Rising Digital Ad Spend

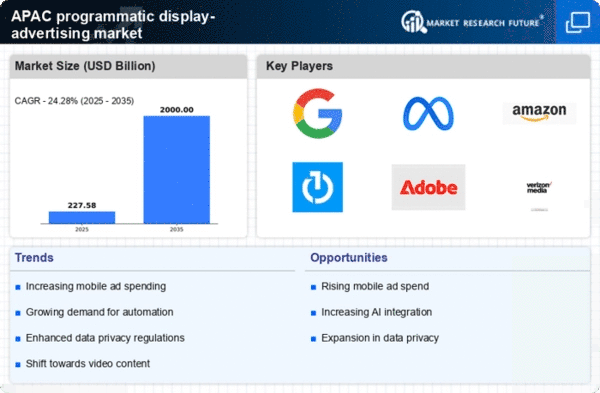

The programmatic display-advertising market in APAC is experiencing a notable increase in digital ad expenditure. As businesses recognize the efficacy of programmatic advertising, the allocation of budgets towards this medium is projected to rise significantly. In 2025, digital ad spending in APAC is expected to surpass $100 billion, with programmatic channels capturing a substantial share. This trend indicates a shift in marketing strategies, as companies prioritize data-driven approaches to enhance targeting and engagement. The growing acceptance of programmatic advertising among small and medium enterprises further fuels this growth, as they seek cost-effective solutions to reach their audiences. Consequently, the rising digital ad spend is a critical driver for the programmatic display-advertising market, reflecting the evolving landscape of advertising in the region.

Mobile Device Proliferation

The proliferation of mobile devices in APAC is a significant driver of the programmatic display-advertising market. With smartphone penetration rates exceeding 80% in many countries, advertisers are increasingly focusing on mobile-first strategies. The shift towards mobile consumption of content necessitates the adaptation of advertising strategies to engage users effectively on their devices. In 2025, mobile programmatic advertising is projected to account for approximately 60% of total programmatic ad spend in the region. This trend underscores the importance of optimizing ad formats and placements for mobile platforms, as consumers increasingly interact with brands through their smartphones. As a result, the growth of mobile device usage is a crucial factor influencing the programmatic display-advertising market, shaping how advertisers approach their campaigns.

Enhanced Targeting Capabilities

The programmatic display-advertising market in APAC benefits from advancements in targeting capabilities, which are becoming increasingly sophisticated. Advertisers are leveraging data analytics and machine learning algorithms to refine their audience segmentation and improve ad relevance. This enhanced targeting allows for more personalized advertising experiences, leading to higher engagement rates. In 2025, it is estimated that targeted ads will account for over 70% of all programmatic display-advertising spend in the region. As advertisers seek to maximize return on investment, the ability to reach specific demographics and consumer behaviors becomes paramount. This trend not only boosts the effectiveness of campaigns but also drives the overall growth of the programmatic display-advertising market, as businesses strive to connect with their audiences in more meaningful ways.

Emergence of New Market Entrants

The programmatic display-advertising market in APAC is witnessing the emergence of new market entrants, which is reshaping the competitive landscape. Startups and tech companies are introducing innovative solutions that enhance the efficiency and effectiveness of programmatic advertising. This influx of new players fosters competition, driving existing companies to improve their offerings and adopt cutting-edge technologies. In 2025, it is anticipated that the number of programmatic advertising platforms in APAC will increase by over 30%, providing advertisers with a wider array of options. This diversification not only benefits advertisers through increased choice but also stimulates market growth as new entrants bring fresh ideas and approaches to the industry. Consequently, the emergence of new market entrants is a vital driver for the programmatic display-advertising market, contributing to its dynamic evolution.

Regulatory Developments in Advertising

Regulatory developments in advertising are influencing the programmatic display-advertising market in APAC. Governments are increasingly implementing regulations aimed at ensuring transparency and accountability in digital advertising practices. These regulations may include guidelines on data usage, consumer privacy, and advertising standards. As compliance becomes a priority for advertisers, the programmatic display-advertising market must adapt to these evolving legal frameworks. In 2025, it is expected that compliance-related expenditures will rise, as companies invest in technologies and processes to meet regulatory requirements. This shift may lead to increased operational costs but also presents opportunities for companies that can navigate the regulatory landscape effectively. Thus, regulatory developments are a significant driver for the programmatic display-advertising market, shaping how businesses approach their advertising strategies.