Enhanced Targeting Capabilities

The programmatic display-advertising market is benefiting from advancements in targeting technologies. Advertisers in Argentina are increasingly utilizing data analytics and machine learning to refine their audience targeting. This capability allows for more personalized ad experiences, which can lead to higher engagement rates. In 2025, it is estimated that targeted ads will account for over 70% of all programmatic spending in the country. Enhanced targeting not only improves the effectiveness of campaigns but also maximizes return on investment for advertisers. As these technologies continue to evolve, the programmatic display-advertising market is expected to see further growth, driven by the demand for precision in advertising.

Rising Digital Advertising Spend

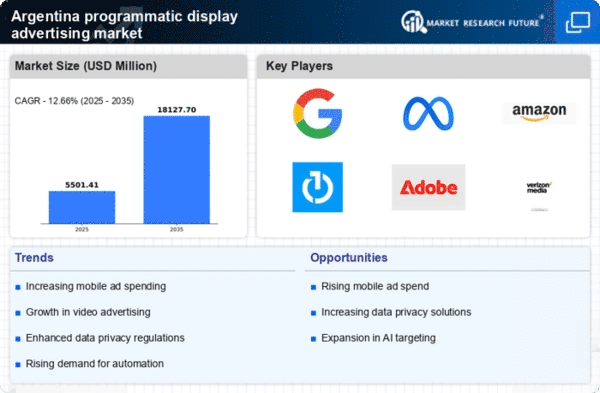

The programmatic display-advertising market in Argentina is experiencing a notable increase in digital advertising expenditure. As businesses recognize the importance of online presence, the allocation of budgets towards digital channels has surged. In 2025, digital advertising spending is projected to reach approximately $3 billion, with programmatic channels capturing a significant share. This shift indicates a growing reliance on automated systems for ad placements, allowing advertisers to optimize their campaigns effectively. The trend suggests that as more companies invest in digital strategies, the programmatic display-advertising market will likely expand, driven by the need for targeted and efficient advertising solutions.

Shift Towards Mobile Optimization

The programmatic display advertising market is witnessing a significant shift towards mobile optimization. With the increasing penetration of smartphones in Argentina, advertisers are adapting their strategies to cater to mobile users. In 2025, mobile advertising is projected to represent around 60% of total digital ad spend, highlighting the importance of mobile-friendly campaigns. This trend indicates that advertisers are recognizing the necessity of reaching consumers on their preferred devices. Consequently, the programmatic display-advertising market is likely to evolve, focusing on mobile-first strategies that enhance user experience and engagement.

Regulatory Developments and Compliance

The programmatic display advertising market is influenced by evolving regulatory frameworks in Argentina. As data privacy concerns gain prominence, advertisers must navigate a complex landscape of compliance requirements. The introduction of stricter regulations may impact how data is collected and utilized for advertising purposes. In 2025, it is expected that compliance-related expenditures will rise, as businesses invest in technologies and practices to adhere to these regulations. This trend indicates that while regulatory challenges may pose obstacles, they also present opportunities for innovation within the programmatic display-advertising market, as companies seek to develop compliant yet effective advertising strategies.

Growing Importance of Real-Time Bidding

Real-time bidding (RTB) is becoming a cornerstone of the programmatic display-advertising market in Argentina. This technology allows advertisers to bid for ad space in real-time, ensuring that they reach their target audience at the right moment. The adoption of RTB is expected to increase as more advertisers seek to maximize their ad spend efficiency. In 2025, it is anticipated that RTB will account for over 50% of programmatic transactions in the country. This growth suggests that advertisers are increasingly valuing the ability to make data-driven decisions quickly, which enhances the overall effectiveness of their campaigns in the programmatic display-advertising market.