Aging Population

The aging population is a critical factor influencing the Global Alzheimer's Drugs Market Industry. As life expectancy rises globally, the number of elderly individuals susceptible to Alzheimer's disease is increasing. This demographic shift is expected to result in a higher prevalence of dementia-related disorders, thereby driving demand for effective treatments. The market is projected to reach 7.5 USD Billion by 2024, reflecting the urgent need for therapeutic options. Furthermore, as the global population aged 65 and older continues to grow, the industry anticipates a compound annual growth rate of 9.33% from 2025 to 2035, indicating robust market potential.

Increased Research Funding

The Global Alzheimer's Drugs Market Industry benefits from increased research funding aimed at understanding and treating Alzheimer's disease. Governments and private organizations are investing significantly in research initiatives, which enhances the development of new drugs. For example, the National Institutes of Health has allocated substantial resources to Alzheimer's research, fostering innovation in drug discovery. This influx of funding not only supports clinical trials but also encourages collaboration between academia and industry. As a result, the market is poised for growth, with a projected compound annual growth rate of 9.33% from 2025 to 2035, reflecting the commitment to finding effective treatments.

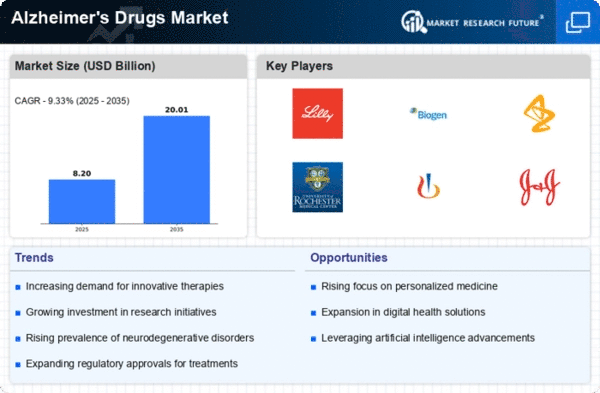

Market Trends and Projections

The Global Alzheimer's Drugs Market Industry is characterized by dynamic trends and projections that reflect its growth potential. The market is expected to reach 7.5 USD Billion in 2024, with a significant increase to 20 USD Billion anticipated by 2035. This growth trajectory suggests a compound annual growth rate of 9.33% from 2025 to 2035. Factors such as rising prevalence of Alzheimer's disease, advancements in drug development, and increased research funding contribute to this optimistic outlook. The industry is poised for transformation as new therapies emerge, addressing the needs of a growing patient population.

Growing Awareness and Diagnosis

Rising awareness about Alzheimer's disease and improved diagnostic capabilities are driving the Global Alzheimer's Drugs Market Industry. As public understanding of the disease increases, more individuals seek medical advice, leading to earlier diagnosis and treatment. Enhanced diagnostic tools, such as neuroimaging and biomarker testing, facilitate accurate identification of Alzheimer's, allowing for timely intervention. This trend not only increases the patient population but also stimulates demand for effective therapies. Consequently, the market is expected to expand significantly, with projections indicating a market value of 20 USD Billion by 2035, as more patients are diagnosed and treated.

Advancements in Drug Development

Innovations in drug development are a key driver of the Global Alzheimer's Drugs Market Industry. Recent advancements in biotechnology and pharmacology have led to the emergence of novel therapeutic agents targeting the underlying mechanisms of Alzheimer's disease. For instance, monoclonal antibodies and small molecules are being explored in clinical trials, showing promise in slowing disease progression. As these therapies gain regulatory approval, they are likely to contribute to market growth. The industry anticipates a surge in market value, potentially reaching 20 USD Billion by 2035, as new treatments become available to address the unmet needs of patients.

Rising Prevalence of Alzheimer's Disease

The Global Alzheimer's Drugs Market Industry is experiencing growth due to the increasing prevalence of Alzheimer's disease worldwide. As populations age, the incidence of Alzheimer's is projected to rise significantly. By 2024, the market is estimated to reach 7.5 USD Billion, reflecting the urgent need for effective treatments. The World Health Organization indicates that the number of people living with dementia is expected to reach 152 million by 2050, underscoring the necessity for innovative drug development. This growing patient population drives demand for new therapies, thereby propelling the Global Alzheimer's Drugs Market Industry forward.