Regulatory Support for ATM Operations

Regulatory frameworks play a crucial role in shaping the Automated Teller Machine Market. Governments and financial authorities are increasingly recognizing the importance of ATMs in promoting financial inclusion and economic stability. As a result, there is a growing trend towards supportive regulations that facilitate the deployment and operation of ATMs. For instance, some jurisdictions are implementing policies that encourage the installation of ATMs in remote areas, thereby enhancing access to financial services. Additionally, regulations aimed at improving security standards for ATMs are being introduced, which can bolster consumer confidence. This regulatory support is likely to foster a more favorable environment for the growth of the Automated Teller Machine Market.

Increased Demand for Cashless Transactions

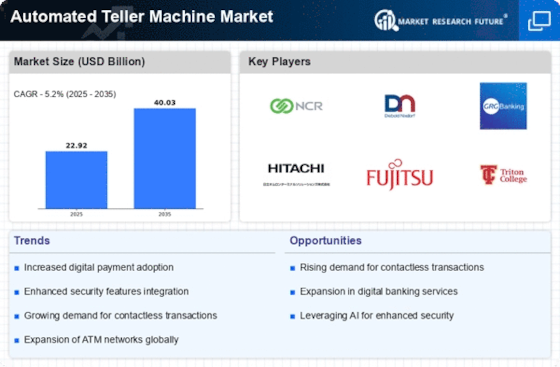

The Automated Teller Machine Market is experiencing a notable shift towards cashless transactions. As consumers increasingly prefer digital payment methods, the demand for ATMs that support various cashless options is rising. This trend is evidenced by the growing number of contactless payment transactions, which have surged significantly in recent years. According to recent data, cashless transactions are projected to account for a substantial portion of total payment volumes, indicating a shift in consumer behavior. Consequently, ATM providers are adapting their machines to accommodate these preferences, integrating features that allow for mobile payments and digital wallets. This evolution not only enhances user convenience but also positions the Automated Teller Machine Market to capitalize on the ongoing transition towards a more digital economy.

Technological Advancements in ATM Features

Technological innovations are driving the evolution of the Automated Teller Machine Market. Modern ATMs are increasingly equipped with advanced features such as biometric authentication, enhanced security measures, and user-friendly interfaces. These advancements not only improve the customer experience but also address growing concerns regarding security and fraud. For instance, the integration of biometric technology, such as fingerprint and facial recognition, is becoming more prevalent, potentially reducing unauthorized access. Furthermore, the implementation of artificial intelligence in ATMs allows for predictive maintenance, ensuring machines are operational and reducing downtime. As these technologies continue to develop, they are likely to attract more users, thereby expanding the reach of the Automated Teller Machine Market.

Rising Consumer Expectations for Convenience

Consumer expectations are evolving, and the Automated Teller Machine Market must adapt to meet these demands. Today's consumers seek convenience and efficiency in their banking experiences, which is driving the need for ATMs that offer a wide range of services beyond cash withdrawal. Features such as bill payment, fund transfers, and account management are becoming increasingly important. Data suggests that ATMs offering multifunctional capabilities are more likely to attract users, as they provide a one-stop solution for various banking needs. This shift in consumer behavior is prompting ATM operators to enhance their service offerings, thereby positioning the Automated Teller Machine Market for sustained growth in a competitive landscape.

Expansion of ATM Networks in Emerging Markets

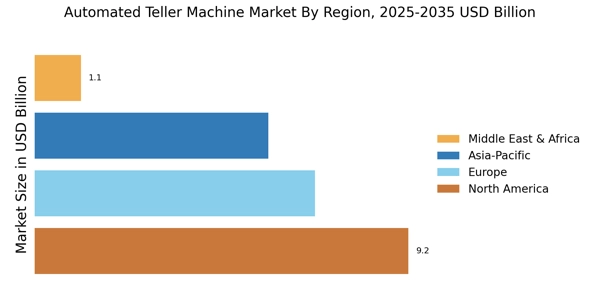

The Automated Teller Machine Market is witnessing significant growth in emerging markets, where the expansion of ATM networks is becoming increasingly vital. As financial inclusion initiatives gain momentum, more individuals in these regions are gaining access to banking services. This is reflected in the rising number of ATMs being deployed in rural and underserved areas, which facilitates easier access to cash and banking services. Data indicates that the number of ATMs in these markets is expected to grow at a compound annual growth rate (CAGR) of over 10% in the coming years. This expansion not only supports local economies but also enhances the overall landscape of the Automated Teller Machine Market, as it opens new avenues for service providers.