Analytics of Things Market Summary

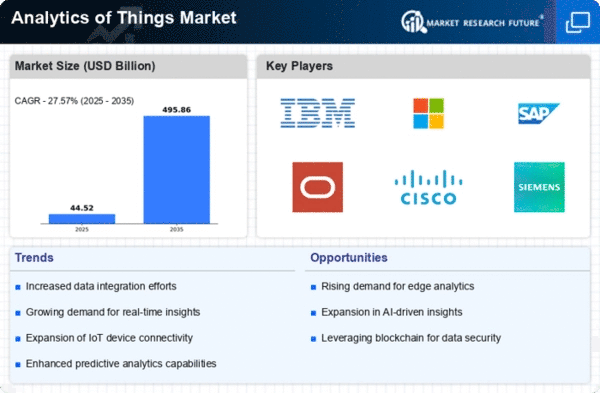

As per MRFR analysis, the Analytics of Things Market Size was estimated at 34.9 USD Billion in 2024. The Analytics of Things industry is projected to grow from 43.45 USD Billion in 2025 to 495.86 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 27.57% during the forecast period 2025 - 2035.

Key Market Trends & Highlights

The Analytics of Things Market is poised for substantial growth driven by technological advancements and increasing demand for data-driven insights.

- The integration of AI and machine learning is transforming data analytics capabilities across various sectors.

- Real-time data processing is becoming essential for industries such as manufacturing and healthcare to enhance operational efficiency.

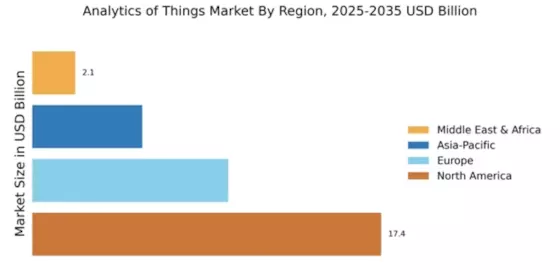

- Data security and privacy concerns are prompting organizations to adopt more robust analytics solutions, particularly in North America.

- The rising demand for IoT devices and advancements in data analytics technologies are key drivers propelling the market forward.

Market Size & Forecast

| 2024 Market Size | 34.9 (USD Billion) |

| 2035 Market Size | 495.86 (USD Billion) |

| CAGR (2025 - 2035) | 27.57% |

Major Players

IBM (US), Microsoft (US), SAP (DE), Oracle (US), Cisco (US), Siemens (DE), GE (US), Honeywell (US), Intel (US), Dell (US)