Asia Pacific Suture Needles Market Summary

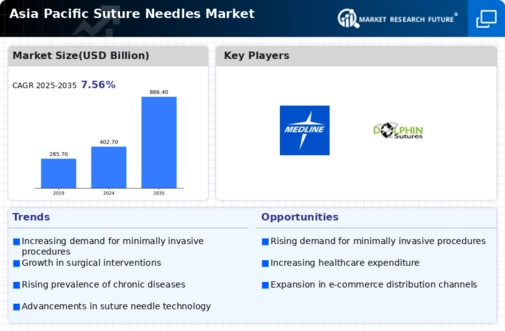

The Asia-Pacific Suture Needles market is poised for substantial growth, reaching an estimated valuation of 886.4 USD Billion by 2035.

Key Market Trends & Highlights

Asia Pacific Suture Needles Market Key Trends and Highlights

- The market valuation is projected to grow from 402.7 USD Billion in 2024 to 886.4 USD Billion by 2035.

- A compound annual growth rate (CAGR) of 7.44% is anticipated from 2025 to 2035, indicating robust market expansion.

- Increasing demand for advanced surgical procedures is likely to drive the market forward in the coming years.

- Growing adoption of minimally invasive surgical techniques due to rising patient preference is a major market driver.

Market Size & Forecast

| 2024 Market Size | 402.7 (USD Billion) |

| 2035 Market Size | 886.4 (USD Billion) |

| CAGR (2025-2035) | 7.44% |

Major Players

3M Health Care, Roboz Surgical Instrument, Hu-Friedy Mfg. Co., LLC, TNI medical AG, Unimed Medical Supplies Inc., Medline Industries, Inc., Ethicon US, LLC, Sutures India Private Limited, Dolphin Sutures, Karl Hammacher, H&H Medical Corporation