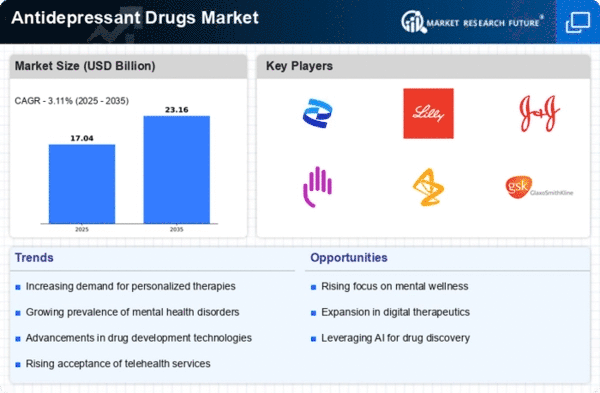

Market Growth Projections

The Global Antidepressant Drug Market Industry is poised for substantial growth, with projections indicating a market value of 16.5 USD Billion in 2024 and an anticipated increase to 23.2 USD Billion by 2035. This growth trajectory reflects a compound annual growth rate of 3.11% from 2025 to 2035, driven by various factors including rising prevalence of depression, advancements in pharmaceutical research, and increased awareness of mental health issues. As the market evolves, it is likely to witness the introduction of innovative therapies and a broader acceptance of antidepressant medications, further solidifying its position in the healthcare landscape.

Growing Geriatric Population

The aging global population is a significant driver of the Global Antidepressant Drug Market Industry. Older adults are particularly susceptible to depression due to factors such as chronic illness, social isolation, and cognitive decline. As the geriatric population continues to expand, the demand for antidepressant medications is expected to rise correspondingly. By 2035, the number of individuals aged 65 and older is projected to reach 1.5 billion globally, further emphasizing the need for effective mental health interventions. This demographic shift is likely to sustain market growth, contributing to the overall increase in market value.

Rising Prevalence of Depression

The increasing prevalence of depression globally is a primary driver of the Global Antidepressant Drug Market Industry. According to estimates, over 264 million individuals suffer from depression worldwide, leading to a heightened demand for effective treatment options. This growing patient population necessitates a robust supply of antidepressant medications, contributing to the market's projected value of 16.5 USD Billion in 2024. As awareness of mental health issues continues to rise, healthcare providers are more likely to prescribe antidepressants, further propelling market growth. The urgency to address mental health concerns is likely to sustain this upward trajectory in the coming years.

Advancements in Pharmaceutical Research

Innovations in pharmaceutical research and development are significantly influencing the Global Antidepressant Drug Market Industry. The emergence of novel antidepressant classes, such as fast-acting antidepressants and personalized medicine approaches, enhances treatment efficacy and patient outcomes. For instance, the introduction of ketamine-based therapies has shown promise in treating resistant depression, attracting attention from both clinicians and patients. This ongoing research is expected to drive market growth, with projections indicating a market value of 23.2 USD Billion by 2035. As new therapies enter the market, they may reshape treatment paradigms and expand the overall antidepressant market.

Regulatory Support for Mental Health Initiatives

Regulatory bodies worldwide are increasingly recognizing the importance of mental health, leading to supportive policies that bolster the Global Antidepressant Drug Market Industry. Initiatives aimed at improving access to mental health care and funding for research into new treatments are becoming more prevalent. For example, government programs that promote mental health screenings and subsidize antidepressant medications enhance patient access to necessary treatments. Such regulatory support is likely to foster market growth, as it encourages pharmaceutical companies to invest in research and development. This environment of support may contribute to the anticipated market value of 23.2 USD Billion by 2035.

Increased Awareness and Acceptance of Mental Health

The growing awareness and acceptance of mental health issues play a crucial role in shaping the Global Antidepressant Drug Market Industry. Public campaigns and educational initiatives have contributed to a reduction in stigma associated with mental health disorders, encouraging individuals to seek treatment. This cultural shift is reflected in the rising number of prescriptions for antidepressants, as more patients are willing to discuss their mental health concerns with healthcare providers. As a result, the market is likely to experience sustained growth, with a projected compound annual growth rate of 3.11% from 2025 to 2035, indicating a robust future for antidepressant medications.