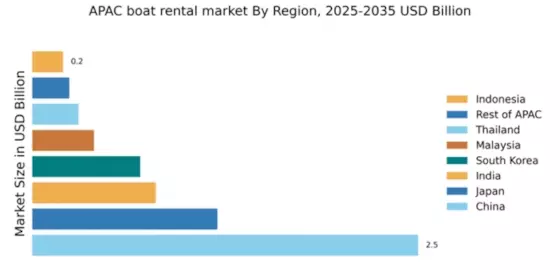

China : Rapid Growth and Urban Demand

China holds a commanding market share of 2.5% in the APAC boat rental sector, driven by increasing disposable incomes and a growing interest in leisure activities. The demand for boat rentals is particularly strong in coastal cities like Shanghai and Shenzhen, where urbanization and tourism are booming. Government initiatives promoting marine tourism and investments in port infrastructure further bolster this growth, creating a favorable regulatory environment for boat rental services. Additionally, the rise of e-commerce platforms facilitates easier access to rental services, enhancing consumer engagement.

India : Growing Interest in Water Sports

India's boat rental market is valued at 0.8%, reflecting a burgeoning interest in water sports and recreational activities. Key growth drivers include rising urban populations and increased tourism in states like Goa and Kerala, known for their scenic coastlines. Government policies promoting tourism infrastructure and safety regulations are also pivotal in shaping the market. The demand for boat rentals is expected to rise as more Indians seek unique leisure experiences, particularly among younger demographics.

Japan : Unique Blend of Tradition and Innovation

Japan's boat rental market stands at 1.2%, characterized by a blend of traditional boat experiences and modern leisure activities. Key growth drivers include a strong domestic tourism sector and international interest in cultural experiences, particularly in cities like Tokyo and Kyoto. The government supports marine tourism through various initiatives, enhancing infrastructure and safety regulations. The demand for unique experiences, such as traditional fishing and sightseeing cruises, is on the rise, appealing to both locals and tourists.

South Korea : Tech-Driven Market Growth

South Korea's boat rental market is valued at 0.7%, driven by technological advancements and a growing interest in leisure boating. Major cities like Busan and Incheon are key markets, benefiting from government initiatives aimed at promoting marine tourism. The demand for boat rentals is increasing, particularly among younger consumers seeking unique recreational activities. The competitive landscape features both local and international players, with a focus on enhancing customer experience through technology and service innovation.

Malaysia : Tourism-Driven Market Expansion

Malaysia's boat rental market is valued at 0.4%, with significant growth driven by its rich marine biodiversity and tourism appeal. Key markets include Langkawi and Penang, where water sports and leisure activities are increasingly popular. Government initiatives to promote marine tourism and improve infrastructure are crucial for market expansion. The demand for boat rentals is expected to rise as more tourists seek unique experiences, supported by a competitive landscape featuring both local and international players.

Thailand : Vibrant Market with Diverse Offerings

Thailand's boat rental market is valued at 0.3%, thriving on its reputation as a premier tourist destination. Key growth drivers include the influx of international tourists and a strong domestic market, particularly in regions like Phuket and Krabi. Government policies promoting marine tourism and safety regulations are enhancing the market environment. The competitive landscape features a mix of local operators and international brands, catering to diverse consumer preferences for leisure and adventure activities.

Indonesia : Island Hopping and Adventure Awaits

Indonesia's boat rental market is valued at 0.2%, with significant potential for growth driven by its vast archipelago and increasing tourism. Key markets include Bali and Komodo, where water sports and eco-tourism are gaining traction. Government initiatives to improve marine infrastructure and promote sustainable tourism are pivotal for market development. The competitive landscape is evolving, with local operators increasingly partnering with international brands to enhance service offerings and attract a broader customer base.

Rest of APAC : Varied Markets with Unique Dynamics

The Rest of APAC region holds a market share of 0.24%, characterized by diverse opportunities in boat rentals. Countries like Vietnam and the Philippines are emerging markets, driven by increasing tourism and local demand for recreational boating. Government initiatives to promote marine tourism and improve infrastructure are essential for market growth. The competitive landscape varies significantly, with local players dominating in some areas while international brands are expanding their presence in others, catering to unique consumer preferences.