E-commerce Growth

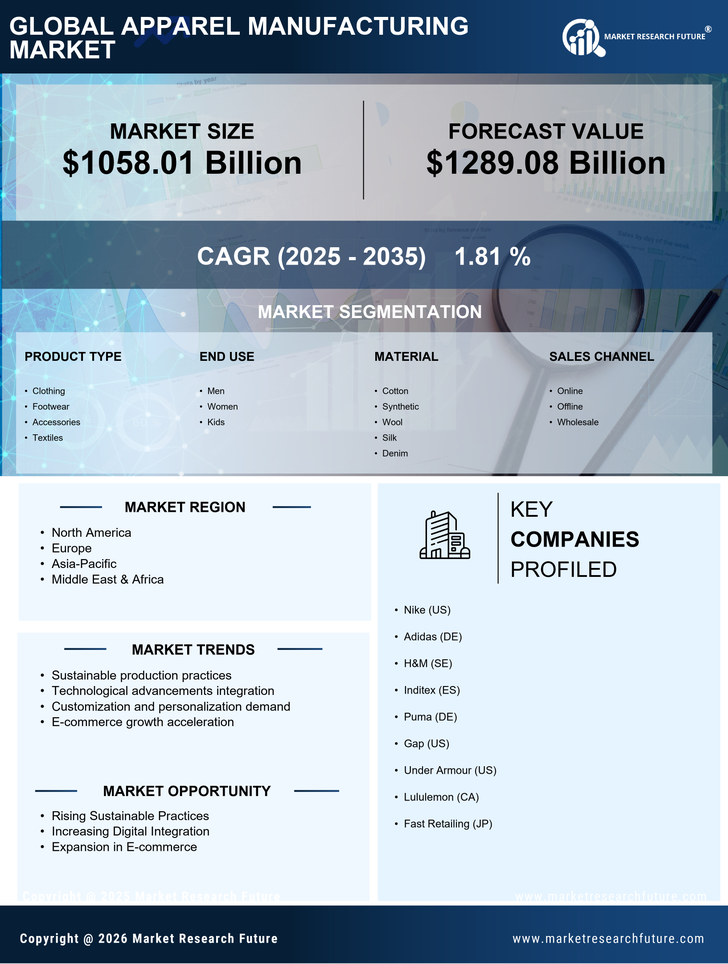

The rise of e-commerce has significantly impacted the apparel manufacturing Market, reshaping how consumers shop for clothing. With online sales projected to account for over 30% of total apparel sales by 2025, manufacturers are adapting their strategies to capitalize on this trend. This shift necessitates a focus on digital marketing, supply chain optimization, and enhanced customer experience. As brands invest in their online presence, they are likely to reach a wider audience and increase sales. Additionally, the convenience of online shopping is driving consumer preferences, indicating that e-commerce growth is a vital factor influencing the dynamics of the Apparel Manufacturing Market.

Sustainability Initiatives

The Apparel Manufacturing Market is increasingly influenced by sustainability initiatives, as consumers demand eco-friendly products. Companies are adopting sustainable practices, such as using organic materials and reducing waste, to meet these expectations. In 2025, it is estimated that the market for sustainable apparel will reach approximately 200 billion dollars, reflecting a growing trend towards environmentally responsible manufacturing. This shift not only caters to consumer preferences but also aligns with regulatory pressures aimed at reducing environmental impact. As brands commit to sustainability, they enhance their market position and appeal to a broader audience, indicating that sustainability is not merely a trend but a fundamental driver of growth in the Apparel Manufacturing Market.

Technological Advancements

Technological advancements play a pivotal role in shaping the Apparel Manufacturing Market. Innovations such as automation, artificial intelligence, and 3D printing are revolutionizing production processes, leading to increased efficiency and reduced costs. For instance, the integration of AI in supply chain management is projected to enhance inventory accuracy by up to 30%, thereby minimizing waste and optimizing resource allocation. Furthermore, advancements in fabric technology are enabling the creation of high-performance materials that cater to diverse consumer needs. As manufacturers embrace these technologies, they are likely to gain a competitive edge, suggesting that technological progress is a crucial driver of transformation within the Apparel Manufacturing Market.

Global Supply Chain Optimization

The Apparel Manufacturing Industry, as companies strive to enhance efficiency and reduce costs. The complexity of sourcing materials and distributing products across various regions necessitates a streamlined approach to supply chain management. In 2025, it is expected that advancements in logistics and inventory management will lead to a reduction in lead times by approximately 20%. This improvement not only enhances operational efficiency but also allows manufacturers to respond more swiftly to market demands. As companies focus on optimizing their supply chains, they are likely to improve their competitive positioning, indicating that supply chain efficiency is a vital component of success in the Apparel Manufacturing Market.

Consumer Demand for Customization

Consumer demand for customization is emerging as a significant driver in the Apparel Manufacturing Market. As individuals seek unique and personalized clothing options, manufacturers are responding by offering customizable products. This trend is supported by advancements in technology, such as on-demand printing and digital design tools, which allow for greater flexibility in production. In 2025, it is anticipated that the market for customized apparel will grow substantially, reflecting a shift towards individualized consumer experiences. By catering to this demand, manufacturers can differentiate themselves in a competitive landscape, suggesting that customization is a key factor influencing the future of the Apparel Manufacturing Market.