APAC Oil & Gas Projects Market

APAC Oil and Gas Projects Market APAC Oil and Gas Projects Market Research Report: By Type (Surface and Lease Equipment, Gathering & Processing, Oil, Gas & NGL Pipelines, Oil & Gas Storage, Refining & Oil Products Transport and Export Terminals), By Drilling (Offshore, Onshore), andBy Regional (China, India, Japan, South Korea, Malaysia, Thailand, Indonesia, Rest of APAC)- Forecast to 2035

APAC Oil and Gas Projects Market Overview:

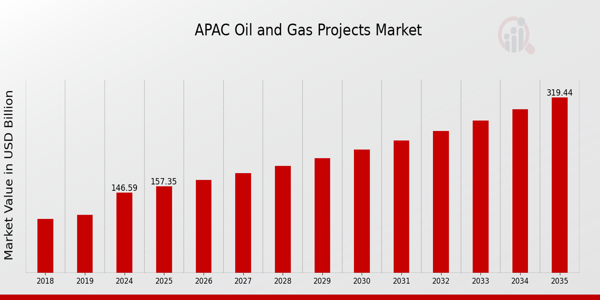

As per MRFR analysis, the APAC Oil and Gas Projects Market Size was estimated at 138.75 (USD Billion) in 2023.The APAC Oil and Gas Projects Market is expected to grow from 146.59(USD Billion) in 2024 to 319.45 (USD Billion) by 2035. The APAC Oil and Gas Projects Market CAGR (growth rate) is expected to be around 7.338% during the forecast period (2025 - 2035).

Key APAC Oil and Gas Projects Market Trends Highlighted

The growing need for energy supplies, which is being fueled by the fast industrialization and urbanization of nations like China and India, is one of the major factors propelling the APAC oil and gas projects market. A strategic emphasis on improving energy security and lowering reliance on imported fossil fuels is used to meet this goal.

Significant infrastructure development expenditures are also being made in the region, driven by government programs meant to increase the region's capacity for producing gas and oil. Additionally, as APAC nations gradually move toward cleaner energy sources, there is an increased interest in technology that facilitates the switch to renewable energy sources while preserving the viability of fossil fuels.

Technological developments in drilling and exploration methods present opportunities to be investigated in the APAC Oil and Gas Projects Market since they can open up new reserves and improve operational effectiveness. Innovation in drilling and processing methods can be fostered by regional partnerships between countries, which can result in the sharing of resources and information.

Recent patterns show that the oil and gas industry is investing more heavily in digital technologies, with businesses concentrating on automation and data analytics to streamline processes and cut expenses. Furthermore, legal frameworks in different APAC countries are changing to promote environmental sustainability, which will influence project designs and operating procedures in the future.

The market is navigating through obstacles like shifting oil prices and regulatory restraints, but overall project development momentum is strong due to the pressing need to meet the growing energy demands of APAC countries.

Source: Primary Research, Secondary Research, Market Research Future Database and Analyst Review

APAC Oil and Gas Projects Market Drivers

Increasing Energy Demand in APAC Region

The APAC Oil and Gas Projects Market is currently experiencing a surge in energy demand due to rapid industrialization and population growth. According to the International Energy Agency, Asia-Pacific accounted for over 50% of the world's total energy consumption in 2020, with forecasts suggesting an increase of approximately 25% by 2035.

Countries such as China and India are key contributors to this trend, as their GDP growth and energy consumption continue to rise. For instance, China's National Energy Administration projects that by 2025, natural gas consumption will increase by 30% compared to 2020 levels.

Additionally, government initiatives supporting infrastructure development, such as the 'Gas4China' program, further enhance the growth prospects of oil and gas projects in the APAC region. This evolving landscape indicates a robust growth trajectory for the APAC Oil and Gas Projects Market.

Technological Advancements in Exploration and Production

Technological innovations in the exploration and production of oil and gas resources are significant drivers of the APAC Oil and Gas Projects Market. Advanced techniques, such as hydraulic fracturing and horizontal drilling, are being increasingly adopted across the region to enhance production efficiency while reducing operational costs.

According to the Ministry of Petroleum and Natural Gas in India, the introduction of new technologies has led to a 15% increase in production levels from new offshore drilling initiatives.

Notable companies, such as Royal Dutch Shell and Total, have also implemented cutting-edge technologies across their operations in APAC, which not only maximizes yield but also improves environmental safety, ensuring regulatory compliance.

Government Policies Favoring Energy Security

Governments in the APAC region are proactively implementing policies aimed at enhancing energy security, significantly influencing the APAC Oil and Gas Projects Market. For example, Japan's 'Energy Supply Plan' focuses on increasing the share of domestic resources and reducing dependency on imported fossil fuels by boosting natural gas production.

Additionally, the Indonesian government has set a target of increasing oil production to 1 million barrels per day by 2030, supported by investment incentives and regulatory reforms. Such governmental support not only boosts investor confidence but also stimulates projects that lead to sustainable growth in the oil and gas sector throughout the region.

Rising Market Interest in Renewable Energies

The shift towards diversification and the adoption of renewable energy sources in the APAC Oil and Gas Projects Market is becoming more pronounced. The region is poised to invest approximately USD 1.5 trillion in renewable energy projects over the next decade, as per forecasts from the Asian Development Bank.

While the focus on renewables aims to mitigate environmental concerns, governments recognize the necessity for oil and gas as a transitional energy source.

Countries such as South Korea and Australia are integrating renewable energy into their oil and gas projects, thereby enhancing energy efficiency and sustainability. Such dynamics illustrate the evolving energy paradigm in APAC, positively impacting the market's growth and development.

APAC Oil and Gas Projects Market Segment Insights:

Oil and Gas Projects Market Type Insights

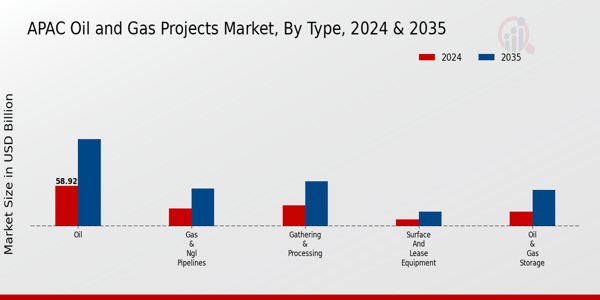

The APAC Oil and Gas Projects Market is a dynamic sector characterized by diverse segments that play critical roles in the overall industry landscape. Focusing on the Type segment, one can observe that the major areas of activity include Surface and Lease Equipment, Gathering and Processing, Oil, Gas and NGL Pipelines, Oil and Gas Storage, Refining and Oil Products Transport, and Export Terminals.

Each of these segments contributes significantly to the region's infrastructure and operational efficiency in meeting energy demands. Surface and Lease Equipment serves as the backbone for oil and gas extraction operations, ensuring that producers can effectively harness resources from the ground.

This segment emphasizes innovation and technology, which are critical in optimizing production processes and reducing operational downtime. Gathering and Processing is pivotal in the initial stages of oil and gas production, where raw materials are separated and refined for further transportation, which directly impacts supply chain productivity.

Oil, Gas and NGL Pipelines are essential for the transportation of hydrocarbons across vast distances. The network of pipelines enhances connectivity between extraction sites and processing facilities, thus ensuring a steady supply of energy to meet the growing demands of the APAC region.

Moreover, with the increasing investments in infrastructure safety and efficiency, this segment is poised for steady development, driven by regulatory support and technological advancements, which minimize leakage risks and maximize throughput.

Oil and Gas Storage is yet another essential segment that plays a critical role in managing supply fluctuations and ensuring stability in the market. Given the volatile nature of energy prices and consumption patterns, the capability to store oil and gas effectively enhances security and reliability for suppliers and consumers alike.

In parallel, the Refining and Oil Products Transport segment underscores the need for sophisticated refining technologies to convert crude oil into valuable products such as transportation fuels and petrochemicals. This segment not only fuels the regional economy but also supports the transition toward cleaner energy sources.

Lastly, Export Terminals facilitate the international trade of oil and gas, linking APAC with global markets. As the region continues to integrate more deeply into the global economy, these terminals become vital to managing trade flows, meeting international standards, and expanding market reach.

Overall, the APAC Oil and Gas Projects Market segmentation confirms the sector’s capacity to adapt and evolve while responding to both local and global energy challenges. Each segment, with its unique demand and function, confirms a comprehensive strategy toward enhancing energy security and economic growth in the region.

The ongoing trends illustrate a clear path toward increased investment in technology, infrastructure, and innovation, opening up numerous opportunities for stakeholders across the industry. As the world moves toward a more sustainable energy paradigm, the APAC region's oil and gas market continues to play a crucial role in balancing growth and environmental responsibilities.

Source: Primary Research, Secondary Research, Market Research Future Database and Analyst Review

Oil and Gas Projects Market Drilling Insights

The APAC Oil and Gas Projects Market focused on the Drilling segment highlights significant growth, driven by the increasing demand for energy and rising exploration activities across the region. The Drilling segment is divided into Offshore and Onshore activities, each playing a crucial role in meeting the region's energy needs.

Offshore drilling is essential due to the vast untapped reserves prevalent in certain maritime areas of APAC, which offer higher production potential. In contrast, Onshore drilling remains vital for leveraging land-based resources, particularly in regions with established infrastructure.

The ongoing transition towards cleaner energy sources is also spurring investments in advanced drilling technologies, enhancing efficiency and sustainability. Major oil-producing countries in APAC are actively implementing regulatory frameworks to optimize oil exploration and extraction processes, ensuring the sector's growth aligns with environmental standards.

Moreover, advancements in drilling techniques and increased capital expenditure in the industry are expected to facilitate robust growth, ultimately contributing to the overall APAC Oil and Gas Projects Market revenue and driving market dynamics in the years to come.

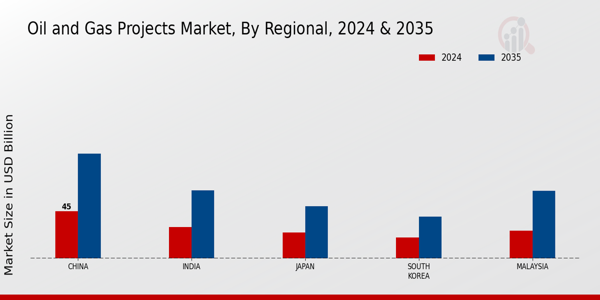

Oil and Gas Projects Market Regional Insights

The APAC Oil and Gas Projects Market exhibits a robust landscape characterized by its diverse regional segmentation, which includes significant players such as China, India, Japan, South Korea, Malaysia, Thailand, Indonesia, and the Rest of APAC. China dominates the market with its immense demand for energy and ongoing commitment to expand its oil and gas exploration and production capabilities.

India is also a critical market, leveraging its rapidly growing economy and increasing energy needs to enhance investment in oil and gas projects. Japan, with its advanced technology in energy efficiency and innovations in liquefied natural gas, remains a significant contributor to the sector.

South Korea's focus on energy diversification and sustainability fuels its role in the oil and gas landscape. Malaysia, with its strategic positioning in Southeast Asia, benefits from its rich natural resources and expanding infrastructure.

Thailand and Indonesia are also emerging markets in the region, showing promising growth potential due to new discoveries and government initiatives aimed at boosting local production capabilities. Collectively, these nations offer numerous opportunities and challenges, underscoring the importance of understanding regional dynamics within the APAC Oil and Gas Projects Market.

Market trends indicate a push towards renewable energy integration, driving investment into sustainable oil and gas practices across these countries, while regulatory frameworks and geopolitical dynamics continue to shape the industry landscape.

Source: Primary Research, Secondary Research, Market Research Future Database and Analyst Review

APAC Oil and Gas Projects Market Key Players and Competitive Insights:

The APAC Oil and Gas Projects Market is characterized by a complex interplay of established corporations and emerging players, all exhibiting a robust competition for market share. As the region grapples with increasing energy demands, driven by economic growth and industrial expansion, companies are continually adapting their strategies to secure a competitive edge.

Key drivers in this market include advances in technology, regulatory changes, and the need for sustainable energy solutions. The presence of a diverse range of oil and gas projects, from exploration to refining, enhances competitive dynamics, with firms focused on optimizing their operations to meet the evolving market landscape.

Companies are not only competing on the basis of technology and innovation but also emphasizing partnerships and joint ventures to enhance their capabilities and achieve regional expansion.

Gazprom maintains a significant presence in the APAC Oil and Gas Projects Market, capitalizing on its extensive expertise in exploration, production, and transportation of natural gas and oil. The company enjoys several competitive strengths in this region, including its strong logistical network and longstanding relationships with various stakeholders.

Gazprom's ability to leverage its strategic partnerships allows it to navigate regulatory environments while driving cost efficiencies in its operations. The organization also benefits from a solid history of investments in infrastructure, enhancing its positioning in the market.

By focusing on technological advancements and sustainable practices, Gazprom is well-poised to meet the challenges of a dynamic energy market in the Asia-Pacific region.

Indian Oil Corporation has positioned itself as a major player in the APAC Oil and Gas Projects Market, distinguished by its extensive portfolio that encompasses petroleum refining, pipeline transportation, and marketing of petroleum products. The corporation's strengths lie in its diverse product offerings, which include a variety of fuels and lubricants tailored to meet the regional demands.

Indian Oil Corporation not only commands significant market presence due to its vast network but also reinforces its position through mergers and acquisitions aimed at strengthening its operational capabilities and expanding its reach in the APAC region.

The company's commitment to sustainability and innovation in refining technologies further solidifies its competitive advantage, enabling it to capitalize on shifting consumer preferences toward cleaner energy. As a result, Indian Oil Corporation continues to enhance its footprint in the region, positioning itself for future growth in a rapidly evolving energy landscape.

Key Companies in the APAC Oil and Gas Projects Market Include:

Gazprom

Indian Oil Corporation

BP

Woodside Petroleum

Sinopec

ONGC

China National Petroleum Corporation

ConocoPhillips

Hindustan Petroleum Corporation Limited

PTT Public Company Limited

Royal Dutch Shell

Cairn Oil & Gas

Saudi Aramco

PetroChina

TotalEnergies

APAC Oil and Gas Projects Market Developments

The APAC Oil and Gas Projects Market is witnessing significant developments. In September 2023, Indian Oil Corporation announced a substantial investment plan aimed at expanding its refining and petrochemicals capacity while integrating green energy projects.

Concurrently, BP and Woodside Petroleum are advancing joint ventures in offshore exploration, particularly in Australia, with environmental assessments underway. Major Chinese state-owned enterprises, such as China National Petroleum Corporation and Sinopec, are actively exploring new oil fields, contributing to the region's energy security.

In terms of mergers and acquisitions, a notable event in June 2023 involved ConocoPhillips acquiring a stake in renewable energy assets from TotalEnergies, reflecting a strategic shift towards green investments.

The growth in market valuation for companies such as Royal Dutch Shell and PetroChina is also notable, with robust financial results reported in Q3 2023, driven by rising oil prices and strong demand recovery post-pandemic.

Additionally, the APAC region is set to increase its investments in sustainable energy sources, aligning with global efforts to transition to cleaner energy options. Overall, these developments underline a dynamic and evolving landscape in the APAC Oil and Gas Projects Market.

APAC Oil and Gas Projects Market Segmentation Insights

Oil and Gas Projects Market Type Outlook

Surface and Lease Equipment

Gathering & Processing

Oil

Gas & NGL Pipelines

Oil & Gas Storage

Refining & Oil Products Transport and Export Terminals

Oil and Gas Projects Market Drilling Outlook

Offshore

Onshore

Oil and Gas Projects Market Regional Outlook

China

India

Japan

South Korea

Malaysia

Thailand

Indonesia

Rest of APAC

FAQs

What is the expected market size of the APAC Oil and Gas Projects Market in 2024?

The APAC Oil and Gas Projects Market is expected to be valued at 146.59 USD Billion in 2024.

What will be the market size of the APAC Oil and Gas Projects Market by 2035?

By 2035, the market is projected to reach a value of 319.45 USD Billion.

What is the expected CAGR for the APAC Oil and Gas Projects Market from 2025 to 2035?

The expected compound annual growth rate for the market is 7.338% during the period from 2025 to 2035.

Which region holds the largest share of the APAC Oil and Gas Projects Market in 2024?

In 2024, China is expected to dominate the market with a value of 45.0 USD Billion.

What is the projected market value for India in the APAC Oil and Gas Projects Market by 2035?

India's market value is anticipated to reach 65.0 USD Billion by 2035.

Who are the key players in the APAC Oil and Gas Projects Market?

Major players in the market include Gazprom, BP, and Royal Dutch Shell among others.

What is the market size for Oil in the APAC Oil and Gas Projects Market in 2024?

The market size for Oil is projected to be valued at 58.92 USD Billion in 2024.

How much is the Oil & Gas Storage segment expected to grow by 2035?

The Oil & Gas Storage segment is expected to grow to 52.73 USD Billion by 2035.

What is the expected market value for Japan in 2024 within the APAC Oil and Gas Projects Market?

Japan is anticipated to have a market value of 25.0 USD Billion in 2024.

What is the forecasted market value for the Gas & NGL Pipelines segment by 2035?

The Gas & NGL Pipelines segment is projected to reach 54.78 USD Billion by 2035.

Kindly complete the form below to receive a free sample of this Report

Customer Stories

“This is really good guys. Excellent work on a tight deadline. I will continue to use you going forward and recommend you to others. Nice job”

“Thanks. It’s been a pleasure working with you, please use me as reference with any other Intel employees.”

“Thanks for sending the report it gives us a good global view of the Betaïne market.”

“Thank you, this will be very helpful for OQS.”

“We found the report very insightful! we found your research firm very helpful. I'm sending this email to secure our future business.”

“I am very pleased with how market segments have been defined in a relevant way for my purposes (such as "Portable Freezers & refrigerators" and "last-mile"). In general the report is well structured. Thanks very much for your efforts.”

“I have been reading the first document or the study, ,the Global HVAC and FP market report 2021 till 2026. Must say, good info! I have not gone in depth at all parts, but got a good indication of the data inside!”

“We got the report in time, we really thank you for your support in this process. I also thank to all of your team as they did a great job.”