Rising Demand for Cell-Based Research

The Automated Cell Counters Market is significantly influenced by the rising demand for cell-based research across various sectors, including pharmaceuticals and biotechnology. As the focus on drug discovery and development intensifies, the need for efficient and accurate cell counting methods becomes paramount. The market is estimated to reach a valuation of USD 1.5 billion by 2026, reflecting the growing investment in research and development activities. This trend is further supported by the increasing prevalence of chronic diseases, which necessitates extensive research into cellular mechanisms. Consequently, automated cell counters are becoming indispensable tools in laboratories, enabling researchers to conduct high-throughput analyses with greater precision. The ongoing advancements in cell counting technologies are likely to cater to this demand, ensuring that the market continues to expand in response to evolving research needs.

Growing Adoption of Automation in Healthcare

The growing adoption of automation in healthcare is a pivotal factor influencing the Automated Cell Counters Market. As healthcare facilities strive to improve operational efficiency and patient outcomes, the integration of automated solutions becomes increasingly important. The market is anticipated to grow at a CAGR of approximately 9% in the coming years, driven by the need for rapid and accurate diagnostic tools. Automated cell counters facilitate high-throughput screening and analysis, which are essential in clinical laboratories. This trend is further supported by the increasing emphasis on reducing turnaround times for test results, thereby enhancing patient care. As healthcare providers continue to embrace automation, the demand for automated cell counting technologies is expected to rise, positioning these solutions as integral components of modern healthcare diagnostics.

Increased Focus on Quality Control in Laboratories

Quality control remains a critical aspect of laboratory operations, and the Automated Cell Counters Market is adapting to meet these stringent requirements. Laboratories are increasingly adopting automated solutions to ensure consistent and reliable results in cell counting, which is essential for maintaining compliance with regulatory standards. The market is projected to witness a steady growth trajectory, with an anticipated CAGR of around 7% over the next few years. This growth is driven by the need for enhanced accuracy and reproducibility in experimental results, particularly in clinical diagnostics and research applications. Automated cell counters provide a level of precision that manual counting methods cannot achieve, thereby reducing variability and improving overall data integrity. As laboratories prioritize quality assurance, the demand for automated cell counting solutions is expected to rise, further solidifying their role in modern laboratory practices.

Technological Advancements in Automated Cell Counters

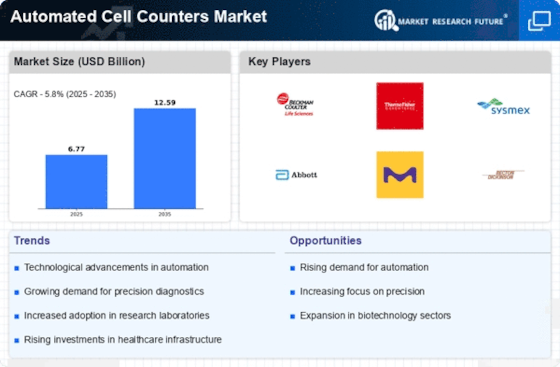

The Automated Cell Counters Market is experiencing a surge in technological advancements, particularly in imaging and analysis techniques. Innovations such as high-resolution imaging and advanced algorithms enhance the accuracy and efficiency of cell counting. These developments are crucial as they allow for the analysis of complex cell populations, which is increasingly important in research and clinical settings. The market is projected to grow at a compound annual growth rate (CAGR) of approximately 8% over the next five years, driven by the demand for precise and rapid cell analysis. Furthermore, the integration of automation in laboratory workflows is likely to streamline processes, thereby reducing human error and increasing throughput. As laboratories seek to improve productivity, the adoption of advanced automated cell counters is expected to rise, further propelling the market forward.

Expansion of Biotechnology and Pharmaceutical Industries

The expansion of the biotechnology and pharmaceutical industries is a significant driver for the Automated Cell Counters Market. As these sectors continue to grow, the demand for advanced laboratory equipment, including automated cell counters, is likely to increase. The market is projected to experience robust growth, with estimates suggesting a value of USD 1.8 billion by 2027. This growth is attributed to the increasing number of biopharmaceutical companies focusing on cell-based therapies and personalized medicine. Automated cell counters play a vital role in these applications by providing accurate cell quantification, which is essential for developing effective therapies. Furthermore, the rise in funding for biotechnology research is expected to bolster the market, as more laboratories seek to invest in cutting-edge technologies to enhance their research capabilities.