Increasing Maritime Trade Activities

The Antifouling Paints and Coating Market is experiencing growth due to the rising maritime trade activities. As international trade expands, the demand for ships and vessels increases, necessitating effective antifouling solutions to maintain vessel performance and efficiency. The International Maritime Organization has reported a steady increase in global shipping volumes, which correlates with the need for advanced coatings that prevent biofouling. This trend is particularly evident in regions with high shipping traffic, where the accumulation of marine organisms can significantly hinder vessel speed and fuel efficiency. Consequently, ship owners are increasingly investing in high-quality antifouling paints to ensure compliance with environmental regulations and to enhance operational efficiency. The market is likely to see sustained growth as shipping activities continue to rise, driving the demand for innovative antifouling solutions.

Rising Demand from Recreational Boating Sector

The Antifouling Paints and Coating Market is witnessing a surge in demand from the recreational boating sector. As leisure boating becomes increasingly popular, boat owners are seeking effective antifouling solutions to protect their vessels from marine growth. The growth of the recreational boating market is supported by rising disposable incomes and a growing interest in water-based activities. This trend is particularly pronounced in regions with extensive coastlines and favorable weather conditions, where boating is a favored pastime. Manufacturers are responding to this demand by offering a range of antifouling paints specifically designed for smaller vessels, which often require different formulations compared to commercial shipping. The increasing focus on maintaining the aesthetic and functional aspects of recreational boats is likely to further propel the demand for specialized antifouling coatings in the Antifouling Paints and Coating Market.

Expansion of Shipbuilding and Repair Industries

The Antifouling Paints and Coating Market is benefiting from the expansion of shipbuilding and repair industries. As new vessels are constructed and existing ones are refurbished, the need for high-performance antifouling coatings becomes paramount. The shipbuilding sector is experiencing growth due to increased investments in maritime infrastructure and the rising demand for cargo and passenger vessels. Additionally, the repair and maintenance segment is also expanding, as ship owners seek to prolong the lifespan of their vessels through effective antifouling solutions. This trend is particularly evident in regions with established shipyards and repair facilities, where the demand for quality coatings is robust. The interplay between new ship construction and maintenance activities is likely to sustain the growth of the Antifouling Paints and Coating Market, as stakeholders prioritize the use of advanced coatings to enhance vessel performance and compliance.

Regulatory Pressure for Environmental Compliance

The Antifouling Paints and Coating Market is significantly influenced by regulatory pressures aimed at environmental protection. Governments and international bodies are implementing stringent regulations to limit the use of harmful substances in marine coatings. For instance, the European Union has established regulations that restrict the use of biocides in antifouling paints, pushing manufacturers to develop eco-friendly alternatives. This regulatory landscape is compelling companies to innovate and invest in research and development to create compliant products that meet environmental standards. As a result, the market is witnessing a shift towards the adoption of non-toxic and biodegradable antifouling solutions. The increasing awareness of environmental sustainability among consumers and stakeholders further amplifies this trend, suggesting that companies that prioritize compliance and sustainability may gain a competitive edge in the Antifouling Paints and Coating Market.

Technological Innovations in Coating Formulations

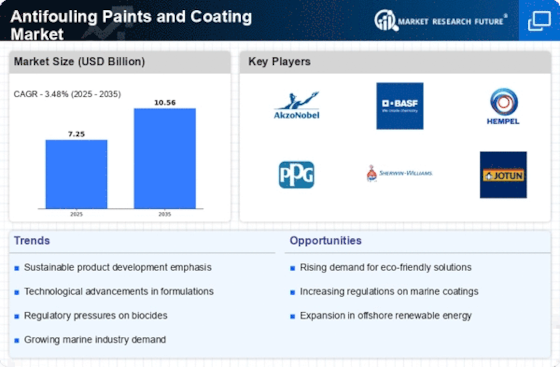

Technological advancements are playing a pivotal role in shaping the Antifouling Paints and Coating Market. Innovations in coating formulations, such as the development of self-polishing and fouling-release coatings, are enhancing the performance and longevity of antifouling paints. These advanced formulations not only improve the efficacy of biofouling prevention but also reduce the environmental impact associated with traditional antifouling solutions. The introduction of nanotechnology in coatings is also gaining traction, offering improved adhesion and durability. According to industry reports, the market for advanced antifouling coatings is projected to grow at a compound annual growth rate of over 5% in the coming years. This trend indicates a strong demand for innovative products that can meet the evolving needs of the maritime industry, thereby driving growth in the Antifouling Paints and Coating Market.