Market Analysis

In-depth Analysis of Analytics of Things Market Industry Landscape

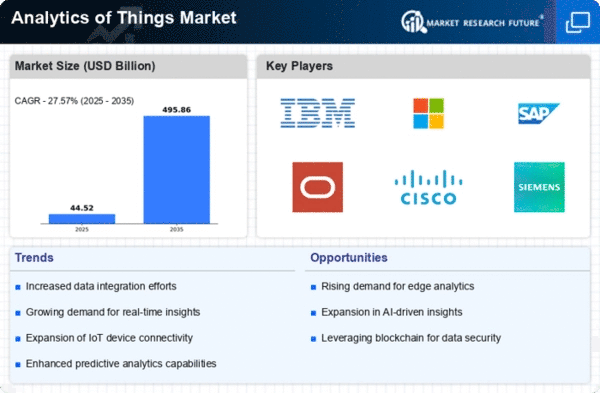

The Analytics of Things (AoT) market is currently undergoing dynamic changes driven by technological advancements and the growing importance of data-driven decision-making across various industries. As organizations increasingly recognize the value of leveraging data to gain insights and improve operational efficiency, the demand for analytics solutions tailored for the Internet of Things (IoT) ecosystem is on the rise.

One of the key market dynamics shaping the Analytics of Things landscape is the continuous expansion of the IoT ecosystem. With an ever-growing number of connected devices, sensors, and systems generating massive amounts of data, there is a heightened need for advanced analytics tools to extract meaningful insights from this wealth of information. This surge in data volumes has prompted businesses to adopt AoT solutions that can provide real-time analytics, predictive modeling, and prescriptive analytics to enhance decision-making processes.

Moreover, the increasing adoption of cloud computing has significantly influenced the Analytics of Things market. Cloud-based analytics platforms offer scalability, flexibility, and cost-effectiveness, enabling organizations to efficiently handle the vast amounts of data generated by IoT devices. This shift towards cloud-based AoT solutions has democratized access to analytics capabilities, making them more accessible to businesses of all sizes. As a result, the market has witnessed a proliferation of analytics tools and platforms catering to diverse industry needs.

Another noteworthy factor driving market dynamics is the emphasis on data security and privacy. As the IoT ecosystem expands, concerns regarding the protection of sensitive information have become paramount. Analytics of Things solutions that prioritize robust security measures, including encryption, authentication, and compliance with data protection regulations, are gaining traction. Organizations are increasingly prioritizing solutions that not only deliver powerful analytics but also ensure the confidentiality and integrity of the data being analyzed.

The Analytics of Things market is also witnessing a shift towards industry-specific applications. As businesses seek more tailored and specialized analytics solutions, vendors are developing industry-focused AoT platforms that address the unique challenges and requirements of sectors such as healthcare, manufacturing, energy, and agriculture. These industry-specific analytics solutions are designed to deliver targeted insights and drive innovation within specific verticals.

Furthermore, the market dynamics of AoT are influenced by the integration of artificial intelligence (AI) and machine learning (ML) technologies. The combination of AoT with AI and ML capabilities enables organizations to gain deeper insights, automate decision-making processes, and uncover hidden patterns within complex datasets. This convergence of technologies enhances the overall effectiveness of Analytics of Things solutions, making them invaluable for organizations seeking a competitive edge in today's data-driven business landscape.

Leave a Comment