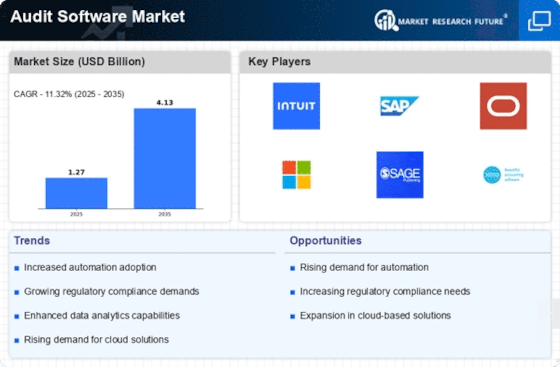

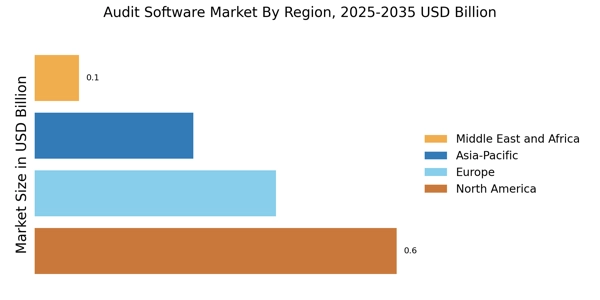

North America : Leading Market Innovators

North America is the largest market for audit software, holding approximately 45% of the global share. The region's growth is driven by increasing regulatory compliance requirements and the adoption of advanced technologies like AI and machine learning. The demand for efficient audit processes is further fueled by the rise of remote work and digital transformation initiatives across various sectors. The United States and Canada are the leading countries in this market, with major players like Intuit, Oracle, and Microsoft establishing a strong presence. The competitive landscape is characterized by continuous innovation and strategic partnerships, ensuring that these companies remain at the forefront of the audit software industry. The focus on enhancing user experience and integrating cloud solutions is also shaping market dynamics.

Europe : Regulatory Compliance Focus

Europe is the second-largest market for audit software, accounting for around 30% of the global market share. The region's growth is primarily driven by stringent regulatory frameworks and the need for enhanced transparency in financial reporting. The increasing emphasis on data protection and compliance with regulations like GDPR is propelling demand for robust audit solutions across various industries. Leading countries in this region include Germany, the UK, and France, where companies are increasingly adopting audit software to streamline their processes. In Europe, the UK audit software market remains one of the most mature, supported by strict financial reporting standards and widespread adoption among accounting and CPA firms. Key players such as SAP and Sage are well-established, contributing to a competitive landscape that encourages innovation. The presence of numerous SMEs also drives demand for affordable and scalable audit solutions, further enhancing market growth.

Asia-Pacific : Emerging Market Potential

Asia-Pacific is witnessing significant growth in the audit software market, holding approximately 20% of the global share. The region's expansion is fueled by increasing digitalization, a growing number of startups, and rising awareness of compliance requirements. Countries like China and India are leading this growth, driven by their rapidly evolving economies and the need for efficient audit processes in various sectors. Asia-Pacific represents a high-growth region, with the India audit software market expanding rapidly due to increased SME digitization and regulatory compliance requirements. Meanwhile, the Japan audit software market benefits from advanced enterprise adoption, and the South Korea audit software market is driven by strong technology integration and corporate governance reforms. The competitive landscape is becoming increasingly dynamic, with both local and international players vying for market share. Companies like Xero and Zoho are gaining traction, catering to the needs of small and medium enterprises. The focus on cloud-based solutions and automation is reshaping the market, making audit processes more efficient and accessible for businesses across the region.

Middle East and Africa : Untapped Market Opportunities

The Middle East and Africa region is gradually emerging in the audit software market, currently holding about 5% of the global share. The growth is driven by increasing investments in technology and a rising awareness of the importance of compliance and transparency in financial practices. Countries like South Africa and the UAE are leading this trend, with a growing number of businesses seeking efficient audit solutions to meet regulatory requirements.

The GCC audit software market is gaining momentum as governments and enterprises in the region emphasize regulatory compliance, transparency, and digital governance initiatives.

The South America audit software market is gradually expanding as regulatory frameworks strengthen across the region. The Brazil audit software market leads adoption due to its large BFSI and corporate sectors, while the Argentina audit software market is witnessing steady growth driven by increasing compliance awareness and digital transformation initiatives.

The competitive landscape is still developing, with both local and international players entering the market. Companies are focusing on providing tailored solutions to meet the unique needs of businesses in this region. The increasing adoption of cloud technology and mobile solutions is expected to further enhance market growth, making audit software more accessible to a wider audience.