Market Analysis

In-depth Analysis of Ammonium Phosphate Market Industry Landscape

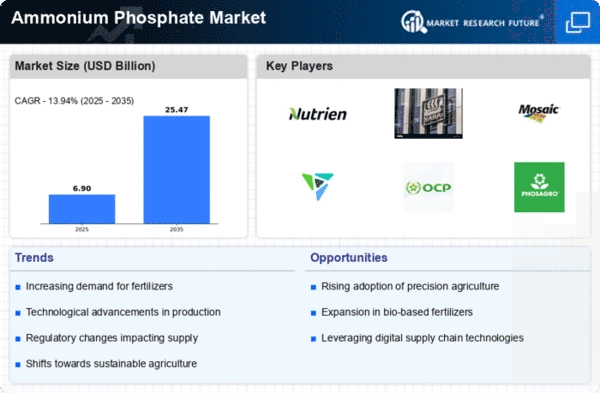

The Ammonium Phosphate market is characterized by dynamic and multifaceted forces that shape its landscape. At its core, market dynamics refer to the constant changes and interactions between various factors that influence supply and demand, pricing, and overall industry trends. In the case of Ammonium Phosphate, a key player in the global fertilizer market, several factors contribute to the intricate dynamics.

Firstly, the market is significantly influenced by the agriculture sector. As Ammonium Phosphate is a crucial component in fertilizers, its demand is intricately tied to the agricultural practices worldwide. Fluctuations in global food demand, climatic conditions affecting crop yields, and shifts in farming practices all contribute to the dynamic nature of the Ammonium Phosphate market. For instance, during periods of high food demand or adverse weather conditions affecting traditional farming, the demand for fertilizers, including Ammonium Phosphate, tends to rise.

Global economic conditions also play a pivotal role in shaping the market dynamics. Economic growth, industrial development, and population trends influence the overall demand for agricultural products. As economies grow, the need for increased food production becomes apparent, thereby driving the demand for fertilizers. Conversely, economic downturns or recessions may lead to a temporary reduction in agricultural activities, impacting the demand for Ammonium Phosphate.

Government regulations and policies further contribute to the dynamics of the Ammonium Phosphate market. Environmental concerns, such as water pollution from excess fertilizer runoff, often lead to regulatory measures aimed at controlling the use of certain fertilizers. Changes in these regulations can affect the production, distribution, and pricing of Ammonium Phosphate. Additionally, subsidies or incentives provided by governments to promote sustainable agriculture practices can influence the market dynamics by encouraging or discouraging the use of specific fertilizers.

Competitive forces among key market players also contribute to the dynamic nature of the Ammonium Phosphate market. Companies continually strive to innovate, improve product quality, and optimize production processes to gain a competitive edge. Mergers and acquisitions, technological advancements, and strategic partnerships can reshape the market landscape, impacting supply chains and pricing structures. The constant pursuit of market share and profitability drives companies to adapt to changing market conditions, thereby contributing to the overall dynamism.

Price volatility is another significant aspect of the Ammonium Phosphate market dynamics. The prices of key raw materials, such as ammonia and phosphoric acid, can fluctuate due to factors like geopolitical tensions, natural disasters, or changes in energy prices. These fluctuations directly impact the production costs of Ammonium Phosphate, influencing its market price. Moreover, the interconnected nature of global markets means that events in one region can have ripple effects on prices and supply chains globally.

The Ammonium Phosphate market is a dynamic and complex environment shaped by a combination of factors. From agricultural trends and economic conditions to government regulations and competitive forces, each element contributes to the ever-changing dynamics of the market. Market participants, including producers, suppliers, and consumers, must navigate this dynamic landscape by staying informed about the various forces at play and adapting their strategies to ensure sustainable growth in this crucial sector of the global fertilizer market.

Leave a Comment