Market Trends

Key Emerging Trends in the Automated Cell Counters Market

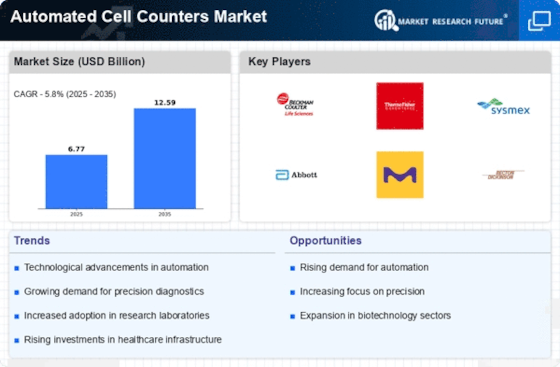

The market trends of automated cell counters have witnessed significant growth and transformation in recent years, driven by advancements in technology and increased demand for efficient and accurate cell counting methods across various industries. Automated cell counters play a crucial role in biomedical research, clinical diagnostics, and pharmaceutical development, providing rapid and precise cell counting results.

One prominent trend in the automated cell counters market is the integration of cutting-edge technologies. Manufacturers are incorporating advanced features such as image analysis, artificial intelligence, and machine learning algorithms to enhance the accuracy and speed of cell counting processes. These technological advancements not only improve the efficiency of cell counting but also contribute to reducing errors and increasing reproducibility in research and diagnostic applications.

Another key trend is the rising adoption of automated cell counting in pharmaceutical and biotechnology industries. As these sectors continue to expand, the need for high-throughput cell counting solutions becomes more critical. Automated cell counters offer the advantage of processing a large number of samples in a short time, allowing researchers and scientists to accelerate their workflow and increase overall productivity. This trend is expected to drive the market growth as pharmaceutical companies focus on streamlining their research and development processes.

Furthermore, the increasing prevalence of chronic diseases and the growing importance of personalized medicine have fueled the demand for automated cell counting in clinical diagnostics. Accurate cell counting is essential for various medical procedures, including blood cell analysis, cancer research, and infectious disease diagnostics. Automated cell counters provide a reliable and standardized method for obtaining precise cell counts, aiding healthcare professionals in making informed decisions regarding patient treatment and care.

Cost-effectiveness is also a significant factor influencing market trends in automated cell counters. As the technology becomes more widespread and competition among manufacturers intensifies, there is a trend toward more affordable and user-friendly automated cell counting solutions. This makes the technology accessible to a broader range of research laboratories, clinical settings, and academic institutions, contributing to its widespread adoption.

Additionally, the COVID-19 pandemic has accelerated the demand for automated cell counters, particularly in the context of vaccine development and research. The urgent need for high-throughput testing and analysis during the pandemic has underscored the importance of efficient and reliable cell counting methods. Automated cell counters have played a crucial role in supporting the rapid development and production of vaccines, highlighting their significance in responding to global health challenges.

Leave a Comment