North America : Innovation and Leadership Hub

North America continues to lead the global market for Artificial Intelligence Integration Services, holding a significant market share of 12.5 in 2024. The region's growth is driven by rapid technological advancements, increased investment in AI research, and a strong regulatory framework that encourages innovation. Demand for AI solutions across various sectors, including healthcare, finance, and retail, is propelling market expansion, supported by government initiatives promoting digital transformation.

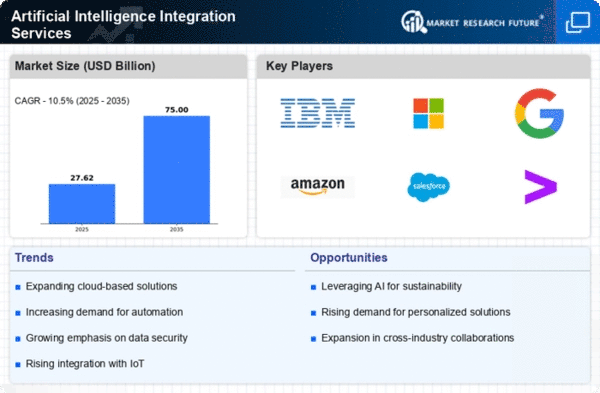

The competitive landscape in North America is characterized by the presence of major players such as IBM, Microsoft, and Google, which are at the forefront of AI integration. The U.S. remains the leading country, with a robust ecosystem that fosters collaboration between tech giants and startups. This synergy enhances the development of cutting-edge AI solutions, ensuring that North America maintains its dominance in the global market.

Europe : Emerging AI Integration Market

Europe is witnessing a significant rise in the demand for Artificial Intelligence Integration Services, with a market size of 7.5 in 2024. The region's growth is fueled by stringent regulations aimed at ensuring ethical AI use, alongside increasing investments in AI technologies. European governments are actively promoting AI adoption across industries, which is expected to drive market expansion. The focus on sustainability and digital transformation further enhances the demand for AI solutions in various sectors.

Leading countries in Europe, such as Germany, France, and the UK, are at the forefront of AI integration, supported by a strong presence of key players like SAP and Accenture. The competitive landscape is evolving, with numerous startups emerging to address specific market needs. As the region embraces AI, collaboration between established firms and innovative startups is crucial for driving advancements and maintaining competitiveness in the global market.

Asia-Pacific : Rapidly Growing AI Landscape

Asia-Pacific is rapidly emerging as a key player in the Artificial Intelligence Integration Services market, with a market size of 4.5 in 2024. The region's growth is driven by increasing digitalization, a burgeoning tech-savvy population, and significant investments in AI research and development. Governments are implementing supportive policies to foster AI adoption, which is expected to further accelerate market growth. The demand for AI solutions in sectors like manufacturing, finance, and healthcare is on the rise, reflecting a broader trend towards automation and efficiency.

Countries like China, Japan, and India are leading the charge in AI integration, with a strong presence of both global and local players. Companies such as Alibaba and Tencent are making significant strides in AI technology, enhancing the competitive landscape. The collaboration between government initiatives and private sector innovation is crucial for establishing Asia-Pacific as a formidable force in The Artificial Intelligence Integration Services.

Middle East and Africa : Emerging AI Frontier

The Middle East and Africa region is at the nascent stage of developing its Artificial Intelligence Integration Services market, currently valued at 0.5 in 2024. Despite its small size, the region presents significant growth potential driven by increasing investments in technology and digital transformation initiatives. Governments are recognizing the importance of AI in enhancing economic diversification and are implementing strategies to promote its adoption across various sectors, including healthcare and finance.

Countries like the UAE and South Africa are leading the way in AI integration, with initiatives aimed at fostering innovation and attracting foreign investment. The competitive landscape is gradually evolving, with local startups emerging alongside established global players. As the region continues to invest in AI capabilities, it is poised for substantial growth in the coming years, making it an area of interest for investors and technology firms alike.