Evolving Consumer Preferences

Consumer preferences are evolving rapidly, impacting the Assortment And Space Optimization (ASO) Market. Shifts towards healthier, sustainable, and locally sourced products are prompting retailers to rethink their assortments. This trend is reflected in the increasing demand for organic and eco-friendly products, which have seen a growth rate of approximately 15% annually. Retailers must adapt their space allocation strategies to accommodate these changing preferences, ensuring that they meet consumer expectations while maximizing sales potential. Consequently, understanding and responding to these evolving preferences is crucial for success in the ASO market.

Focus on Omnichannel Retailing

The rise of omnichannel retailing is significantly influencing the Assortment And Space Optimization (ASO) Market. Retailers are now required to provide a seamless shopping experience across various channels, including online and brick-and-mortar stores. This necessitates a strategic approach to assortment planning and space optimization, as retailers must ensure product availability and visibility in all formats. Recent data indicates that retailers with effective omnichannel strategies can achieve up to a 25% increase in customer retention. As the retail landscape continues to evolve, the emphasis on omnichannel approaches will likely drive further developments in the ASO market.

Integration of Advanced Technologies

The integration of advanced technologies, such as artificial intelligence and machine learning, is transforming the Assortment And Space Optimization (ASO) Market. These technologies enable retailers to automate and refine their assortment planning processes, leading to more efficient space utilization. For instance, AI algorithms can predict consumer demand patterns, allowing for dynamic adjustments in product placement. This technological advancement is projected to enhance operational efficiency by up to 30%, thereby driving profitability. As retailers seek to remain competitive, the adoption of these technologies is likely to accelerate, further influencing the ASO market.

Rising Demand for Data-Driven Insights

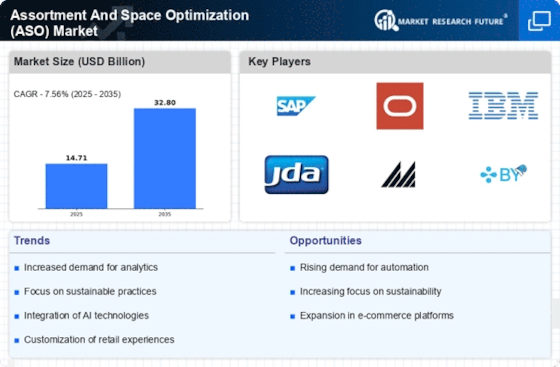

The Assortment And Space Optimization (ASO) Market is experiencing a notable shift towards data-driven decision-making. Retailers are increasingly leveraging advanced analytics to optimize product assortments and shelf space. This trend is driven by the need to enhance customer satisfaction and improve sales performance. According to recent studies, retailers utilizing data analytics have reported up to a 20% increase in sales due to better inventory management and assortment strategies. As competition intensifies, the ability to analyze consumer behavior and preferences becomes paramount, suggesting that data-driven insights will continue to shape the ASO landscape.

Increased Competition and Market Saturation

The Assortment And Space Optimization (ASO) Market is facing heightened competition and market saturation, compelling retailers to optimize their assortments and shelf space more effectively. With numerous players vying for market share, differentiation through product offerings becomes essential. Retailers are increasingly focusing on niche markets and unique product assortments to stand out. This competitive pressure is driving innovations in space optimization techniques, as retailers seek to maximize their return on investment. As the market continues to evolve, the ability to navigate this competitive landscape will be critical for success in the ASO market.