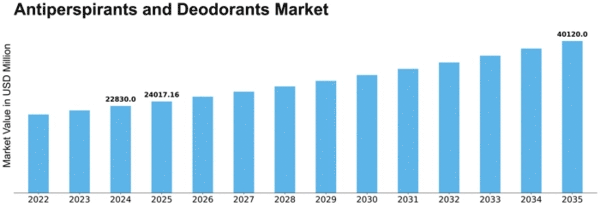

Antiperspirants And Deodorants Size

Antiperspirants and Deodorants Market Growth Projections and Opportunities

The antiperspirants and deodorants market, a fundamental part of the individual consideration area, encounters development and improvement because of a large number of market determinants. A compelling determinant is the developing awareness in regard to individual cleanliness and the tendency towards unending newness. Because of the rising requests of shoppers who lead dynamic ways of life and face the intricacies of contemporary pressure, there is a creating market for antiperspirants and deodorants that offer productive sweat security and scent control, in this manner fulfilling the prerequisite for persevering through certainty.

The market elements of antiperspirants and deodorants are altogether impacted by mechanical redesigns and plan advancements. Progressing innovative work tries bringing about the presentation of novel and improved parts, including intensifies that ingest dampness and high-level antimicrobial specialists. Item progress in a serious market is supported by definitions that give skin-accommodating and dependable security notwithstanding viable scent covering.

Way of life choices and purchaser inclinations considerably affect the antiperspirants and deodorants market. As the interest for regular and sans aluminum choices increments, so does the tendency towards natural excellence and wellbeing. Piece of the pie increments for brands that take care of shopper inclinations for items made out of regular fixings and diminished compound substance. Further, the development of item contributions is worked with by the interest for altered aromas and novel implements, which empower clients to choose antiperspirants and deodorants that relate to their particular tendencies.

The shopper decisions in the antiperspirants and deodorants market are essentially affected by brand picture and advertising techniques. Promoting systems that really convey the particular selling points of an item — e.g., definitions custom fitted to explicit sexes, clinical-strength security, or skin responsiveness — can possibly influence shopper buying decisions. Brands that lay out a compatibility with shoppers by means of publicizing efforts that feature the positive parts of way of life, social obligation, or inclusivity do as such to encourage an association that outperforms the simple utilitarian credits of the item, in this way improving client dedication.

The circulation channels and market openness of antiperspirants and deodorants considerably affect their accessibility to purchasers. Through broad circulation across numerous retail channels — including drug stores, corrective stores, general stores, and online business stages — a large number of items are promptly accessible to buyers. Compelling conveyance networks add to the seriousness of brands in the antiperspirants and deodorants market by expanding market entrance.

Concerning item claims and fixing wellbeing, administrative contemplations are critical in the antiperspirants and deodorants industry. Administrative bodies and states uphold rules to ensure that these items fulfill exact wellbeing principles, give the guaranteed benefits, and don't incur harm upon purchasers. Producers really must comply with these guidelines to lay out certainty among shoppers and fulfill lawful commitments across different business sectors.

Leave a Comment