Increasing Prevalence of ADHD

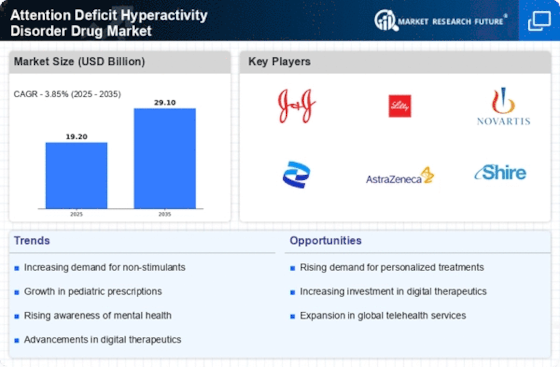

The rising prevalence of Attention Deficit Hyperactivity Disorder (ADHD) is a primary driver of the Attention Deficit Hyperactivity Disorder Drug Market. Recent estimates suggest that approximately 5-10% of children and 2-5% of adults are affected by ADHD, leading to a growing demand for effective treatment options. This increasing recognition of ADHD as a significant public health concern has prompted healthcare providers to seek appropriate pharmacological interventions. As awareness continues to expand, the market for ADHD drugs is likely to experience substantial growth, with a projected increase in sales driven by both new diagnoses and ongoing treatment for existing patients. The Attention Deficit Hyperactivity Disorder Drug Market is thus positioned to benefit from this trend, as more individuals seek medical assistance and effective management of their symptoms.

Advancements in Pharmacotherapy

Advancements in pharmacotherapy are significantly influencing the Attention Deficit Hyperactivity Disorder Drug Market. The development of novel medications, including non-stimulant options and extended-release formulations, has expanded the therapeutic landscape for ADHD. These innovations not only enhance treatment efficacy but also improve patient adherence by reducing dosing frequency. For instance, the introduction of medications such as viloxazine has provided alternatives for patients who may not respond well to traditional stimulants. As research continues to unveil new therapeutic targets and drug delivery systems, the market is expected to witness a surge in product offerings. This diversification in treatment options is likely to cater to a broader patient demographic, thereby driving growth within the Attention Deficit Hyperactivity Disorder Drug Market.

Regulatory Support and Approval

Regulatory support and approval processes play a crucial role in shaping the Attention Deficit Hyperactivity Disorder Drug Market. Regulatory agencies are increasingly recognizing the need for expedited review processes for ADHD medications, particularly those that demonstrate innovative mechanisms of action. This trend is evident in the recent approvals of several new drugs that address unmet medical needs within the ADHD population. The streamlined approval pathways not only facilitate quicker access to new treatments but also encourage pharmaceutical companies to invest in research and development. As a result, the market is likely to see a continuous influx of new products, enhancing competition and providing patients with more choices. This regulatory environment is pivotal in fostering growth within the Attention Deficit Hyperactivity Disorder Drug Market.

Integration of Behavioral Therapies

The integration of behavioral therapies with pharmacological treatments is emerging as a key driver in the Attention Deficit Hyperactivity Disorder Drug Market. Research indicates that combining medication with behavioral interventions can lead to improved outcomes for individuals with ADHD. This holistic approach not only addresses the symptoms of ADHD but also enhances overall functioning and quality of life. As healthcare providers increasingly adopt this integrated model, the demand for ADHD medications is expected to rise. Moreover, insurance coverage for both medication and therapy is becoming more prevalent, further encouraging treatment adherence. This synergy between behavioral therapies and pharmacological options is likely to create a more robust market environment, fostering growth within the Attention Deficit Hyperactivity Disorder Drug Market.

Growing Acceptance of Mental Health Treatment

The growing acceptance of mental health treatment is a significant driver for the Attention Deficit Hyperactivity Disorder Drug Market. Societal attitudes towards mental health have evolved, leading to increased openness about seeking help for conditions like ADHD. This cultural shift has resulted in more individuals recognizing the importance of treatment, thereby increasing the demand for ADHD medications. Furthermore, educational initiatives aimed at destigmatizing mental health issues have contributed to higher diagnosis rates and treatment uptake. As more people seek assistance for ADHD, the market is poised for expansion, with healthcare providers actively promoting pharmacological interventions as part of comprehensive treatment plans. This acceptance is likely to bolster the Attention Deficit Hyperactivity Disorder Drug Market in the coming years.