Growing Focus on Sustainability

Sustainability is becoming a central theme in the Automated Truck Market. With increasing awareness of environmental issues, companies are under pressure to reduce their carbon footprints. Automated trucks, which can optimize fuel efficiency and reduce emissions, are seen as a viable solution. The transportation sector accounts for approximately 29% of total greenhouse gas emissions, highlighting the urgent need for cleaner alternatives. The adoption of electric and hybrid automated trucks is gaining traction, with projections indicating that the electric truck market could reach USD 1 trillion by 2030. This shift towards sustainable transportation solutions is likely to drive investments in the Automated Truck Market, as businesses seek to align with environmental regulations and consumer expectations. Consequently, sustainability initiatives are expected to significantly influence the growth trajectory of the automated trucking sector.

Regulatory Support and Frameworks

Regulatory developments are playing a pivotal role in shaping the Automated Truck Market. Governments are increasingly recognizing the potential benefits of automated trucking, leading to the establishment of supportive regulatory frameworks. These regulations aim to ensure safety, promote innovation, and facilitate the integration of automated vehicles into existing transportation systems. For example, several countries have introduced pilot programs to test automated trucks on public roads, providing valuable data for future regulations. The establishment of clear guidelines is essential for fostering public trust and encouraging investment in automated technologies. As regulatory bodies continue to adapt to the evolving landscape of transportation, the Automated Truck Market is likely to benefit from enhanced legitimacy and support, paving the way for broader adoption of automated trucking solutions.

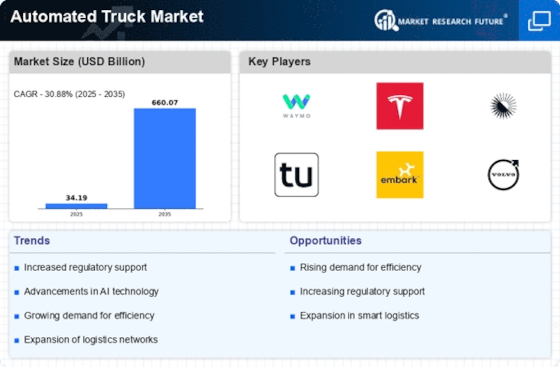

Rising Demand for Efficient Logistics

The Automated Truck Market is experiencing a surge in demand for efficient logistics solutions. As e-commerce continues to expand, companies are seeking ways to optimize their supply chains. Automated trucks offer the potential for reduced operational costs and improved delivery times. According to recent data, the logistics sector is projected to grow at a compound annual growth rate of 7.5% over the next five years. This growth is likely to drive investments in automated trucking technologies, as businesses aim to enhance their competitive edge. Furthermore, the integration of automated trucks into logistics networks could lead to significant reductions in fuel consumption and emissions, aligning with broader sustainability goals. As a result, the Automated Truck Market is poised for substantial growth, driven by the need for more efficient and cost-effective logistics solutions.

Increasing Investment in Infrastructure

Investment in infrastructure is a critical driver for the Automated Truck Market. As automated trucks become more prevalent, there is a growing need for infrastructure that supports their operation. This includes the development of smart roads, dedicated lanes, and charging stations for electric automated trucks. Recent estimates suggest that infrastructure investment in the transportation sector could exceed USD 2 trillion over the next decade. Such investments are likely to enhance the efficiency and safety of automated trucking operations. Furthermore, collaboration between public and private sectors is essential to create an environment conducive to the growth of the Automated Truck Market. As infrastructure continues to evolve, it will play a vital role in facilitating the widespread adoption of automated trucking technologies.

Technological Innovations in Automation

Technological advancements are a key driver in the Automated Truck Market. Innovations in artificial intelligence, machine learning, and sensor technologies are enhancing the capabilities of automated trucks. These advancements enable vehicles to navigate complex environments, make real-time decisions, and improve safety. For instance, the implementation of advanced driver-assistance systems (ADAS) has been shown to reduce accident rates significantly. The market for automated trucks is expected to reach USD 1.5 billion by 2026, reflecting the increasing adoption of these technologies. Moreover, the development of 5G networks is likely to facilitate better communication between vehicles and infrastructure, further enhancing the efficiency of automated trucking operations. As these technologies continue to evolve, they will play a crucial role in shaping the future of the Automated Truck Market.