Growing Investment in Biologics

The surge in investment in biologics is significantly influencing the Autoinjectors Market. Biologics, which often require injection for administration, are becoming increasingly prevalent in the treatment of various diseases, including cancer and autoimmune disorders. As pharmaceutical companies invest heavily in the development of biologic therapies, the demand for autoinjectors that can effectively deliver these complex medications is expected to rise. Market analysis suggests that the biologics segment is one of the fastest-growing areas in the pharmaceutical industry, which in turn is likely to propel the growth of the Autoinjectors Market. This trend indicates a promising future for manufacturers who can adapt their products to meet the specific needs of biologic therapies.

Regulatory Support for Autoinjectors

Regulatory support plays a crucial role in shaping the Autoinjectors Market. Various health authorities are increasingly recognizing the importance of autoinjectors in facilitating self-administration of medications, particularly for chronic conditions. This recognition has led to streamlined approval processes for new devices, encouraging innovation and market entry. For instance, the introduction of guidelines that prioritize patient safety and device efficacy has fostered a more favorable environment for manufacturers. As a result, the number of approved autoinjectors has risen, contributing to a more competitive landscape. The regulatory framework is expected to continue evolving, which may further enhance the growth prospects of the Autoinjectors Market.

Rising Demand for Self-Administration

The growing trend towards self-administration of medications is a significant driver in the Autoinjectors Market. Patients increasingly prefer the convenience and autonomy that autoinjectors provide, particularly for conditions requiring regular injections, such as diabetes and rheumatoid arthritis. This shift is supported by demographic changes, including an aging population that seeks to manage their health independently. Market data indicates that the demand for self-injection devices is on the rise, with projections suggesting a substantial increase in market share for autoinjectors. This trend not only reflects changing patient preferences but also highlights the potential for manufacturers to innovate and expand their product offerings within the Autoinjectors Market.

Increased Prevalence of Chronic Diseases

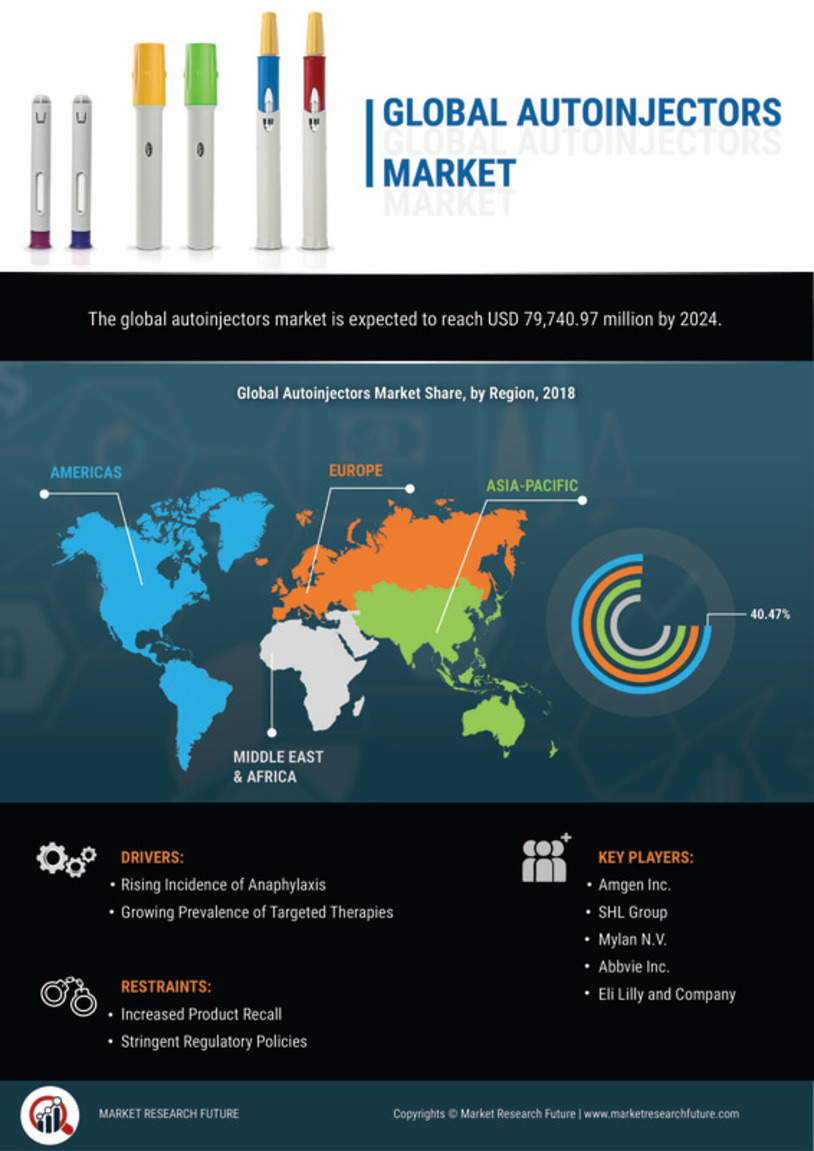

The rising prevalence of chronic diseases is a pivotal factor driving the Autoinjectors Market. Conditions such as diabetes, multiple sclerosis, and allergies necessitate regular medication, often administered via injections. As the global burden of these diseases continues to grow, the demand for efficient and user-friendly delivery systems like autoinjectors is expected to increase. Recent statistics indicate that chronic diseases account for a significant portion of healthcare expenditures, prompting healthcare systems to seek cost-effective solutions. Consequently, the Autoinjectors Market is likely to benefit from this trend, as more patients require reliable and convenient methods for managing their conditions.

Technological Advancements in Autoinjectors

The Autoinjectors Market is experiencing rapid technological advancements that enhance the efficacy and user-friendliness of these devices. Innovations such as smart autoinjectors, which integrate connectivity features, allow for real-time monitoring and data collection. This capability not only improves patient adherence but also provides healthcare professionals with valuable insights into treatment regimens. Furthermore, advancements in needle technology and drug formulation are contributing to reduced pain and improved delivery efficiency. According to recent data, the market for smart autoinjectors is projected to grow significantly, indicating a shift towards more sophisticated solutions in the Autoinjectors Market. As these technologies evolve, they are likely to attract a broader consumer base, thereby driving market growth.