Rising Awareness and Education

There is a growing awareness of respiratory diseases among the South American population, which is driving demand for asthma and COPD medications. Educational campaigns by health organizations are informing patients about the importance of early diagnosis and treatment. This heightened awareness is leading to increased consultations with healthcare professionals, resulting in more prescriptions for asthma copd-drugs. The asthma copd-drugs market is likely to see a surge in demand as patients become more proactive in managing their conditions. Additionally, healthcare providers are increasingly emphasizing the need for adherence to treatment regimens, which may further boost the market as patients seek reliable and effective medications.

Government Initiatives and Funding

Government initiatives aimed at improving respiratory health are significantly influencing the asthma copd-drugs market in South America. Various countries are implementing national health programs that prioritize the treatment of asthma and COPD. For instance, funding for public health campaigns and subsidies for medications are becoming more common. These initiatives are designed to enhance access to essential drugs and promote awareness about respiratory diseases. The asthma copd-drugs market stands to benefit from these efforts, as increased funding can lead to better healthcare infrastructure and improved patient outcomes. Furthermore, collaboration between governments and pharmaceutical companies may foster the development of new therapies tailored to the needs of the population.

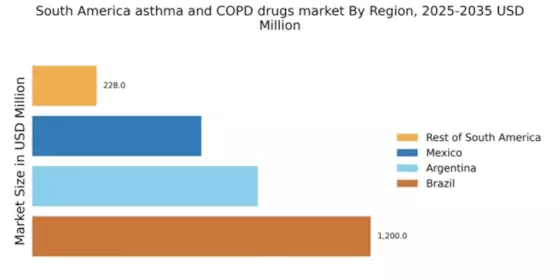

Expansion of Pharmaceutical Market Players

The expansion of pharmaceutical companies in South America is a notable driver for the asthma copd-drugs market. Both local and international companies are increasingly entering the market, attracted by the rising demand for respiratory medications. This influx of new players is fostering competition, which may lead to more affordable drug options for patients. Additionally, partnerships between established firms and local manufacturers are facilitating the development of generic drugs, further enhancing market accessibility. The asthma copd-drugs market is likely to benefit from this competitive landscape, as it encourages innovation and the introduction of diverse treatment options tailored to the needs of the South American population.

Technological Advancements in Drug Delivery

Technological advancements in drug delivery systems are transforming the asthma copd-drugs market in South America. Innovations such as smart inhalers and nebulizers are enhancing the efficacy of treatments by ensuring accurate dosing and improved patient compliance. These devices often come equipped with digital health features that allow for better monitoring of medication usage. As a result, patients are more likely to adhere to their treatment plans, leading to better health outcomes. The asthma copd-drugs market is poised for growth as these advanced delivery systems become more widely adopted, providing patients with more effective management options for their respiratory conditions.

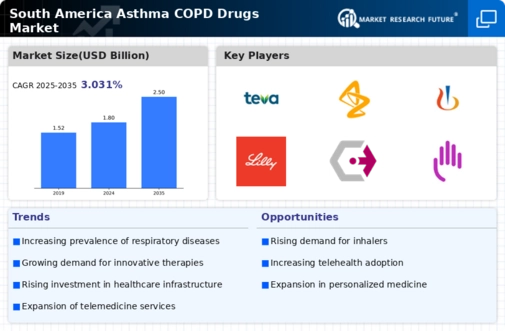

Increasing Prevalence of Respiratory Diseases

The rising incidence of respiratory diseases in South America is a crucial driver for the asthma copd-drugs market. According to health statistics, approximately 10% of the population suffers from asthma, while COPD affects around 5% of adults. This growing prevalence necessitates the development and availability of effective medications. The increasing burden of these diseases on healthcare systems is prompting governments and healthcare providers to invest in innovative treatments. As a result, pharmaceutical companies are focusing on research and development to create new drugs that cater to the specific needs of patients in this region. The asthma copd-drugs market is thus likely to experience significant growth as more patients seek effective management options for their conditions.