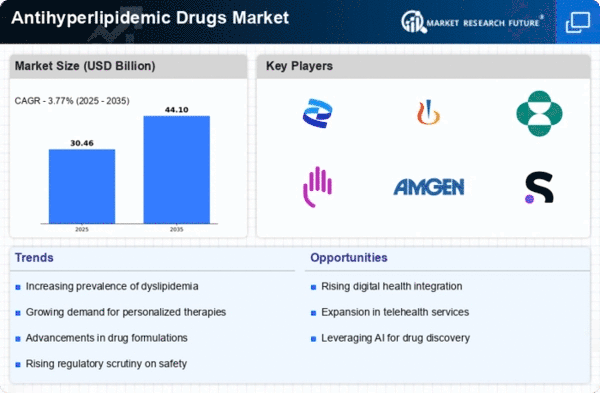

Market Growth Projections

The Global Antihyperlipidemic Drugs Market is projected to exhibit a steady growth trajectory, with expectations of reaching 29.4 USD Billion in 2024 and 44.1 USD Billion by 2035. This growth is underpinned by a compound annual growth rate of 3.77% from 2025 to 2035. The increasing prevalence of hyperlipidemia, coupled with advancements in drug formulations and rising healthcare expenditures, creates a conducive environment for market expansion. Additionally, growing awareness and regulatory support further bolster the market's potential. These projections indicate a robust future for the Global Antihyperlipidemic Drugs Market, reflecting the ongoing commitment to addressing lipid management and cardiovascular health.

Growing Awareness and Education

Increased awareness and education regarding cardiovascular health significantly impact the Global Antihyperlipidemic Drugs Market Industry. Public health campaigns and educational initiatives by healthcare organizations are effectively informing individuals about the risks associated with high cholesterol levels. This heightened awareness leads to more individuals seeking medical advice and treatment, thereby driving demand for antihyperlipidemic drugs. Additionally, healthcare providers are increasingly emphasizing the importance of lipid management in preventing cardiovascular diseases, which further propels the market. As a result, the Global Antihyperlipidemic Drugs Market is expected to experience robust growth, reflecting a shift towards proactive health management.

Advancements in Drug Formulations

Innovations in drug formulations are transforming the Global Antihyperlipidemic Drugs Market Industry. Newer formulations, such as combination therapies and extended-release versions, enhance patient compliance and therapeutic outcomes. For instance, the introduction of fixed-dose combinations allows for simplified treatment regimens, which may lead to better adherence among patients. Furthermore, advancements in delivery systems, such as injectable formulations, are emerging as alternatives to traditional oral medications. These developments not only improve the efficacy of treatments but also expand the market by catering to diverse patient needs. The anticipated growth in this sector aligns with the projected market value of 44.1 USD Billion by 2035.

Increasing Healthcare Expenditure

The rise in global healthcare expenditure is a pivotal factor influencing the Global Antihyperlipidemic Drugs Market Industry. As countries allocate more funds towards healthcare, there is a corresponding increase in the availability and accessibility of antihyperlipidemic medications. This trend is particularly evident in developed nations, where healthcare budgets are expanding to accommodate preventive measures and chronic disease management. Enhanced funding allows for better screening programs and treatment options, which are essential for managing hyperlipidemia. The projected compound annual growth rate of 3.77% for the period from 2025 to 2035 indicates a sustained investment in this area, further solidifying the market's growth trajectory.

Rising Prevalence of Hyperlipidemia

The increasing prevalence of hyperlipidemia globally drives the Global Antihyperlipidemic Drugs Market Industry. According to health statistics, hyperlipidemia affects a significant portion of the adult population, with estimates suggesting that nearly 40% of adults over 40 years are affected. This growing patient population necessitates effective treatment options, thereby expanding the market for antihyperlipidemic drugs. As awareness of cholesterol-related health risks rises, healthcare providers are more likely to prescribe these medications, contributing to market growth. The Global Antihyperlipidemic Drugs Market is projected to reach 29.4 USD Billion in 2024, reflecting the urgent need for effective management of lipid levels.

Regulatory Support for Drug Approvals

Regulatory support for the approval of new antihyperlipidemic drugs plays a crucial role in shaping the Global Antihyperlipidemic Drugs Market Industry. Regulatory agencies are streamlining the approval processes for innovative therapies, thereby facilitating quicker access to new treatment options for patients. This supportive environment encourages pharmaceutical companies to invest in research and development, leading to a broader range of antihyperlipidemic medications entering the market. As new drugs receive approval, they contribute to the overall growth of the market, addressing the diverse needs of patients with hyperlipidemia. The ongoing regulatory advancements are likely to enhance market dynamics in the coming years.