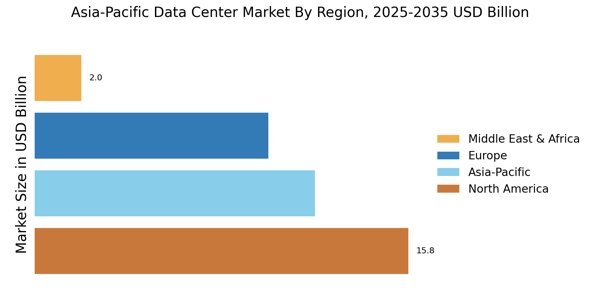

In recent developments within the Global Asia-Pacific Data Center Market, significant activity has been observed among leading companies such as Amazon Web Services, Google Cloud, and Microsoft Azure, who continue to expand their footprint in the region. There's been a notable surge in demand for cloud services, with increasing investments aimed at enhancing infrastructure to support workloads and data handling capacities. Equinix has been actively acquiring new data centers to strengthen its market position, while Vantage Data Centers has also made headlines with its recent expansions across various Asia-Pacific locations.

Meanwhile, Alibaba Cloud and Tencent Cloud are gaining traction, aided by the growing digital transformation initiatives across enterprises in the region. In terms of mergers and acquisitions, Digital Realty has been pursuing strategic investments to enhance its portfolio, showcasing the competitive landscape as companies seek to adapt and innovate amid evolving technological trends. Growth in market valuation for these entities is projected to foster increased collaborations, sustainability efforts, and advancements in edge computing capabilities across the Asia-Pacific Data Center Market, reflecting a robust outlook for the sector.

The Data Centre Market in the APAC region is characterized by a dynamic competitive landscape, driven by increasing demand for cloud services, data storage, and digital transformation initiatives. Key players such as Equinix (US), NTT Communications (JP), and Alibaba Cloud (CN) are strategically positioned to leverage these growth drivers. Equinix (US) focuses on expanding its interconnection services, while NTT Communications (JP) emphasizes its hybrid cloud solutions. Alibaba Cloud (CN) is heavily investing in AI and big data capabilities, which collectively shape a competitive environment that is increasingly reliant on technological innovation and strategic partnerships.

In terms of business tactics, companies are localizing their operations to better serve regional markets, optimizing supply chains to enhance efficiency, and investing in sustainable practices. The market structure appears moderately fragmented, with a mix of established players and emerging companies vying for market share. The collective influence of these key players fosters a competitive atmosphere where innovation and service differentiation are paramount.

In December 2025, Equinix (US) announced the acquisition of a local data centre operator in Australia, which is expected to enhance its service offerings and expand its footprint in the region. This strategic move underscores Equinix's commitment to strengthening its position in the APAC market by increasing its capacity and improving service delivery to meet the growing demand for data services.

In November 2025, NTT Communications (JP) launched a new suite of edge computing solutions aimed at enhancing connectivity and reducing latency for its customers. This initiative reflects NTT's focus on digital transformation and its intent to capitalize on the increasing need for real-time data processing, thereby positioning itself as a leader in the edge computing space.

In October 2025, Alibaba Cloud (CN) unveiled a new AI-driven data management platform designed to optimize data storage and retrieval processes. This development not only highlights Alibaba's commitment to innovation but also indicates a strategic pivot towards integrating advanced technologies into its service offerings, which may enhance its competitive edge in the rapidly evolving data centre landscape.

As of January 2026, current trends in the Data Centre Market include a pronounced shift towards digitalization, sustainability, and the integration of AI technologies. Strategic alliances among key players are increasingly shaping the competitive landscape, fostering collaboration that enhances service offerings and operational efficiencies. Looking ahead, competitive differentiation is likely to evolve from traditional price-based competition to a focus on innovation, technological advancements, and supply chain reliability, as companies strive to meet the complex demands of a digital-first economy.