Growth in Aquaculture

The expansion of the aquaculture sector is contributing to the growth of the Global Antifouling Agent Market Industry. As fish farming becomes a more prevalent source of protein, the need for effective antifouling solutions in aquaculture systems is increasing. Fouling organisms can adversely affect fish health and productivity, leading to economic losses for farmers. The use of antifouling agents in aquaculture can mitigate these issues, ensuring healthier stock and improved yields. This trend is likely to drive demand for specialized antifouling products tailored for aquaculture applications, further enhancing market dynamics.

Regulatory Compliance

Stringent regulations regarding environmental protection are influencing the Global Antifouling Agent Market Industry. Governments worldwide are implementing policies to limit the use of harmful substances in antifouling paints. For instance, the European Union's Biocidal Products Regulation mandates that only approved antifouling agents can be used. This regulatory landscape encourages manufacturers to innovate and develop eco-friendly alternatives, which could potentially capture a larger market share. As compliance becomes increasingly critical, companies are likely to invest in research and development to meet these standards, thereby stimulating market growth.

Increasing Maritime Trade

The Global Antifouling Agent Market Industry is experiencing growth due to the rising volume of maritime trade. As global shipping activities expand, the need for effective antifouling solutions becomes more pronounced. Ships that are fouled by marine organisms can experience increased fuel consumption and reduced speed, leading to higher operational costs. The International Maritime Organization has reported that antifouling agents can reduce fuel consumption by up to 10%. This economic incentive drives ship owners to invest in antifouling technologies, thereby propelling the market forward.

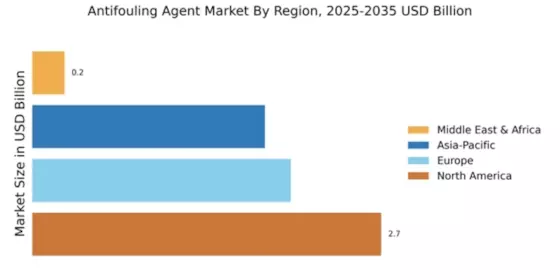

Market Growth Projections

The Global Antifouling Agent Market Industry is projected to experience a compound annual growth rate of 3.18% from 2025 to 2035. This growth trajectory suggests a steady increase in demand for antifouling solutions across various sectors, including shipping, aquaculture, and recreational boating. The market is anticipated to reach a valuation of 9.53 USD Billion by 2035, reflecting the ongoing need for effective antifouling agents. This upward trend may be influenced by factors such as technological advancements, regulatory compliance, and the expansion of maritime activities.

Technological Advancements

Innovations in antifouling technologies are driving the Global Antifouling Agent Market Industry. Recent advancements include the development of biocide-free antifouling coatings that utilize nanotechnology and other advanced materials. These innovations not only enhance performance but also address environmental concerns associated with traditional antifouling agents. The introduction of smart coatings that respond to environmental stimuli represents a significant leap forward. As these technologies become more commercially viable, they are expected to attract investment and expand market opportunities, potentially increasing the market size from 6.75 USD Billion in 2024 to 9.53 USD Billion by 2035.

Rising Demand for Recreational Vessels

The increasing popularity of recreational boating is positively impacting the Global Antifouling Agent Market Industry. As more individuals invest in personal watercraft, the need for antifouling solutions to maintain vessel performance becomes essential. Recreational boats are particularly susceptible to fouling, which can lead to decreased speed and increased fuel costs. The market for antifouling paints specifically designed for recreational vessels is expected to grow, driven by consumer awareness of maintenance and performance. This trend indicates a robust potential for market expansion as the recreational boating sector continues to thrive.