Ammonium Phosphate Size

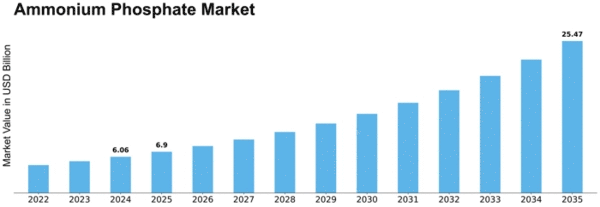

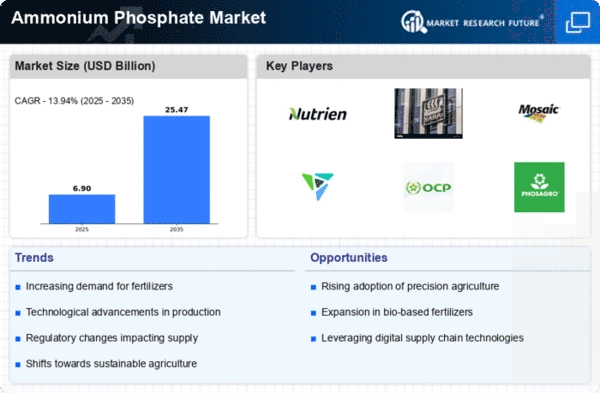

Ammonium Phosphate Market Growth Projections and Opportunities

The Ammonium Phosphate market is influenced by a myriad of market factors that collectively shape its dynamics. One of the primary drivers is the ever-growing demand for fertilizers in the agriculture sector. Ammonium Phosphate, being a crucial component in many fertilizers, experiences a direct correlation with the global agricultural industry. As the global population continues to rise, the need for increased food production becomes imperative, leading to higher demand for fertilizers and, consequently, ammonium phosphate.

Moreover, government policies and regulations play a pivotal role in shaping the market landscape. Environmental concerns and the push towards sustainable agricultural practices have led to stricter regulations regarding the use and production of fertilizers. The Ammonium Phosphate market is thus influenced by compliance with these regulations, prompting manufacturers to invest in more environmentally friendly production methods and formulations.

Market factors are also significantly affected by geopolitical events and trade policies. The availability and pricing of raw materials, such as phosphoric acid and ammonia, are subject to geopolitical tensions and trade agreements. Fluctuations in the prices of these raw materials directly impact the production cost of ammonium phosphate, subsequently influencing its market pricing and competitiveness.

Technological advancements contribute to the evolution of the Ammonium Phosphate market. Innovations in production processes, such as the development of more efficient and sustainable methods, enhance the overall market efficiency. Additionally, advancements in agricultural technology and practices impact the demand for ammonium phosphate, as modern farming techniques often require specialized fertilizers to maximize yield and minimize environmental impact.

Market trends in consumer preferences and awareness of sustainable practices also play a role in shaping the Ammonium Phosphate market. With a growing emphasis on organic and sustainable farming, there is an increasing demand for eco-friendly fertilizers, impacting the market dynamics. Consumer awareness regarding the environmental impact of chemical fertilizers has led to a shift towards products that have a lower ecological footprint.

The global economy and currency exchange rates are crucial external factors that affect the Ammonium Phosphate market. Fluctuations in currency values can impact the cost of imports and exports, influencing the competitiveness of market players in different regions. Economic growth or recession can also impact overall consumer spending, subsequently affecting the demand for agricultural products and, by extension, ammonium phosphate.

Furthermore, the competitive landscape within the Ammonium Phosphate market is shaped by factors such as mergers and acquisitions, product developments, and strategic partnerships. Companies within the industry continuously strive to gain a competitive edge through these initiatives, impacting market concentration and influencing pricing dynamics.

The Ammonium Phosphate market is a complex and dynamic system influenced by a multitude of factors. From agricultural demands and environmental regulations to geopolitical events and technological advancements, these market factors collectively contribute to shaping the present and future trajectory of the Ammonium Phosphate market. Stakeholders in the industry must remain vigilant and adaptive to navigate these factors successfully and sustainably.

Leave a Comment