Market Share

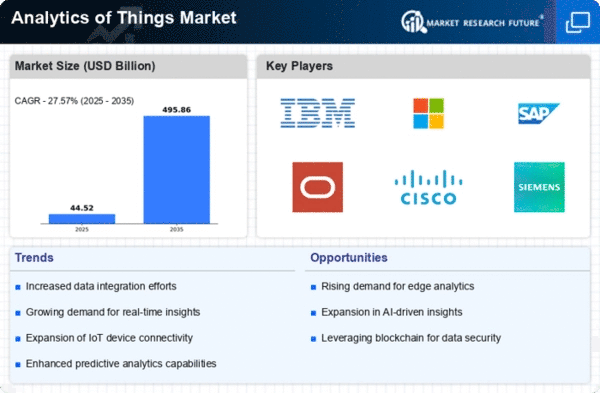

Analytics of Things Market Share Analysis

In the dynamic landscape of the Analytics of Things (AoT) market, companies employ various market share positioning strategies to establish a competitive edge. One prevalent approach involves differentiation, where companies focus on offering unique and innovative AoT solutions to distinguish themselves from competitors. By investing in research and development, companies can create advanced analytics tools, predictive models, and data visualization techniques that cater to specific industry needs. This strategy not only attracts a niche customer base but also enhances the overall perceived value of their offerings.

Another pivotal strategy in market share positioning within the AoT sector is cost leadership. Companies pursuing this approach aim to provide efficient and cost-effective solutions, making them attractive to a broader customer base. Through economies of scale and operational efficiency, these firms can offer competitive pricing while maintaining profitability. This strategy often involves strategic partnerships, streamlined processes, and technology optimization to reduce production and operational costs. As a result, companies adopting a cost leadership approach can penetrate the market and gain a significant share by appealing to budget-conscious customers.

Strategic alliances and partnerships play a crucial role in market share positioning within the AoT industry. By collaborating with key players, businesses can access complementary technologies, expand their customer base, and create synergies that drive innovation. Strategic partnerships also allow companies to combine their strengths, mitigating weaknesses and positioning themselves as comprehensive solution providers. These collaborations can involve technology integrations, joint ventures, or co-development efforts, enabling companies to leverage each other's expertise and resources for mutual benefit.

Furthermore, a customer-centric market share positioning strategy involves tailoring AoT solutions to meet specific customer needs. This approach requires a deep understanding of the target market, allowing companies to develop personalized and industry-specific analytics solutions. By aligning their offerings with the unique challenges and requirements of different sectors, companies can build strong relationships with clients and gain a competitive advantage. This customer-centric strategy also involves providing excellent customer support, ongoing training, and continuous product enhancements to ensure long-term satisfaction and loyalty.

Market segmentation is another effective strategy in the AoT sector. By identifying and targeting specific customer segments, companies can tailor their marketing and product development efforts to address the distinct needs of each group. This focused approach enables companies to allocate resources efficiently, enhance customer engagement, and establish themselves as specialists within particular niches. Through market segmentation, companies can capture a larger share of the AoT market by customizing their strategies for various industries, such as healthcare, manufacturing, or logistics.

Leave a Comment