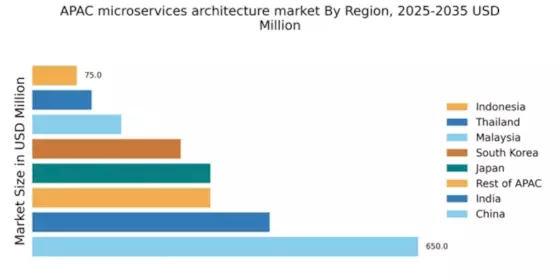

China : Rapid Growth and Innovation Hub

China holds a commanding market share of 43.3% in the APAC microservices architecture market, valued at $650.0 million. Key growth drivers include the rapid digital transformation across industries, government support for cloud computing, and increasing demand for scalable applications. The Chinese government has implemented favorable policies to promote technology adoption, while significant investments in infrastructure bolster industrial development, particularly in tech hubs like Beijing and Shenzhen.

India : Innovation and Start-up Ecosystem

India captures a market share of 26.7%, valued at $400.0 million, driven by a burgeoning start-up ecosystem and increasing cloud adoption across sectors. The demand for microservices is fueled by the need for agile development and cost-effective solutions. Government initiatives like Digital India and Make in India are pivotal in fostering a conducive environment for tech innovation and infrastructure development, particularly in cities like Bengaluru and Hyderabad.

Japan : Strong Focus on Automation

Japan holds a market share of 20.0%, valued at $300.0 million, characterized by a strong emphasis on automation and efficiency. Key growth drivers include the aging population, which necessitates innovative solutions, and the government's push for digital transformation in traditional industries. Regulatory frameworks support technology integration, while significant investments in R&D enhance infrastructure capabilities, particularly in Tokyo and Osaka.

South Korea : Tech-Driven Business Environment

South Korea accounts for a market share of 16.7%, valued at $250.0 million, driven by a tech-savvy population and strong government support for innovation. The demand for microservices is growing in sectors like finance and telecommunications, supported by initiatives such as the Korean New Deal. Major cities like Seoul and Busan are key markets, with significant presence from global players like IBM and Microsoft.

Malaysia : Strategic Location for Tech Firms

Malaysia holds a market share of 10.0%, valued at $150.0 million, with growth driven by increasing cloud adoption and a supportive regulatory environment. The government’s initiatives, such as the Malaysia Digital Economy Corporation, promote digital transformation across industries. Key markets include Kuala Lumpur and Penang, where local and international players are establishing a strong foothold in the microservices sector.

Thailand : Focus on Digital Transformation

Thailand captures a market share of 6.7%, valued at $100.0 million, with growth driven by the government's focus on digital transformation and smart city initiatives. The demand for microservices is increasing in sectors like retail and finance, supported by favorable regulatory policies. Bangkok is a key market, with local firms and international players like Oracle expanding their presence in the region.

Indonesia : Rapidly Growing Digital Economy

Indonesia holds a market share of 5.0%, valued at $75.0 million, characterized by a rapidly growing digital economy and increasing internet penetration. The government’s initiatives to boost the digital landscape are pivotal in driving demand for microservices. Key markets include Jakarta and Surabaya, where local start-ups and The microservices architecture market share, creating a competitive landscape.

Rest of APAC : Varied Growth Across Sub-regions

The Rest of APAC accounts for a market share of 20.0%, valued at $300.0 million, reflecting diverse market dynamics and varying levels of technology adoption. Growth is driven by localized demand for microservices across different sectors, supported by government initiatives tailored to each country. Key markets include Singapore and Vietnam, where both local and international players are establishing a presence, enhancing the competitive landscape.