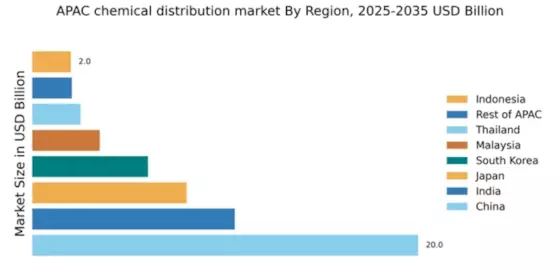

China : Unmatched Market Share and Growth

Key markets include Shanghai, Beijing, and Guangdong, where major players like BASF SE and Dow Inc. have established significant operations. The competitive landscape is characterized by a mix of local and international firms, fostering innovation and price competition. Local dynamics are influenced by the booming automotive and electronics sectors, which drive demand for high-performance chemicals. The business environment is increasingly favorable, supported by government incentives for foreign investment.

India : Rapid Growth in Chemical Demand

Key markets include Maharashtra, Gujarat, and Tamil Nadu, where companies like SABIC and LyondellBasell are expanding their presence. The competitive landscape features a mix of domestic and multinational players, enhancing market dynamics. Local industries such as textiles, pharmaceuticals, and agriculture are significant consumers of chemicals, driving demand. The business environment is evolving, with increasing foreign direct investment and supportive government policies.

Japan : Innovation Drives Market Growth

Key markets include Tokyo, Osaka, and Aichi, where major players like Mitsubishi Chemical Corporation and Evonik Industries AG operate. The competitive landscape is characterized by innovation and collaboration among firms. Local market dynamics are influenced by the automotive and electronics industries, which are significant consumers of chemicals. The business environment is stable, supported by a skilled workforce and advanced technology.

South Korea : Strategic Location and Innovation

Key markets include Seoul, Ulsan, and Incheon, where companies like Huntsman Corporation and Wacker Chemie AG have a significant presence. The competitive landscape features both local and international players, fostering a dynamic market environment. Local industries such as electronics and automotive are major consumers of chemicals, driving demand. The business environment is favorable, supported by government initiatives to boost the chemical sector.

Malaysia : Strategic Location in Southeast Asia

Key markets include Kuala Lumpur, Penang, and Johor, where major players like BASF SE and Dow Inc. are expanding their operations. The competitive landscape is characterized by a mix of local and international firms, enhancing market dynamics. Local industries such as palm oil and electronics are significant consumers of chemicals, driving demand. The business environment is improving, supported by government incentives for foreign investment.

Thailand : Strategic Location and Industrial Growth

Key markets include Bangkok, Rayong, and Chonburi, where companies like SABIC and Huntsman Corporation have established significant operations. The competitive landscape features a mix of local and international players, fostering innovation and competition. Local industries such as automotive and agriculture are major consumers of chemicals, driving demand. The business environment is favorable, supported by government initiatives to attract foreign investment.

Indonesia : Emerging Market with Opportunities

Key markets include Jakarta, West Java, and East Java, where companies like Dow Inc. and LyondellBasell are expanding their presence. The competitive landscape features a mix of domestic and multinational players, enhancing market dynamics. Local industries such as textiles, food processing, and agriculture are significant consumers of chemicals, driving demand. The business environment is evolving, with increasing foreign direct investment and supportive government policies.

Rest of APAC : Varied Growth Across Sub-regions

Key markets include Vietnam, Philippines, and Singapore, where various international players are establishing operations. The competitive landscape is characterized by a mix of local and multinational firms, fostering innovation and competition. Local industries such as agriculture, textiles, and electronics are significant consumers of chemicals, driving demand. The business environment is improving, supported by government initiatives to attract foreign investment.