Health and Wellness Awareness

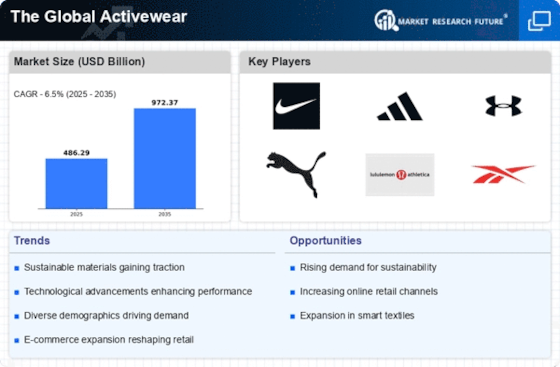

The increasing awareness of health and wellness among consumers appears to be a pivotal driver for The Global activewear Industry. As individuals prioritize fitness and healthy lifestyles, the demand for activewear that supports physical activities has surged. Reports indicate that the activewear segment is projected to grow at a compound annual growth rate of approximately 6.5% over the next five years. This trend is likely fueled by a growing emphasis on personal well-being, leading to a rise in gym memberships and outdoor activities. Consequently, brands are responding by innovating their product lines to cater to this health-conscious demographic, thereby enhancing their market presence in the activewear sector.

Fashion and Lifestyle Integration

The integration of activewear into everyday fashion is transforming The Global Activewear Industry. Consumers increasingly seek versatile clothing that can transition seamlessly from workout sessions to casual outings. This trend has led to the emergence of athleisure, a style that combines athletic and leisurewear, appealing to a broader audience. Market data suggests that the athleisure segment is expected to account for a substantial share of the activewear market, with projections indicating a growth rate of around 7% annually. As fashion brands collaborate with sportswear companies, the lines between fitness and fashion continue to blur, driving innovation and expanding consumer choices in the activewear landscape.

Youth Engagement and Fitness Trends

The engagement of younger demographics in fitness activities is emerging as a crucial driver for The Global Activewear Industry. Millennials and Generation Z are increasingly participating in sports, fitness classes, and outdoor activities, leading to a heightened demand for stylish and functional activewear. Market analysis indicates that this demographic is more inclined to invest in quality activewear, with spending on fitness apparel expected to rise significantly. Brands are capitalizing on this trend by creating targeted marketing campaigns and product lines that resonate with younger consumers. As fitness becomes a lifestyle choice for these generations, the activewear market is likely to experience sustained growth, driven by their preferences and purchasing power.

Technological Advancements in Fabric

Technological advancements in fabric and material science are significantly influencing The Global Activewear Industry. Innovations such as moisture-wicking fabrics, breathable materials, and smart textiles are enhancing the performance and comfort of activewear. These developments not only improve the functionality of the garments but also cater to the evolving preferences of consumers who seek high-performance apparel. The market for smart activewear, which integrates wearable technology, is anticipated to grow rapidly, with estimates suggesting a potential increase of over 10% in the next few years. As brands invest in research and development, the introduction of cutting-edge materials is likely to redefine consumer expectations and drive sales in the activewear sector.

Sustainability and Ethical Production

The growing emphasis on sustainability and ethical production practices is reshaping The Global Activewear Industry. Consumers are increasingly aware of the environmental impact of their purchases and are seeking brands that prioritize eco-friendly materials and ethical manufacturing processes. This shift in consumer behavior is prompting activewear companies to adopt sustainable practices, such as using recycled materials and reducing carbon footprints. Market Research Future indicates that the demand for sustainable activewear is on the rise, with projections suggesting a growth rate of approximately 8% in this segment over the next few years. As brands align their values with those of environmentally conscious consumers, sustainability is likely to become a key differentiator in the competitive landscape of the activewear market.