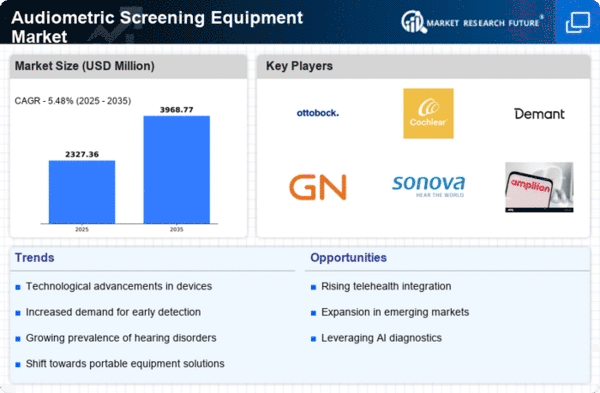

Market Growth Projections

The Global Audiometric Screening Equipment Market Industry is poised for substantial growth, with projections indicating a market value of 2.21 USD Billion in 2024 and an anticipated increase to 3.97 USD Billion by 2035. This growth trajectory suggests a robust compound annual growth rate (CAGR) of 5.46% from 2025 to 2035. Such figures reflect the increasing demand for audiometric screening solutions driven by various factors, including technological advancements, rising awareness of hearing health, and government initiatives. The market's expansion is indicative of a broader recognition of the importance of hearing health in overall well-being.

Government Initiatives and Funding

Government initiatives aimed at improving public health significantly influence the Global Audiometric Screening Equipment Market Industry. Many countries are implementing programs to enhance hearing health awareness and provide funding for audiometric screening in schools and communities. For example, initiatives in various nations promote early hearing detection and intervention programs, ensuring that children receive necessary screenings. Such efforts not only increase the demand for audiometric equipment but also foster partnerships between public health organizations and manufacturers. This collaborative approach is likely to sustain market growth, as funding and support for hearing health initiatives continue to expand.

Rising Awareness of Hearing Health

Growing awareness of hearing health among the general population significantly impacts the Global Audiometric Screening Equipment Market Industry. Educational campaigns and outreach programs are increasingly informing individuals about the importance of regular hearing assessments. This heightened awareness encourages people to seek audiometric screenings, thereby driving demand for advanced equipment. As more individuals recognize the value of early detection and intervention, healthcare providers are likely to expand their audiometric services. This trend is expected to contribute to the market's growth, aligning with the projected increase in market value to 2.21 USD Billion in 2024.

Increasing Prevalence of Hearing Disorders

The rising incidence of hearing disorders globally drives the demand for audiometric screening equipment. According to recent data, approximately 466 million people worldwide experience disabling hearing loss. This growing prevalence necessitates effective screening solutions, thereby propelling the Global Audiometric Screening Equipment Market Industry. As awareness of hearing health increases, healthcare providers are more inclined to invest in advanced audiometric devices. The market is projected to reach 2.21 USD Billion in 2024, reflecting a significant response to this pressing health issue. The emphasis on early detection and intervention further underscores the importance of reliable audiometric screening tools.

Aging Population and Associated Hearing Loss

The aging global population is a critical driver of the Global Audiometric Screening Equipment Market Industry. As individuals age, the likelihood of experiencing hearing loss increases, creating a heightened need for effective screening solutions. By 2035, the number of people aged 65 and older is projected to reach 1.5 billion, further emphasizing the importance of audiometric screening. This demographic shift compels healthcare systems to prioritize hearing health, leading to increased investments in audiometric devices. The market's growth trajectory, with a projected CAGR of 5.46% from 2025 to 2035, reflects the urgent need for comprehensive hearing assessments among older adults.

Technological Advancements in Audiometric Devices

Technological innovations in audiometric screening equipment are reshaping the Global Audiometric Screening Equipment Market Industry. The introduction of digital audiometers and portable screening devices enhances accessibility and accuracy in hearing assessments. These advancements allow for more efficient testing processes and improved patient experiences. For instance, wireless technology enables remote testing, which is particularly beneficial in underserved regions. As a result, the market is expected to grow, with projections indicating a value of 3.97 USD Billion by 2035. The continuous evolution of technology in this sector suggests a promising future for audiometric screening solutions.