Rising Health Consciousness

The algae protein Market is experiencing a surge in demand driven by increasing health consciousness among consumers. As individuals become more aware of the nutritional benefits associated with algae protein, such as its high protein content and essential amino acids, the market is likely to expand. Research indicates that algae protein can contain up to 70% protein by weight, making it a potent alternative to traditional protein sources. This shift towards healthier dietary choices is prompting food manufacturers to incorporate algae protein into various products, including snacks, beverages, and supplements. Consequently, the Algae Protein Market is poised for growth as consumers seek nutritious and sustainable food options that align with their health goals.

Innovations in Food Technology

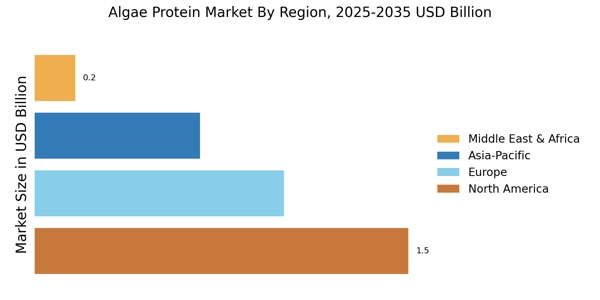

Innovations in food technology are playing a pivotal role in the Algae Protein Market. Advances in extraction and processing techniques have enhanced the quality and palatability of algae protein, making it more appealing to a broader audience. For instance, improved methods for isolating protein from algae have led to products that are not only rich in nutrients but also possess desirable taste and texture. The market for algae protein is projected to reach USD 1.5 billion by 2027, reflecting the impact of these technological advancements. As food manufacturers continue to explore new applications for algae protein, the Algae Protein Market is likely to witness significant growth, driven by consumer demand for innovative and health-oriented food products.

Regulatory Support and Incentives

Regulatory support and incentives are becoming increasingly important for the Algae Protein Market. Governments around the world are recognizing the potential of algae as a sustainable protein source and are implementing policies to promote its production and use. This includes funding for research and development, as well as subsidies for algae cultivation. Such initiatives are likely to stimulate innovation and investment in the Algae Protein Market, fostering growth and expansion. As regulatory frameworks evolve to support sustainable food sources, the Algae Protein Market may experience enhanced opportunities for development, positioning it as a key player in the future of protein production.

Increasing Application in Animal Feed

The Algae Protein Market is also witnessing growth due to its increasing application in animal feed. As the demand for sustainable and nutritious feed alternatives rises, algae protein is emerging as a viable option for livestock and aquaculture. Algae protein is rich in essential nutrients, making it an attractive ingredient for enhancing the nutritional profile of animal feed. The market for algae-based animal feed is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 10% in the coming years. This trend not only supports the Algae Protein Market but also contributes to the overall sustainability of the food supply chain, as it reduces reliance on conventional feed sources.

Sustainability and Environmental Awareness

Sustainability and environmental awareness are increasingly influencing consumer choices, thereby impacting the Algae Protein Market. Algae cultivation is known for its low environmental footprint, requiring minimal land and water resources compared to traditional agriculture. This aspect resonates with environmentally conscious consumers who are seeking sustainable protein sources. The Algae Protein Market is expected to benefit from this trend, as more individuals prioritize eco-friendly products in their purchasing decisions. Furthermore, the potential of algae to sequester carbon dioxide during growth adds to its appeal as a sustainable protein source. As awareness of environmental issues continues to rise, the Algae Protein Market is likely to expand, driven by a growing preference for sustainable food options.