Research Methodology on Truck Platooning Market

This study on the Truck Platooning Market is made to provide an up-to-date analysis of the market. The market is studied from 2023 to 2030 via both a qualitative and quantitative approach.

To analyze the market, primary research is conducted based on interviews and surveys with market experts, industry representatives, and stakeholders. Secondary research was done through an extensive analysis of existing databases, publications, statistics, and company reports.

Data collection techniques such as closed-ended questionnaires and interviews were used to collect data from the market. The market studies were used to analyze the data gained. This is done using multiple tools such as Porter's Five Forces Analysis, SWOT Analysis, Growth Share Matrix, and market attractiveness analysis.

A bottom-up approach is used to estimate the Truck Platooning market size and premium. supply chain analysis was used to assess the potential of the market.

The data collected from both primary and secondary research is validated to check their consistency, veracity, and accuracy.

Scope

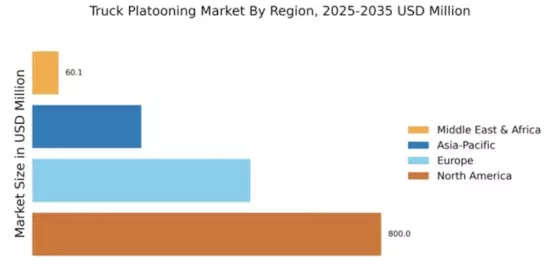

The scope of the research focused on the North American and European regions. The research is conducted with the aim of gaining more in-depth information about the Truck Platooning Market. The data and information provided are based on the market size of the years 2023 and 2030; however, the data for the other years are estimated.

Research Strategy

The research was conducted using a combination of primary and secondary research. The qualitative and quantitative analysis of the Truck Platooning Market was done using PESTEL, Porter's Five Forces analysis, SWOT analysis, and market attractiveness analysis. The data collected was validated using triangulation techniques.

Primary Research Methodology

The primary research is conducted using closed-ended questionnaires and interviews with key stakeholders, industry experts, and market participants were conducted to understand the current trends and developments in the Truck Platooning Market. The collected data was then validated, compiled, and analyzed to get an in-depth understanding of the market.

A detailed analysis of the collected data via Regression analysis, Multivariate analysis, and Correlation analysis.

Secondary Research Methodology

The secondary research is conducted using various research databases such as Bloomberg, Financial Times, Forbes, and the World Bank. The data collected is compiled, validated, and analyzed using market size, demand-supply gap analysis, and market segmentation. The estimated and generated data was used for the quantitative analysis and segmentation.

Findings, Feedback, and Interpretations

The findings of the research identified the key opportunities and potential restraints that can impact the Truck Platooning Market. The insights from primary and secondary research are compiled, validated, and analyzed in detail. These insights are then used to generate the revenue of the market from the year 2023 to 2030.

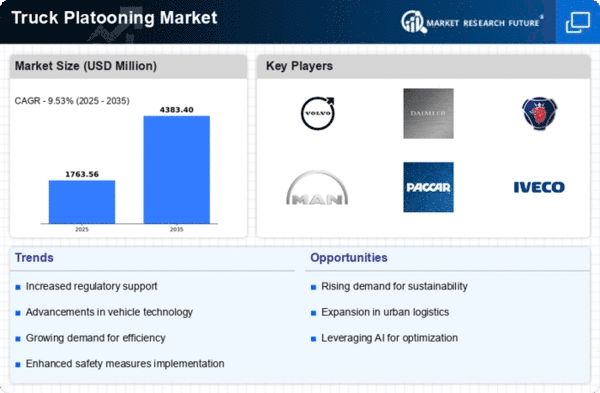

The key findings of the research include high demand for Truck Platooning Solutions due to the increasing adoption of autonomous vehicles, advances in control systems, and growing awareness about driver safety. The market is expected to experience substantial growth in the coming years, riding on further advancements in platooning technologies, increasing fuel emission regulations, and road safety concerns. The market is also likely to benefit from increasing investments in connected vehicle technologies.