Emergence of 5G Technology

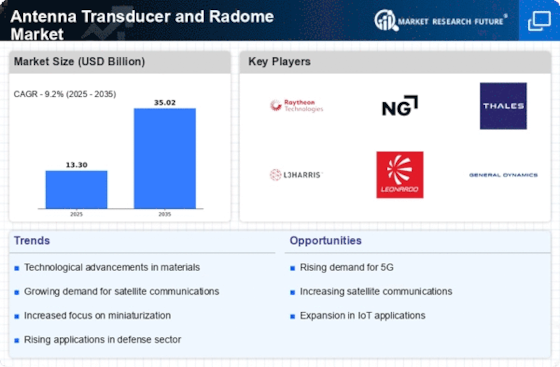

The rollout of 5G technology is poised to revolutionize the Antenna Transducer and Radome Market. With its promise of ultra-fast data speeds and low latency, 5G is expected to drive significant advancements in antenna design and radome technology. The demand for 5G infrastructure is anticipated to create a multi-billion dollar market opportunity, as telecom operators and service providers seek to enhance their network capabilities. This transition necessitates the development of new antenna transducers that can support higher frequencies and increased bandwidth. As a result, manufacturers are likely to focus on creating innovative solutions that not only meet the technical requirements of 5G but also address the challenges posed by urban environments and dense user populations.

Growth in Satellite Communication

The growth of satellite communication is a crucial driver for the Antenna Transducer and Radome Market. As satellite technology advances, the demand for high-performance antennas and radomes that can operate effectively in various environments is increasing. The satellite communication market is projected to reach several billion dollars in the next few years, driven by applications in broadband internet, television broadcasting, and remote sensing. This surge in demand necessitates the development of specialized antenna transducers and radomes that can withstand harsh conditions while maintaining optimal performance. Consequently, companies are investing in research and development to create innovative solutions that cater to the evolving needs of the satellite communication sector.

Rising Demand for Wireless Communication

The increasing demand for wireless communication systems is a primary driver for the Antenna Transducer and Radome Market. As more devices become interconnected, the need for efficient and reliable antennas and radomes intensifies. The market for wireless communication is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 10% in the coming years. This growth is largely attributed to the proliferation of smartphones, IoT devices, and smart home technologies, all of which require advanced antenna solutions. Consequently, manufacturers are focusing on developing innovative antenna transducers and radomes that can support higher frequencies and improved performance, thereby enhancing the overall user experience.

Expansion of Aerospace and Defense Sectors

The aerospace and defense sectors are experiencing substantial growth, which is likely to bolster the Antenna Transducer and Radome Market. With increasing investments in military technologies and commercial aviation, the demand for advanced communication systems is on the rise. For instance, the defense sector is expected to allocate a significant portion of its budget to upgrading communication systems, which includes the integration of sophisticated antenna transducers and radomes. This trend is further supported by the need for enhanced surveillance, navigation, and communication capabilities in modern aircraft and defense systems. As a result, manufacturers are compelled to innovate and provide solutions that meet the stringent requirements of these sectors.

Increased Focus on Research and Development

The heightened focus on research and development within the Antenna Transducer and Radome Market is a significant driver of growth. Companies are increasingly investing in R&D to develop cutting-edge technologies that enhance the performance and efficiency of antennas and radomes. This trend is evident in various sectors, including telecommunications, aerospace, and automotive, where the demand for advanced communication systems is escalating. The investment in R&D is expected to yield innovative solutions that address the challenges of miniaturization, integration, and performance optimization. As a result, the market is likely to witness a surge in new product launches and technological advancements, further propelling the growth of the Antenna Transducer and Radome Market.