硫酸アンモニウム市場 概要

MRFRの分析によると、2024年の硫酸アンモニウム市場規模は32億米ドルと推定されています。硫酸アンモニウム産業は、2025年に33.56億米ドルから2035年には54億米ドルに成長すると予測されており、2025年から2035年の予測期間中に年平均成長率(CAGR)は4.87を示します。

主要な市場動向とハイライト

硫酸アンモニウム市場は、持続可能な慣行と技術革新に向けてのダイナミックな変化を経験しています。

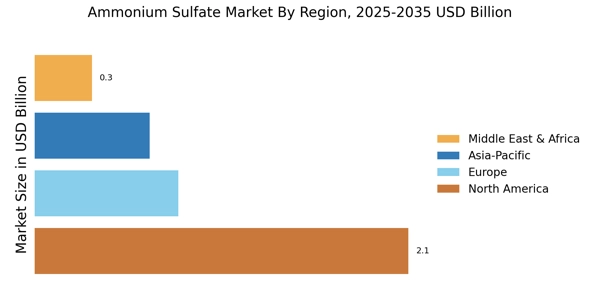

- "北米は、堅調な農業活動に支えられ、硫酸アンモニウムの最大の市場であり続けています。

- アジア太平洋地域は、農業生産性の需要の高まりにより、最も成長が早い市場として浮上しています。

- 固体の硫酸アンモニウムは市場を支配し続けていますが、その多様性から液体形態も注目を集めています。

- 肥料の需要の高まりと土壌健康への意識の高まりが、市場成長を促進する重要な要因です。"

市場規模と予測

| 2024 Market Size | 3.2 (米ドル十億) |

| 2035 Market Size | 5.4 (米ドル十億) |

| CAGR (2025 - 2035) | 4.87% |

主要なプレーヤー

Nutrien Ltd(カナダ)、Yara International ASA(ノルウェー)、K+S AG(ドイツ)、Tessenderlo Group(ベルギー)、Mosaic Company(アメリカ)、OCI N.V.(オランダ)、AdvanSix Inc.(アメリカ)、SABIC(サウジアラビア)