Rising Demand in Packaging Sector

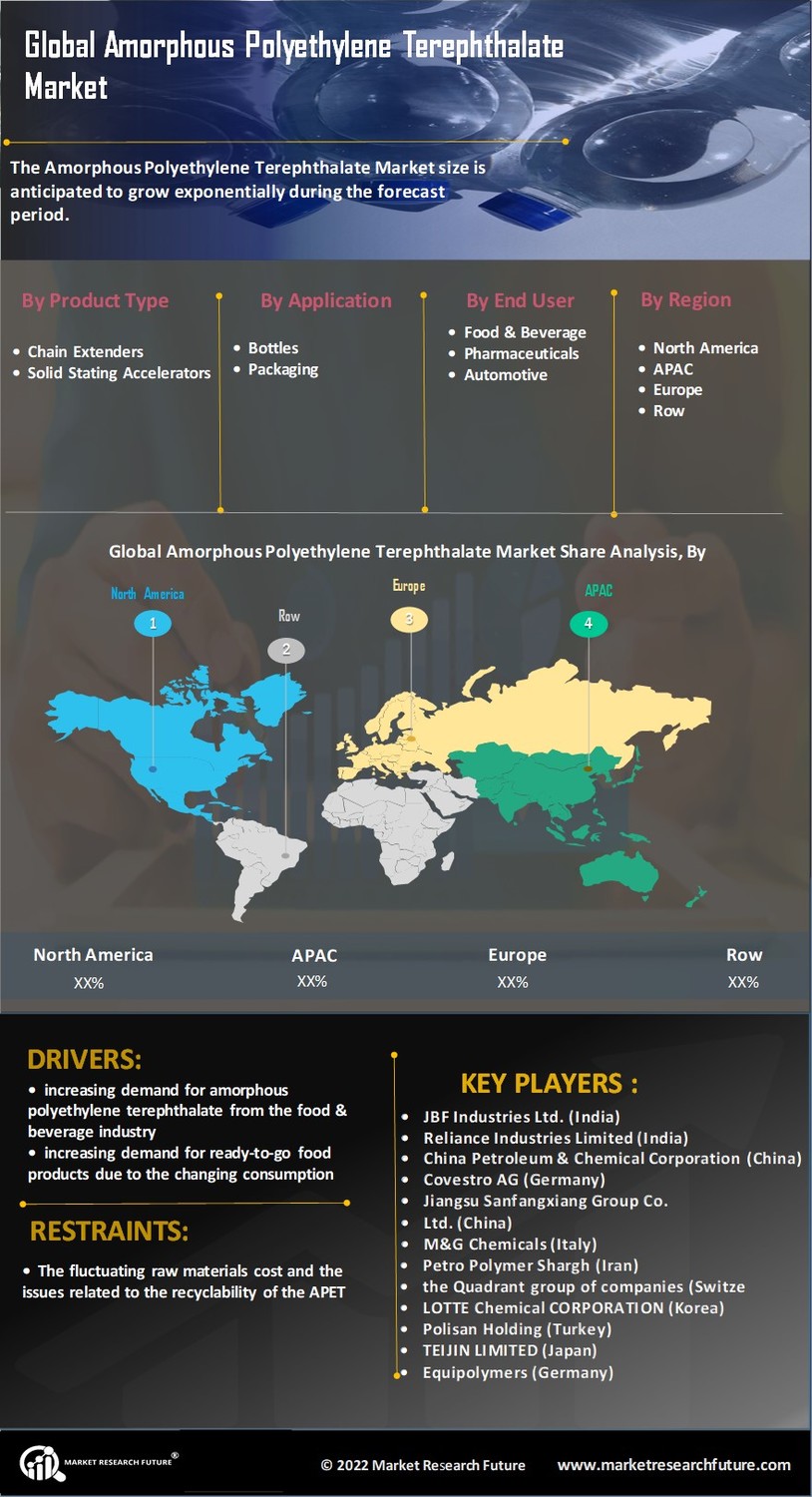

The Global Amorphous Polyethylene Terephthalate Market Industry is experiencing a notable surge in demand, particularly within the packaging sector. This growth is driven by the increasing preference for lightweight, durable, and recyclable materials among manufacturers. For instance, the packaging industry is projected to account for a significant share of the market, as companies seek to enhance product shelf life while minimizing environmental impact. The market is expected to reach approximately 37.9 USD Billion in 2024, reflecting a robust shift towards sustainable packaging solutions that utilize amorphous polyethylene terephthalate due to its favorable properties.

Emerging Markets and Economic Growth

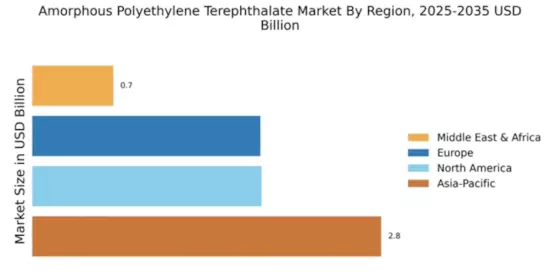

Emerging markets are playing a pivotal role in the expansion of the Global Amorphous Polyethylene Terephthalate Market Industry. Rapid economic growth in regions such as Asia-Pacific and Latin America is leading to increased industrialization and urbanization, driving demand for various applications of amorphous polyethylene terephthalate. As disposable incomes rise, consumers are seeking higher-quality products, which in turn fuels the need for advanced materials. This trend is likely to enhance market dynamics, as manufacturers in these regions capitalize on the growing demand, further contributing to the overall market growth.

Technological Advancements in Production

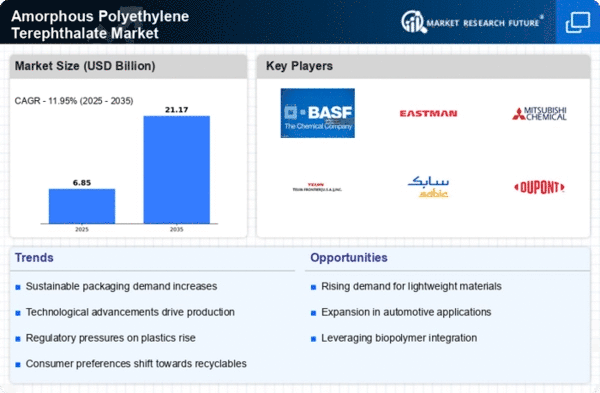

Technological innovations in the production processes of amorphous polyethylene terephthalate are significantly influencing the Global Amorphous Polyethylene Terephthalate Market Industry. Enhanced manufacturing techniques, such as advanced polymerization methods and improved recycling processes, are leading to higher efficiency and lower production costs. These advancements not only improve the quality of the end product but also facilitate the development of new applications across various sectors. As a result, the market is poised for substantial growth, with projections indicating a compound annual growth rate of 7.99% from 2025 to 2035, driven by these technological enhancements.

Sustainability and Environmental Regulations

Sustainability concerns and stringent environmental regulations are driving the Global Amorphous Polyethylene Terephthalate Market Industry towards greener alternatives. Governments worldwide are implementing policies aimed at reducing plastic waste and promoting recycling initiatives. Amorphous polyethylene terephthalate, being recyclable and less harmful to the environment, aligns well with these regulatory frameworks. Companies are increasingly adopting this material to comply with sustainability mandates, thereby enhancing their market position. This shift towards eco-friendly materials is expected to propel the market forward, as consumers and businesses alike prioritize sustainable practices in their operations.

Growth in Electronics and Automotive Applications

The Global Amorphous Polyethylene Terephthalate Market Industry is witnessing increased utilization in the electronics and automotive sectors. The material's excellent thermal stability, electrical insulation properties, and lightweight nature make it an ideal choice for manufacturing components such as connectors, housings, and displays. As the demand for electronic devices and advanced automotive technologies continues to rise, the market for amorphous polyethylene terephthalate is expected to expand significantly. This trend is likely to contribute to the overall market growth, with forecasts suggesting a market value of 88.2 USD Billion by 2035, underscoring the material's versatility and applicability.