Market Growth Projections

The Global Anthrax Treatment Market Industry is poised for substantial growth, with projections indicating a market value of 3.59 USD Billion in 2024 and an anticipated increase to 6.04 USD Billion by 2035. This growth trajectory reflects a compound annual growth rate (CAGR) of 4.84% from 2025 to 2035. Factors contributing to this growth include rising incidences of anthrax, advancements in treatment options, and increased government funding. As the market evolves, stakeholders are likely to focus on innovative solutions to address the challenges posed by anthrax, ensuring that treatment options remain effective and accessible.

Increased Awareness and Education

The Global Anthrax Treatment Market Industry benefits from heightened awareness and education regarding anthrax risks and treatments. Public health campaigns aimed at educating farmers, veterinarians, and healthcare professionals about anthrax prevention and treatment are essential. These initiatives help in early detection and prompt treatment, reducing mortality rates associated with anthrax infections. As awareness increases, so does the demand for effective treatment options, contributing to market growth. The emphasis on education and preventive measures is expected to sustain the market's trajectory, particularly as communities become more informed about the implications of anthrax.

Rising Incidence of Anthrax Cases

The Global Anthrax Treatment Market Industry is experiencing growth due to an increase in reported anthrax cases worldwide. Factors such as agricultural practices, particularly in livestock management, contribute to this rise. For instance, regions with high livestock density, like parts of Africa and Asia, have seen outbreaks that necessitate effective treatment options. This trend underscores the need for robust treatment protocols and preventive measures, driving demand for anthrax therapeutics. As awareness of anthrax risks grows, the market is projected to reach 3.59 USD Billion in 2024, reflecting the urgency for effective treatment solutions.

Government Initiatives and Funding

Government initiatives play a crucial role in shaping the Global Anthrax Treatment Market Industry. Various health organizations and governmental bodies are investing in research and development to combat anthrax outbreaks. For example, the U.S. government has allocated funding for the development of anthrax vaccines and treatments, recognizing the potential threat of bioterrorism. Such initiatives not only enhance public health preparedness but also create a favorable environment for market growth. The commitment to addressing anthrax through policy and funding is likely to drive the market's expansion, particularly as global health security remains a priority.

Advancements in Treatment Modalities

Innovations in treatment modalities are propelling the Global Anthrax Treatment Market Industry forward. Recent developments in antibiotic therapies, such as the use of ciprofloxacin and doxycycline, have shown efficacy against anthrax infections. Additionally, the introduction of monoclonal antibodies, like obiltoxaximab, offers new avenues for treatment. These advancements not only enhance patient outcomes but also stimulate market growth as healthcare providers seek the most effective therapies. The ongoing research and development in this field suggest a promising future, with the market expected to grow to 6.04 USD Billion by 2035, indicating a sustained interest in improving anthrax treatment.

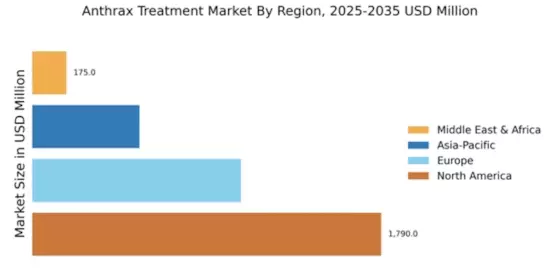

Emerging Markets and Global Expansion

Emerging markets are becoming increasingly relevant in the Global Anthrax Treatment Market Industry. Countries in Africa, Asia, and Latin America are witnessing a rise in anthrax cases, necessitating the availability of effective treatments. The growth rate in these regions is expected to be significant, with a projected CAGR of 4.84% from 2025 to 2035. This expansion is driven by the need for improved healthcare infrastructure and access to treatment options. As these markets develop, they present opportunities for pharmaceutical companies to introduce innovative therapies and expand their reach, ultimately contributing to the overall growth of the anthrax treatment market.