Rising Awareness of Environmental Impact

There is a growing awareness of the environmental impact of traditional animal agriculture, which is driving interest in alternative proteins. The alternative protein processing equipment Market is benefiting from this trend as consumers and businesses alike seek more sustainable food sources. Research indicates that producing plant-based proteins typically requires significantly less water and land compared to animal-based proteins. This awareness is prompting food manufacturers to invest in alternative protein processing technologies that align with sustainability goals. As consumers demand more eco-friendly options, the Alternative Protein Processing Equipment Market is likely to see increased investment in equipment that supports the production of environmentally responsible protein sources.

Regulatory Support for Alternative Proteins

Regulatory frameworks are increasingly supportive of alternative protein products, which positively influences the Alternative Protein Processing Equipment Market. Governments are recognizing the potential of alternative proteins to address food security and environmental concerns. As a result, policies that promote research and development in this sector are being implemented. For instance, some countries are providing grants and subsidies for companies that invest in sustainable protein technologies. This regulatory support is likely to encourage more businesses to enter the market, thereby increasing the demand for processing equipment tailored to alternative proteins. The Alternative Protein Processing Equipment Market is thus positioned to grow as these supportive measures take effect.

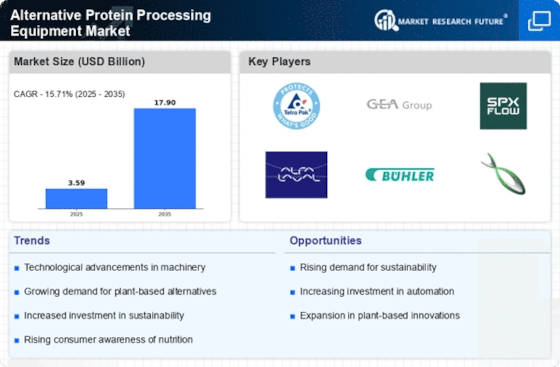

Increasing Investment in Alternative Proteins

Investment in the alternative protein sector is on the rise, significantly impacting the Alternative Protein Processing Equipment Market. Venture capital and private equity firms are increasingly funding startups focused on plant-based and cultured protein products. According to recent data, investments in alternative protein companies reached over $3 billion in the past year, indicating a robust interest in this market segment. This influx of capital is likely to drive demand for advanced processing equipment, as companies seek to scale production and improve product offerings. Consequently, the Alternative Protein Processing Equipment Market stands to benefit from this trend, as manufacturers will need to invest in state-of-the-art machinery to meet the evolving needs of consumers and investors alike.

Technological Innovations in Equipment Design

The Alternative Protein Processing Equipment Market is experiencing a surge in technological innovations that enhance processing efficiency and product quality. Advanced machinery, such as high-capacity extruders and automated fermentation systems, are being developed to meet the growing demand for alternative proteins. These innovations not only streamline production processes but also reduce energy consumption, which is increasingly important in a market that values sustainability. For instance, the introduction of smart sensors and IoT technology allows for real-time monitoring and adjustments, ensuring optimal performance. As a result, manufacturers are likely to see improved yield rates and reduced operational costs, making these technologies essential for competitiveness in the Alternative Protein Processing Equipment Market.

Shifting Consumer Preferences Towards Plant-Based Diets

Consumer preferences are shifting towards plant-based diets, which is a key driver for the Alternative Protein Processing Equipment Market. As more individuals adopt vegetarian and vegan lifestyles, the demand for alternative protein sources is expected to grow. Market Research Future indicates that the plant-based food market is projected to reach $74 billion by 2027, which will likely necessitate the development of specialized processing equipment. This shift not only reflects changing dietary habits but also a broader awareness of health and environmental issues. Manufacturers in the Alternative Protein Processing Equipment Market must adapt to these trends by innovating and providing equipment that can efficiently process a variety of plant-based ingredients.