robust identification solutions to ensure timely deliveries and accurate order processing. This trend is likely to contribute to the market's expansion, as companies invest in advanced identification technologies to stay competitive.

Increasing Demand for Efficient Logistics

The Global Automatic Identification System Market Industry experiences a surge in demand driven by the need for efficient logistics and supply chain management. As businesses strive to optimize operations, technologies such as RFID and barcode scanning become essential. In 2024, the market is valued at 0.3 USD Billion, reflecting a growing recognition of the importance of real-time tracking and inventory management. Companies are increasingly adopting these systems to enhance operational efficiency, reduce errors, and improve customer satisfaction. This trend is expected to continue, with the market projected to reach 2.86 USD Billion by 2035, indicating a robust growth trajectory.

Regulatory Compliance and Safety Standards

Regulatory compliance and safety standards are pivotal drivers in the Global Automatic Identification System Market Industry. Governments worldwide are implementing stringent regulations to enhance safety and security across various sectors, including transportation, healthcare, and manufacturing. Automatic identification systems play a crucial role in ensuring compliance with these regulations by providing accurate tracking and reporting capabilities. For instance, the adoption of RFID technology in healthcare has improved patient safety and medication management. As organizations strive to meet regulatory requirements, the demand for automatic identification systems is expected to rise, further propelling market growth.

Technological Advancements in Identification Systems

Technological advancements significantly influence the Global Automatic Identification System Market Industry, as innovations in identification technologies enhance performance and reliability. The integration of artificial intelligence and machine learning into automatic identification systems allows for improved data analysis and decision-making processes. These advancements not only streamline operations but also reduce costs associated with manual identification methods. As organizations increasingly adopt these cutting-edge technologies, the market is poised for substantial growth. The anticipated compound annual growth rate of 22.75% from 2025 to 2035 underscores the potential for widespread adoption and integration of advanced identification solutions.