Expansion of Crop Varieties

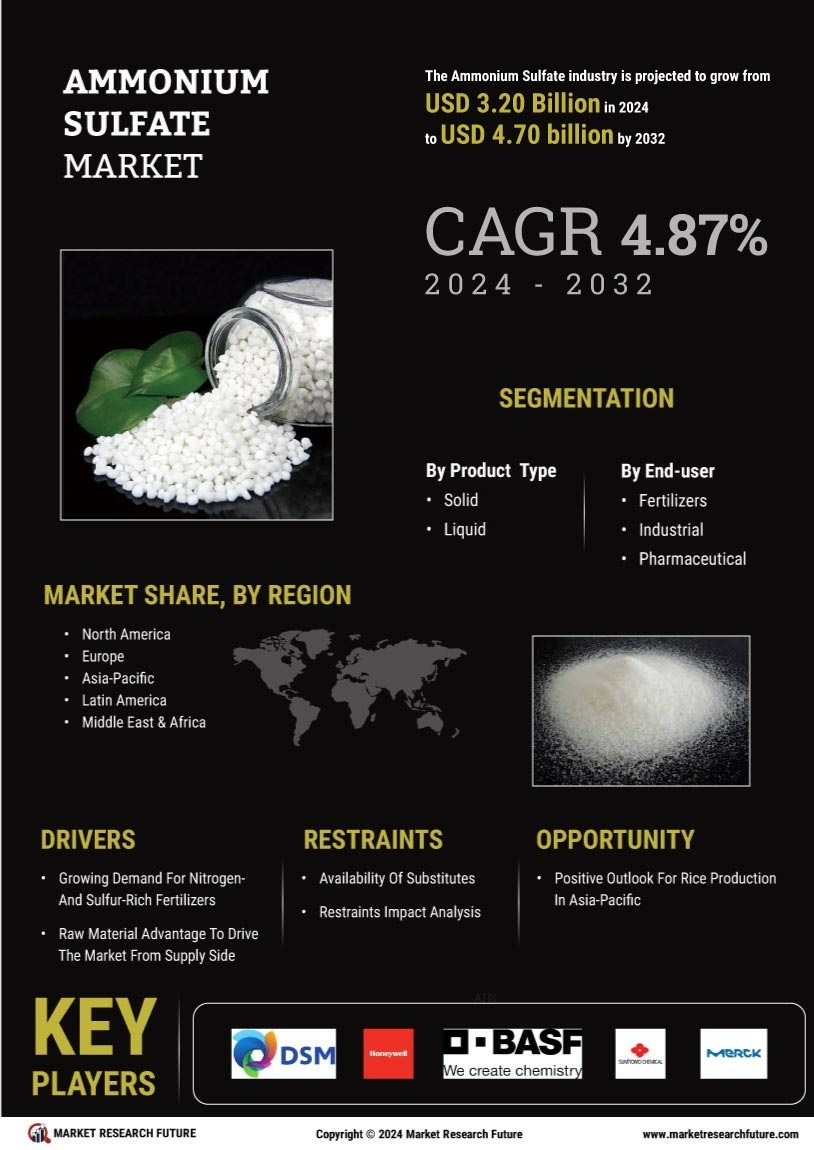

The Ammonium Sulfate Market is experiencing growth due to the expansion of crop varieties that benefit from nitrogen supplementation. As agricultural practices evolve, farmers are diversifying their crop selections to include high-nitrogen-demand plants such as legumes and leafy greens. This diversification necessitates the use of effective fertilizers, with ammonium sulfate being a preferred choice due to its rapid nitrogen release and compatibility with various crops. Market analysis indicates that the demand for ammonium sulfate is expected to rise in tandem with the increasing cultivation of these nitrogen-sensitive crops. This trend suggests a promising outlook for the Ammonium Sulfate Market as it adapts to changing agricultural needs.

Rising Demand for Fertilizers

The Ammonium Sulfate Market is experiencing a notable increase in demand for fertilizers, driven by the need to enhance agricultural productivity. As the global population continues to grow, the pressure on food production intensifies, leading to a greater reliance on nitrogen-based fertilizers. Ammonium sulfate, known for its high nitrogen content, is particularly favored in various crops, including cereals and vegetables. Recent data indicates that the fertilizer market is projected to grow at a compound annual growth rate of approximately 3.5% over the next few years. This trend suggests that the Ammonium Sulfate Market will likely benefit from the expanding agricultural sector, as farmers seek effective solutions to improve crop yields and soil health.

Growing Awareness of Soil Health

The Ammonium Sulfate Market is benefiting from a growing awareness of soil health among farmers and agricultural stakeholders. As the importance of maintaining soil fertility and structure becomes more recognized, the demand for soil amendments, including ammonium sulfate, is on the rise. This compound not only provides essential nutrients but also improves soil pH and enhances microbial activity. Recent studies suggest that healthy soils contribute significantly to sustainable agricultural practices, which in turn supports food security. Consequently, the Ammonium Sulfate Market is likely to see increased adoption as farmers prioritize soil health in their cultivation strategies.

Technological Innovations in Production

The Ammonium Sulfate Market is witnessing advancements in production technologies that enhance efficiency and reduce costs. Innovations such as improved synthesis methods and waste recovery processes are being adopted, allowing manufacturers to produce ammonium sulfate more sustainably. For instance, the integration of by-product recovery from industrial processes has been shown to lower production costs while minimizing environmental impact. As a result, the overall supply chain for ammonium sulfate is becoming more streamlined, which may lead to increased availability and competitive pricing in the market. This technological evolution is likely to bolster the Ammonium Sulfate Market, making it more attractive to both producers and consumers.

Environmental Regulations Favoring Ammonium Sulfate

The Ammonium Sulfate Market is positively influenced by stringent environmental regulations that promote the use of eco-friendly fertilizers. As governments worldwide implement policies aimed at reducing chemical runoff and promoting sustainable farming practices, ammonium sulfate emerges as a viable alternative. Its dual role as a fertilizer and a soil amendment aligns with these regulatory frameworks, encouraging its adoption among farmers. Furthermore, the market for organic fertilizers is expanding, with ammonium sulfate being recognized for its lower environmental impact compared to synthetic options. This shift in regulatory focus appears to create a favorable landscape for the Ammonium Sulfate Market, potentially leading to increased market share and growth opportunities.